Global Business Aircraft Market - Key Trends & Drivers Summarized

Why Are Business Aircraft Gaining Strategic Relevance Across Corporate Mobility, Executive Connectivity, and Long-Haul Travel Optimization?

Business aircraft are regaining strategic prominence as enterprises seek agile, secure, and productivity-enhancing travel alternatives to commercial aviation. These aircraft - ranging from light jets and turboprops to large-cabin intercontinental jets - offer on-demand mobility that supports decentralized operations, time-sensitive engagements, and access to remote or underserved regions. Post-pandemic shifts in corporate travel behavior, heightened focus on risk mitigation, and growing acceptance of hybrid work structures are reinforcing the appeal of private aviation as a strategic enabler of C-suite mobility and executive decision-making.Business aviation is also gaining traction among high-net-worth individuals, sports franchises, and charter operators seeking exclusive, efficient, and tailored air travel experiences. Fleet modernization, increased aircraft utilization, and rising first-time ownership in emerging markets are contributing to a resurgence in demand. With companies prioritizing operational resilience, face-to-face engagement, and optimized time management, business aircraft are being viewed less as a luxury and more as a tool for competitive advantage in high-stakes industries.

How Are Aircraft Design, Connectivity Solutions, and Sustainability Initiatives Advancing the Business Aviation Ecosystem?

Technological innovation is reshaping business aircraft capabilities through enhancements in performance, cabin experience, and emissions reduction. New-generation aircraft offer improved range, fuel efficiency, and reduced noise profiles through aerodynamic refinements, lightweight composite materials, and next-gen engines. Advanced avionics systems with enhanced situational awareness, autopilot integration, and predictive maintenance analytics are supporting safer and more efficient operations.Cabin innovations - such as high-speed in-flight connectivity, customizable seating layouts, and smart environmental controls - are aligning business jets with the expectations of mobile executives and luxury travelers. Satcom-based broadband, VPN access, and cabin digitalization are transforming aircraft into flying workspaces. Parallel to this, manufacturers are investing in sustainability through carbon offset programs, SAF (sustainable aviation fuel) compatibility, and lifecycle-efficient aircraft design. Regulatory alignment with ICAO environmental goals is accelerating R&D into lower-emission propulsion technologies and green manufacturing practices.

Which Buyer Segments, Regional Markets, and Business Models Are Driving Demand for Business Aircraft?

Large corporations, charter service providers, and ultra-high-net-worth individuals remain the primary buyers of business aircraft, with rising adoption in family offices, private investment firms, and professional service industries. The charter and fractional ownership segments are expanding rapidly, driven by demand for flexible, asset-light access models. Government and defense agencies also use business aircraft for executive transport and critical missions.North America accounts for the majority of global fleet activity, supported by an expansive network of fixed-base operators (FBOs), high business travel intensity, and favorable financing infrastructure. Europe follows with strong demand for midsize and long-range jets among multinational firms and luxury travelers. Asia-Pacific is emerging as a high-growth region, particularly in China and India, where private wealth creation and infrastructure development are driving first-time ownership and charter expansion. Latin America and the Middle East are showing steady interest, especially in oil, mining, and regional logistics operations.

Market dynamics are being shaped by a blend of traditional ownership, operating leases, aircraft management services, and on-demand charter platforms. Digital charter marketplaces, jet cards, and fractional programs are democratizing access to business aviation while offering predictable cost structures and scalable flexibility. OEMs and MRO providers are supporting lifecycle value through integrated service offerings, performance upgrades, and cabin retrofits.

What Are the Factors Driving Growth in the Business Aircraft Market?

The business aircraft market is expanding as enterprises and individuals seek fast, flexible, and controlled air travel solutions that support operational continuity, executive productivity, and time-sensitive engagement. The convergence of digital tools, premium cabin experiences, and sustainability roadmaps is further enhancing the strategic relevance of private aviation.Key growth drivers include post-pandemic shifts in business travel dynamics, rise in first-time and fractional ownership, improvements in fuel efficiency and range, digital charter platform proliferation, and increasing availability of sustainable aviation infrastructure. Market confidence is also being bolstered by recovery in corporate earnings and renewed emphasis on face-to-face business interactions.

As organizations navigate decentralized operations, geopolitical complexity, and premium mobility expectations, could business aircraft redefine their role as indispensable assets in shaping the future of agile, secure, and high-value global enterprise travel?

Report Scope

The report analyzes the Business Aircraft market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Large Jet, Mid-Size Jet, Light Jet); End-Use (Operator End-Use, Private End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Large Jet segment, which is expected to reach US$24.6 Billion by 2030 with a CAGR of a 2.1%. The Mid-Size Jet segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.7 Billion in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $8.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Business Aircraft Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Business Aircraft Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Business Aircraft Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Advanced Test Equipment Corporation, AMETEK MOCON, Asian Test Equipments, Benz Co., Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Business Aircraft market report include:

- Airbus SE

- Beechcraft (Textron Aviation)

- Boeing Business Jets

- Bombardier Inc.

- Cessna (Textron Aviation)

- Cirrus Aircraft

- Daher

- Dassault Aviation

- Embraer S.A.

- Gulfstream Aerospace Corporation

- Honda Aircraft Company

- Learjet (Bombardier)

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Nextant Aerospace

- Northrop Grumman Corporation

- Piaggio Aerospace

- Pilatus Aircraft Ltd

- Raytheon Technologies Corporation

- Textron Aviation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus SE

- Beechcraft (Textron Aviation)

- Boeing Business Jets

- Bombardier Inc.

- Cessna (Textron Aviation)

- Cirrus Aircraft

- Daher

- Dassault Aviation

- Embraer S.A.

- Gulfstream Aerospace Corporation

- Honda Aircraft Company

- Learjet (Bombardier)

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Nextant Aerospace

- Northrop Grumman Corporation

- Piaggio Aerospace

- Pilatus Aircraft Ltd

- Raytheon Technologies Corporation

- Textron Aviation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

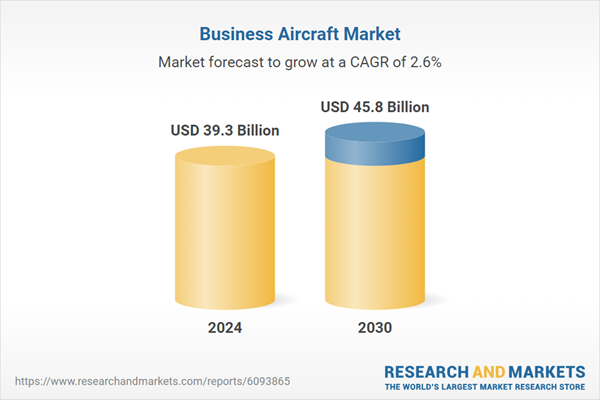

| Estimated Market Value ( USD | $ 39.3 Billion |

| Forecasted Market Value ( USD | $ 45.8 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |