Global Epoxy Resin PCB Laminates Market - Key Trends & Drivers Summarized

Why Are Epoxy Resin PCB Laminates Indispensable to Modern Electronics Manufacturing?

Epoxy resin PCB laminates are the structural and insulating backbone of printed circuit boards, playing an irreplaceable role in nearly all categories of electronic device manufacturing. These laminates, typically composed of fiberglass impregnated with epoxy resin (most commonly FR4), offer a balanced combination of mechanical strength, electrical insulation, heat resistance, and flame retardancy - making them ideal for a wide range of electronic applications. Their primary function is to provide a rigid and stable substrate upon which conductive copper circuits can be etched or printed, enabling the assembly of complex electronic components. As electronics continue to shrink in size while increasing in complexity and functionality, epoxy resin laminates provide the necessary dimensional stability and signal integrity for multilayer PCB architectures. Devices ranging from smartphones, laptops, and consumer gadgets to industrial controllers, automotive electronics, and aerospace systems all depend on these laminates to ensure consistent performance in varied environments. The widespread adoption of high-speed, high-frequency digital circuits has also placed new demands on laminate materials, which must now meet stricter standards for dielectric constant, dissipation factor, and thermal stability. As such, epoxy laminates have evolved significantly, incorporating advanced resin systems and glass fiber technologies to support next-generation performance. Without epoxy-based PCB laminates, the compact, high-density, high-reliability electronics we rely on daily would simply not be feasible.How Are Innovations in Resin Chemistry and Laminate Design Enhancing PCB Performance and Reliability?

Innovations in epoxy resin chemistry and laminate design are driving transformative improvements in PCB performance, enabling the production of more robust, efficient, and thermally stable electronic systems. New resin formulations with higher glass transition temperatures (Tg) and decomposition temperatures (Td) are being developed to accommodate lead-free soldering processes, which require higher thermal resilience during assembly. Low dielectric constant (Dk) and low dissipation factor (Df) epoxy systems are critical for preserving signal integrity in high-speed digital and RF circuits, making them essential for data centers, telecommunications, and next-gen computing applications. To meet the demands of fine-line circuitry, manufacturers are introducing smoother glass cloth weaves and resin systems with controlled flow and fill characteristics, which enhance copper adhesion and minimize delamination during fabrication. Flame retardants that meet modern environmental and safety regulations, such as halogen-free or RoHS-compliant alternatives, are also being incorporated into epoxy resin systems. Additionally, hybrid laminate constructions that combine epoxy resins with ceramic or polyimide elements are being explored to provide superior mechanical and thermal properties for mission-critical applications in aerospace, defense, and automotive electronics. Automated production lines, precision lamination techniques, and digital process controls are further improving consistency and yield, while advances in surface finishes and compatibility with HDI (High-Density Interconnect) processes make epoxy laminates increasingly suitable for compact and multifunctional devices. These innovations are not only enhancing the technical performance of PCBs but also enabling electronics manufacturers to meet the stringent demands of modern applications with improved efficiency and reliability.Why Is Global Demand for Epoxy Resin PCB Laminates Increasing Across Sectors and Regions?

The global demand for epoxy resin PCB laminates is rising sharply, driven by growing adoption across diverse industry sectors and expanding geographic markets. In consumer electronics, the proliferation of smartphones, wearable devices, gaming systems, and home automation tools has led to a massive increase in the production of compact, high-density circuit boards, where epoxy laminates are the standard choice due to their versatility and cost-effectiveness. The automotive industry is also seeing a significant rise in demand, particularly with the global transition to electric vehicles (EVs), advanced driver-assistance systems (ADAS), and vehicle connectivity features - all of which require reliable PCB materials that can withstand vibration, temperature fluctuations, and electrical stress. In the telecommunications sector, the rollout of 5G infrastructure and the deployment of high-speed routers, servers, and base stations require advanced laminates that support low signal loss and high frequency stability. Industrial applications such as robotics, smart manufacturing, and renewable energy systems rely on epoxy-based PCBs for control units, inverters, and monitoring devices that must operate reliably in rugged environments. Regionally, Asia-Pacific dominates the market due to its extensive electronics manufacturing ecosystem, with China, Taiwan, South Korea, and Japan leading the charge. However, North America and Europe are investing heavily in reshoring efforts and advanced electronics for defense, aerospace, and healthcare, contributing to increased laminate consumption. Additionally, emerging markets in Southeast Asia, Latin America, and Africa are experiencing rapid growth in electronic adoption, expanding the global footprint of epoxy resin PCB laminates.What Key Drivers Are Fueling the Continued Growth of the Epoxy Resin PCB Laminates Market?

The growth of the epoxy resin PCB laminates market is fueled by a combination of macroeconomic trends, technological evolution, and increasing demand for miniaturized, high-performance electronic systems. One of the foremost drivers is the relentless push for device miniaturization and increased circuit density, which requires laminates capable of supporting multiple layers, microvias, and fine-line conductors without compromising thermal and mechanical integrity. The transition to electric mobility and smart transportation systems has added a new dimension to demand, as EVs and autonomous vehicles depend on high-reliability PCBs with superior thermal management and vibration resistance - roles well suited to advanced epoxy laminates. Environmental regulations, including RoHS and WEEE directives, are also shaping the market, pushing manufacturers toward halogen-free, lead-free, and recyclable laminate options. Technological convergence in areas such as AI, IoT, and 5G has further broadened the applications of epoxy laminates, as these emerging technologies require compact, high-speed interconnects and consistent electrical performance across temperature ranges. Strategic investments in PCB manufacturing capacity, particularly in India, Vietnam, and Eastern Europe, are expanding the global supply chain, reducing dependency on traditional manufacturing hubs, and enabling faster delivery times. On the supply side, partnerships between resin producers, glass fiber suppliers, and PCB fabricators are fostering co-development of custom materials tailored to specific industry needs. As digital transformation becomes integral to economic development worldwide, epoxy resin PCB laminates will remain a critical component of the hardware foundation powering innovation across consumer, industrial, medical, and military electronics.Report Scope

The report analyzes the Epoxy Resin PCB Laminates market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Physical Form (Solid, Liquid, Solutions, Solvent Cut Epoxy); Application (Communications, Consumer Electronics, Computer / Peripheral, Military / Aerospace, Industrial Electronics, Automotive, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solid Form segment, which is expected to reach US$1 Billion by 2030 with a CAGR of a 8.5%. The Liquid Form segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $325.2 Million in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $383.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Epoxy Resin PCB Laminates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Epoxy Resin PCB Laminates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Epoxy Resin PCB Laminates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AkzoNobel, Arkema, Ashland, BASF, Carboline and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Epoxy Resin PCB Laminates market report include:

- Arlon (Rogers Corporation)

- Covlak S.p.A.

- DuPont Circuit Materials

- Elite Material Co., Ltd.

- Hitachi Chemical Co., Ltd.

- Isola Group

- Kingboard Laminates Holdings Ltd.

- Kolon Industries, Inc.

- Mitsubishi Gas Chemical Co., Inc.

- Nan Ya PCB Corporation

- Nanya Printed Circuit Board Corporation

- Panasonic Electronic Materials Co., Ltd.

- Pan-United Corporation

- Rogers Corporation

- Shengyi Technology Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- Taconic Advanced Dielectric Division

- TTM Technologies, Inc.

- Ventec International Group

- Yixing Jinghua Electronics Materials Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arlon (Rogers Corporation)

- Covlak S.p.A.

- DuPont Circuit Materials

- Elite Material Co., Ltd.

- Hitachi Chemical Co., Ltd.

- Isola Group

- Kingboard Laminates Holdings Ltd.

- Kolon Industries, Inc.

- Mitsubishi Gas Chemical Co., Inc.

- Nan Ya PCB Corporation

- Nanya Printed Circuit Board Corporation

- Panasonic Electronic Materials Co., Ltd.

- Pan-United Corporation

- Rogers Corporation

- Shengyi Technology Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- Taconic Advanced Dielectric Division

- TTM Technologies, Inc.

- Ventec International Group

- Yixing Jinghua Electronics Materials Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 299 |

| Published | January 2026 |

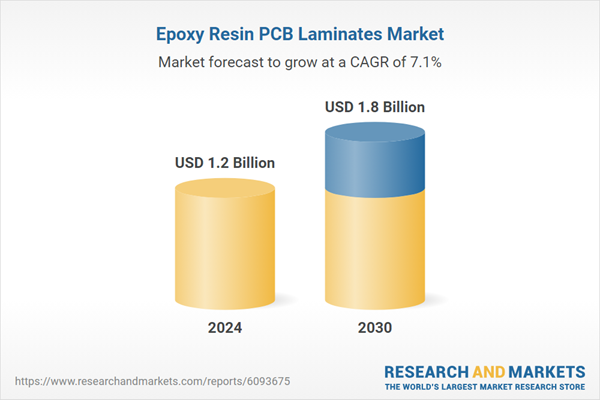

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |