Global FAST (Free Ad-Supported TV) Channels Market - Key Trends & Drivers Summarized

Why Are FAST Channels Reshaping the Global Television and Streaming Landscape?

FAST (Free Ad-Supported TV) channels are rapidly redefining the digital content consumption model by offering linear, scheduled programming supported entirely by advertisements without any subscription fees. These channels deliver curated, genre-specific or brand-driven content streams via internet-connected devices such as smart TVs, mobile apps, and digital media players. Unlike traditional cable, FAST channels provide users with an experience that mimics live TV, but without the cost or contracts, making them highly attractive to price-sensitive consumers who have either cut the cord or never subscribed to pay TV services in the first place. Their growing popularity reflects a broader shift in consumer behavior toward on-demand and flexible viewing that doesn't require ongoing financial commitment. With a lean-back experience that combines the familiarity of linear TV with the flexibility of digital platforms, FAST channels are becoming a compelling alternative to both pay-TV bundles and subscription-based streaming services like Netflix and Disney+. The explosion of content libraries from classic sitcoms and niche reality series to sports replays, music programming, and foreign language content further enhances their appeal. As digital advertising continues to grow and advertisers seek ways to reach fragmented audiences across platforms, FAST channels are emerging as an essential bridge between traditional broadcast and modern streaming.How Are Content Strategy and Technology Advancements Powering the Rise of FAST Channels?

Technological innovation and strategic content curation are the twin engines propelling the growth of FAST channels, enabling platforms to efficiently repurpose existing media libraries and deliver content to highly targeted audiences. Cloud-based playout solutions and AI-driven scheduling tools allow media companies to quickly launch new FAST channels with minimal infrastructure investment, democratizing access for both major studios and independent content creators. As a result, legacy media conglomerates like Paramount, Fox, and NBCUniversal, as well as digital-native platforms like Roku, Pluto TV, and Samsung TV Plus, are expanding their FAST offerings by repackaging archival content into themed channels that cater to specific viewer interests be it true crime, vintage cartoons, or cooking shows. Moreover, AI algorithms are increasingly being used to curate content, predict viewer preferences, and optimize ad placement in real time, thereby improving engagement and monetization. Innovations in ad tech such as server-side ad insertion (SSAI), dynamic ad replacement, and contextual targeting are ensuring that viewers receive relevant ads without interruptive buffering, while advertisers gain granular analytics on viewership patterns. Interactive features like pause ads, scrollable overlays, and clickable content previews are also being tested to blend entertainment with commerce. These technological advancements, combined with flexible monetization models and global scalability, are positioning FAST channels as a resilient and lucrative model in the post-cable TV era.Why Is Consumer Demand for FAST Channels Surging Across Diverse Demographics and Markets?

The surge in demand for FAST channels is being fueled by evolving consumer preferences, economic considerations, and digital accessibility across demographics and regions. As inflationary pressures and subscription fatigue set in, many consumers are re-evaluating the number of paid streaming services they use, opting instead for free, ad-supported options that still deliver a quality viewing experience. FAST channels offer an attractive middle ground cost-free entertainment with minimal trade-offs in content relevance or production value. For younger audiences who grew up with on-demand streaming, FAST platforms provide an unexpected appeal through linear programming that simplifies decision-making and reintroduces the 'channel surfing' experience. For older viewers, FAST channels offer familiar TV-style interfaces and access to nostalgic content from earlier decades. Globally, regions such as Latin America, Southeast Asia, and Eastern Europe are embracing FAST models due to increasing internet penetration, smartphone adoption, and a desire for local-language and culturally relevant content. Multicultural and diaspora communities are also driving demand for niche FAST channels focused on regional entertainment, news, and religious programming. Moreover, the convenience of accessing these channels via built-in smart TV apps or streaming sticks without additional hardware or fees further accelerates their adoption. As platforms continue to expand content variety and improve user interface design, the FAST model is gaining traction among cord-nevers, cord-cutters, and even traditional TV viewers, making it a truly inclusive and globally scalable entertainment format.What Are the Key Drivers Sustaining the Growth of the FAST Channels Market Worldwide?

The continued growth of the FAST channels market is driven by a confluence of economic, technological, and strategic forces that align with the evolving digital media ecosystem. First and foremost is the global shift in advertising spend from traditional linear TV to digital video platforms, as brands seek more measurable and targeted reach something FAST channels provide with precision. The declining returns on SVOD models due to market saturation and subscriber churn are also pushing media companies to diversify their monetization strategies, with FAST offerings serving as a complementary revenue stream that capitalizes on unused or underutilized content libraries. The low barrier to entry and high scalability of cloud-based channel infrastructure is encouraging new entrants, from major broadcasters to niche content aggregators, to rapidly build branded FAST channels that serve loyal micro-audiences. Consumer electronics manufacturers are also playing a pivotal role by integrating FAST services into their TV ecosystems, using them as a value-add to drive hardware sales and retain viewer engagement within their platforms. Additionally, favorable data privacy regulations and growing trust in ad-supported content are reducing viewer resistance to ad exposure. Strategic partnerships, content syndication deals, and programmatic advertising innovations are further strengthening the financial viability of FAST ecosystems. As media consumption continues to fragment and evolve, the alignment of consumer convenience, advertiser demand, and platform profitability ensures that FAST channels will remain a key growth engine in the global streaming media landscape for years to come.Key Insights:

- Market Growth: Understand the significant growth trajectory of the Linear Channels segment, which is expected to reach US$14.0 Billion by 2030 with a CAGR of a 17.0%. The Video on Demand segment is also set to grow at 11.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 20.4% CAGR to reach $4.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global FAST Free Ad-Supported TV Channels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global FAST Free Ad-Supported TV Channels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

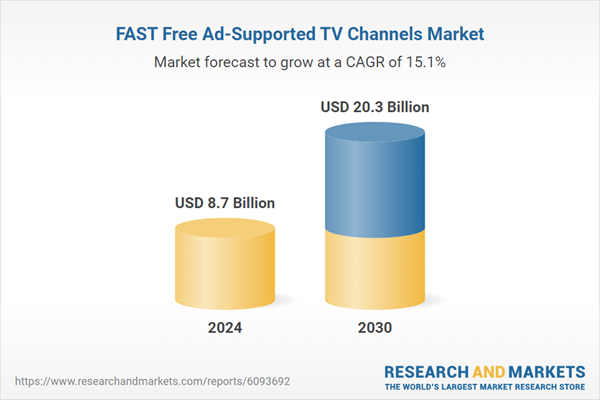

- How is the Global FAST Free Ad-Supported TV Channels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&E Networks (A&E Free), Allen Media Group (Local Now), Amazon (Freevee), Chicken Soup for the Soul Entertainment (Crackle), and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this FAST Free Ad-Supported TV Channels market report include:

- A&E Networks (A&E Free)

- Allen Media Group (Local Now)

- Amazon (Freevee)

- Chicken Soup for the Soul Entertainment (Crackle)

- Comcast (Xumo)

- Dish Network (Sling Freestream)

- E.W. Scripps Company (STIRR)

- FilmRise

- Fox Corporation (Tubi)

- LG Electronics (LG Channels)

- NBCUniversal (Peacock free tier)

- Paramount Global (Pluto TV)

- Plex, Inc. (Plex)

- Redbox Entertainment (Redbox Free Live TV)

- Roku, Inc. (The Roku Channel)

- Samsung Electronics (Samsung TV Plus)

- Syncbak (Zeam)

- TCL Corporation (TCL Channel)

- TelevisaUnivision (ViX)

- Vizio, Inc. (WatchFree+)

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A&E Networks (A&E Free)

- Allen Media Group (Local Now)

- Amazon (Freevee)

- Chicken Soup for the Soul Entertainment (Crackle)

- Comcast (Xumo)

- Dish Network (Sling Freestream)

- E.W. Scripps Company (STIRR)

- FilmRise

- Fox Corporation (Tubi)

- LG Electronics (LG Channels)

- NBCUniversal (Peacock free tier)

- Paramount Global (Pluto TV)

- Plex, Inc. (Plex)

- Redbox Entertainment (Redbox Free Live TV)

- Roku, Inc. (The Roku Channel)

- Samsung Electronics (Samsung TV Plus)

- Syncbak (Zeam)

- TCL Corporation (TCL Channel)

- TelevisaUnivision (ViX)

- Vizio, Inc. (WatchFree+)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.7 Billion |

| Forecasted Market Value ( USD | $ 20.3 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |