Global Carrier Rockets Market - Key Trends & Drivers Summarized

Why Are Carrier Rockets Gaining Strategic Relevance Across Commercial Space Access, Satellite Deployment, and National Space Autonomy?

Carrier rockets - also known as launch vehicles - are becoming central to the global space economy as demand surges for satellite deployment, interplanetary missions, and sovereign space capabilities. These rockets are responsible for delivering payloads into orbit, ranging from small CubeSats and constellations to heavy satellites and crewed spacecraft. As both public and private sector actors expand their space ambitions, carrier rockets are critical enablers of national defense, scientific exploration, space-based infrastructure, and commercial services such as telecommunications, Earth observation, and global broadband.The proliferation of low-Earth orbit (LEO) satellite constellations, led by commercial players seeking to provide global connectivity and data services, is driving demand for more frequent, cost-efficient, and mission-flexible launch systems. Meanwhile, government-backed space programs are investing heavily in indigenous launch capabilities to strengthen strategic autonomy and reduce dependence on foreign launch providers. As a result, carrier rockets are evolving from state-controlled assets to competitive, innovation-driven platforms within a rapidly diversifying space access market.

How Are Reusability, Modular Design, and Propulsion Innovation Transforming Carrier Rocket Capabilities?

Technological breakthroughs are redefining the economics and performance parameters of carrier rockets. Reusability - pioneered by private entities - is reshaping cost structures and launch frequency. First-stage recovery and refurbishment systems, such as those employed by SpaceX and Rocket Lab, are dramatically lowering per-launch costs while enabling rapid turnaround between missions.Modular and scalable rocket architectures are allowing customization based on payload size, mission type, and orbital requirements. Innovations in lightweight composite materials, additive manufacturing, and electric pump-fed propulsion systems are further improving payload-to-weight ratios and reducing manufacturing lead times. Advances in cryogenic and green propellants (e.g., LOX/LH2, methane, hydrocarbon alternatives) are enhancing thrust efficiency, environmental compliance, and mission flexibility.

Smaller, agile launch vehicles optimized for suborbital or small satellite delivery are gaining momentum, while heavy-lift systems are being developed to support lunar missions, interplanetary transport, and space station logistics. Autonomous navigation, AI-based telemetry, and onboard health monitoring systems are also enhancing launch precision and in-flight decision-making.

Which Use Cases, Regional Markets, and Industry Players Are Driving Growth in the Carrier Rockets Market?

Primary use cases span commercial satellite launches, defense and reconnaissance missions, cargo delivery to the International Space Station (ISS), deep space probes, and national flagship programs such as lunar and Mars missions. Rising demand for responsive launch services is also fueling growth in verticals such as Earth monitoring, space tourism, space-based solar power trials, and orbital debris management.North America leads global carrier rocket development, driven by NASA, U.S. Department of Defense, and private launch providers like SpaceX, Blue Origin, and United Launch Alliance (ULA). Europe maintains a strong position through Arianespace and ESA-supported programs. China and India are scaling rapidly, with indigenous launch systems under CNSA and ISRO, respectively. Russia retains significant heritage and capacity through Roscosmos. Emerging players in South Korea, Japan, Iran, and UAE are investing in independent launch vehicles to support growing national space programs.

Private sector competition, public-private partnerships, and venture capital infusion are fueling innovation and launch cadence across commercial and government-backed platforms. Integration of launch services with satellite operators, spaceport developers, and downstream application providers is shaping a vertically integrated market structure.

What Are the Factors Driving Growth in the Carrier Rockets Market?

The carrier rockets market is expanding as orbital access becomes foundational to digital infrastructure, space-based services, and global strategic positioning. These vehicles are no longer niche scientific tools but critical infrastructure powering the next era of communication, navigation, and space exploration.Key growth drivers include increasing launch frequency from commercial satellite constellations, rising geopolitical emphasis on space sovereignty, cost reductions from reusable systems, and continuous technological advancement in propulsion and materials. Supportive regulatory frameworks, international space collaborations, and growth of spaceports and ground logistics are further reinforcing the market.

As global economies and security strategies extend into orbit, could carrier rockets become the logistical backbone of a multi-orbit, multi-actor, and commercially scaled space economy?

Report Scope

The report analyzes the Carrier Rockets market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Payload Type (Cargo, Satellite, Other Payload Types); Range Type (LEO, MEO, GEO, Other Range Types); End-Use (Government, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cargo Payload segment, which is expected to reach US$14.9 Billion by 2030 with a CAGR of a 9.5%. The Satellite Payload segment is also set to grow at 10.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 13.4% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Carrier Rockets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Carrier Rockets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Carrier Rockets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AADCO Medical, Inc., Agfa-Gevaert Group, Allengers Medical Systems Ltd., Assing S.p.A, BMI Biomedical International s.r.l. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Carrier Rockets market report include:

- ABL Space Systems

- Arianespace

- Astra Space, Inc.

- Blue Origin

- China Academy of Launch Vehicle Technology (CALT)

- Deep Blue Aerospace

- ExPace Technology Co., Ltd.

- Firefly Aerospace

- Galactic Energy

- IHI Corporation

- ISRO (Indian Space Research Organisation)

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Northrop Grumman Corporation

- PLD Space

- Relativity Space

- Rocket Lab

- Skyroot Aerospace

- SpaceX

- United Launch Alliance (ULA)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABL Space Systems

- Arianespace

- Astra Space, Inc.

- Blue Origin

- China Academy of Launch Vehicle Technology (CALT)

- Deep Blue Aerospace

- ExPace Technology Co., Ltd.

- Firefly Aerospace

- Galactic Energy

- IHI Corporation

- ISRO (Indian Space Research Organisation)

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Northrop Grumman Corporation

- PLD Space

- Relativity Space

- Rocket Lab

- Skyroot Aerospace

- SpaceX

- United Launch Alliance (ULA)

Table Information

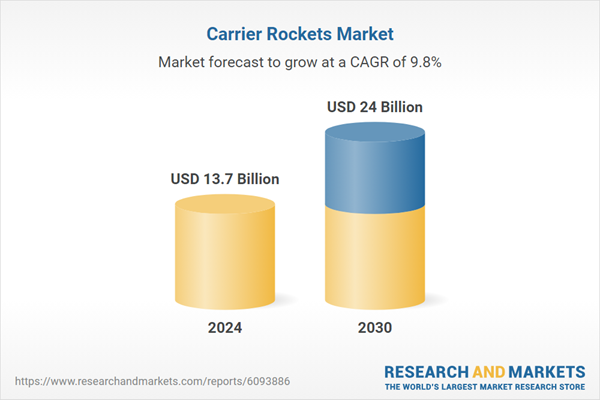

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.7 Billion |

| Forecasted Market Value ( USD | $ 24 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |