Global Fortified Salt Market - Key Trends & Drivers Summarized

Why Is Fortified Salt a Cornerstone of Public Health and Nutritional Security?

Fortified salt plays a critical role in addressing micronutrient deficiencies on a global scale, making it one of the most impactful public health interventions of the past century. By enhancing common table salt with essential nutrients - most commonly iodine, iron, and folic acid - governments and health organizations have effectively used it as a vehicle to combat hidden hunger, a term referring to vitamin and mineral deficiencies that may not immediately present symptoms but have severe long-term health implications. Iodized salt, for example, has been instrumental in nearly eliminating iodine deficiency disorders such as goiter, intellectual disability, and developmental delays in many parts of the world. Iron-fortified salt is now increasingly used to fight anemia, especially in regions where diets are low in bioavailable iron due to limited access to animal-source foods. The wide reach of salt, consumed daily and universally, ensures near-total population coverage, making it an ideal medium for nutrient delivery. Fortified salt is particularly vital in low- and middle-income countries where malnutrition remains prevalent and access to diversified diets is limited. It requires no behavioral change, works with existing food habits, and is cost-effective, making it a cornerstone in national nutrition strategies. With micronutrient deficiencies still affecting over two billion people globally, the role of fortified salt in safeguarding cognitive development, maternal health, and immune function remains irreplaceable in global health policy.How Are Food Policies and Public Programs Driving Demand for Fortified Salt?

The demand for fortified salt is being significantly influenced by proactive government policies, global health initiatives, and social safety net programs that prioritize nutrition at a systemic level. Mandatory salt iodization laws have now been enacted in over 120 countries, supported by the World Health Organization (WHO), UNICEF, and national health ministries. These policies mandate that all edible salt, whether used in households, restaurants, or food processing, must meet minimum fortification standards. Additionally, the growing trend of integrating iron and folic acid fortification into salt - especially in India and sub-Saharan Africa - reflects the need for a multi-nutrient approach to combat complex nutritional deficiencies. Public distribution systems, school feeding programs, and maternal and child health initiatives often include fortified salt as a staple, ensuring it reaches the most vulnerable populations. Partnerships between governments, NGOs, and private sector producers are helping to create sustainable supply chains and quality assurance mechanisms for fortified salt production. Donor-funded programs also help subsidize costs for small-scale salt producers to adopt fortification technology, ensuring equitable access. Moreover, regulatory bodies are increasingly incorporating fortified salt into food labeling and procurement standards to promote accountability and transparency. These collective efforts are not only raising awareness about micronutrient deficiencies but are also normalizing the consumption of fortified salt across socioeconomic groups, thereby accelerating its penetration and effectiveness in public health nutrition.What Innovations Are Enhancing the Stability, Efficacy, and Reach of Fortified Salt?

Technological advancements in micronutrient delivery systems and salt processing techniques are significantly improving the quality, stability, and impact of fortified salt. One of the primary challenges in salt fortification - especially with multiple micronutrients - is the chemical instability that can arise from nutrient interactions, such as the oxidation of iron in the presence of iodine. To address this, researchers have developed encapsulation technologies and microcoating methods that protect individual nutrients during storage and cooking, while preserving bioavailability. Double-fortified salt (DFS), which includes both iodine and iron, now benefits from these innovations, allowing for broader deployment in national nutrition programs. Stabilizers and anti-caking agents have also improved product shelf life and ease of handling in humid environments. In addition to bulk packaging for institutional use, new packaging innovations such as single-use sachets are making fortified salt accessible in rural and underserved areas, where spoilage and contamination are concerns. Digital tools are being employed for real-time quality monitoring, traceability, and regulatory compliance at salt iodization facilities, improving efficiency and reducing wastage. Consumer education campaigns - often supported by mobile technology and social media - are also helping to raise awareness about the benefits of fortified salt, especially among young parents and caregivers. These innovations are ensuring that fortified salt not only meets nutritional standards but also remains accessible, acceptable, and effective across varying consumer needs and infrastructure limitations.What Market Dynamics Are Fueling the Global Growth of the Fortified Salt Industry?

The growth in the fortified salt market is driven by a complex interplay of public health priorities, demographic trends, international collaborations, and market liberalization. One of the key drivers is the sustained global commitment to achieving nutrition-related Sustainable Development Goals (SDGs), particularly the targets related to ending hunger, improving maternal and child health, and reducing anemia. Population growth in emerging economies, coupled with greater government attention to food fortification, is expanding the consumer base for fortified salt at both retail and institutional levels. As urbanization increases, processed food manufacturers are also being required to use iodized salt in compliance with national standards, thereby extending fortification coverage through ready-to-eat meals and packaged snacks. The private sector is responding by developing premium fortified salt products - such as low-sodium iodized salt, gourmet blends with added micronutrients, and flavored variants - that cater to health-conscious consumers in developed markets. Trade liberalization and harmonization of food fortification standards across regions are enabling multinational salt producers to expand operations and enter new markets with minimal regulatory friction. International development agencies and philanthropic foundations continue to provide financial and technical support to fortification initiatives, especially in fragile and resource-limited settings. Meanwhile, growing consumer interest in health and nutrition is reinforcing demand for products with added functional benefits, of which fortified salt is a practical and cost-efficient example. These collective dynamics ensure that the fortified salt industry remains not only economically viable but also strategically positioned to drive meaningful improvements in global nutrition and public health.Report Scope

The report analyzes the Fortified Salt market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Iodine, Iron, Double-Fortified Salts); Application (Hospitality & Service, Food Processing, Household & Animal Feed, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Iodine segment, which is expected to reach US$4.5 Billion by 2030 with a CAGR of a 8.4%. The Iron segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 11.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fortified Salt Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fortified Salt Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fortified Salt Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

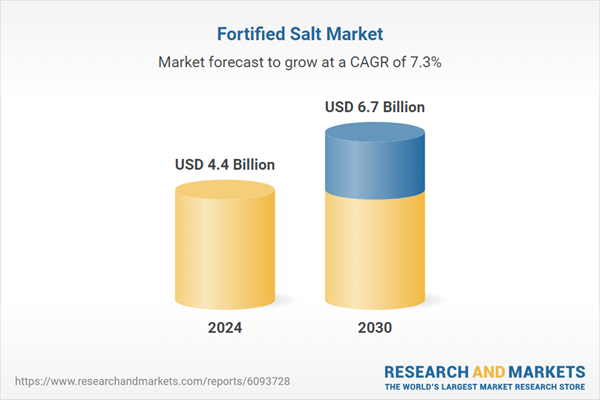

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABH Pharma, Amway, Bayer AG, Bettera Wellness, Church & Dwight Co., Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fortified Salt market report include:

- Ahir Salt Industries

- AkzoNobel

- Ankur Salt

- Bajaj Salt

- Cargill Salt

- China National Salt Industry

- Compass Minerals

- Groupe Salins

- Hindustan Salts

- K+S AG

- Kutch Brine Chem Industries

- Morton Salt

- Nirma Shudh

- Saboo Sodium Chloro

- Sambhar Salts Ltd.

- Schweizer Salinen AG

- Shreeram Chemfood

- Super Salts

- Tata Chemicals

- United Salt Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ahir Salt Industries

- AkzoNobel

- Ankur Salt

- Bajaj Salt

- Cargill Salt

- China National Salt Industry

- Compass Minerals

- Groupe Salins

- Hindustan Salts

- K+S AG

- Kutch Brine Chem Industries

- Morton Salt

- Nirma Shudh

- Saboo Sodium Chloro

- Sambhar Salts Ltd.

- Schweizer Salinen AG

- Shreeram Chemfood

- Super Salts

- Tata Chemicals

- United Salt Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 6.7 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |