Global Circular Fashion Market - Key Trends & Drivers Summarized

Why Is Circular Fashion Gaining Strategic Importance in Sustainability, Consumer Responsibility, and Industry Transformation?

Circular fashion is rapidly emerging as a transformative model within the global apparel industry, aimed at minimizing waste, maximizing resource efficiency, and extending the lifecycle of garments. Unlike the traditional linear model of “take, make, dispose,” circular fashion promotes reuse, repair, resale, rental, and recycling to close material loops and reduce environmental impact. As awareness of the fashion sector's contribution to pollution, landfill burden, and resource depletion grows, circular fashion is becoming a strategic priority for brands, regulators, and consumers alike.Driven by shifting consumer values, particularly among younger demographics, and rising regulatory pressure to meet climate and waste reduction targets, circular fashion is being integrated into core business strategies. From design for durability and modularity to post-use garment recovery and fiber-to-fiber recycling, the industry is embracing a systemic shift aimed at reducing dependency on virgin raw materials while creating new value streams from discarded clothing.

How Are Business Models, Material Technologies, and Digital Platforms Advancing the Circular Fashion Ecosystem?

The evolution of circular fashion is being fueled by innovations in both product design and business operations. Design-for-circularity principles - such as mono-material construction, detachable components, and recyclability - are enabling easier disassembly and repurposing. Regenerative materials, closed-loop synthetics, and biodegradable fibers are gaining ground as alternatives to resource-intensive textiles like conventional cotton and petroleum-based synthetics.Business models centered on resale, rental, refurbishment, and product-as-a-service are redefining how apparel is consumed. Peer-to-peer resale platforms, white-label recommerce services, and subscription-based clothing rental models are scaling quickly, supported by changing attitudes toward ownership and increasing demand for affordability and novelty. Take-back programs and digital product passports are further enabling traceability, transparency, and circular lifecycle tracking.

Technologies such as AI for inventory optimization, blockchain for supply chain verification, and RFID for reverse logistics are making circular operations more viable at scale. As data systems mature, fashion companies are better positioned to measure circularity, optimize recovery flows, and reduce environmental footprints through intelligent design and logistics.

Which Market Segments and Regional Initiatives Are Leading the Adoption of Circular Fashion?

Adoption is strongest in mid-to-premium and luxury fashion segments, where brand equity, customer loyalty, and product longevity align with the economics of resale and repair. Activewear, denim, outerwear, and accessories are categories seeing accelerated circular innovation due to their higher material value, frequent use, and potential for refurbishment. Younger consumers are also driving resale and rental growth, particularly in urban centers with high digital engagement.Europe leads the global transition to circular fashion, supported by the EU's Circular Economy Action Plan, Extended Producer Responsibility (EPR) policies, and national initiatives promoting textile waste reduction. North America is showing strong momentum through consumer-driven resale platforms and sustainability commitments from major retailers. In Asia-Pacific, interest is growing rapidly in Japan, South Korea, and China, with circular fashion emerging as part of wider green consumerism and tech-enabled retail transformation.

What Are the Factors Driving Growth in the Circular Fashion Market?

The circular fashion market is gaining momentum as environmental, social, and economic factors converge to reshape the apparel value chain. The urgency to reduce textile waste, decarbonize supply chains, and meet consumer expectations for ethical and sustainable products is fueling rapid adoption of circular principles and practices.Key growth drivers include rising consumer awareness of fast fashion's environmental toll, regulatory frameworks mandating extended responsibility and waste recovery, increased digitalization enabling reverse logistics and secondary markets, and cost-saving opportunities in materials recovery and product lifecycle extension. Investors and retailers are also recognizing circularity as a lever for long-term resilience and brand differentiation in a resource-constrained future.

As fashion evolves from a linear consumption model to a regenerative and circular ecosystem, could circular fashion redefine how value, style, and sustainability coexist in the global apparel economy?

Report Scope

The report analyzes the Circular Fashion market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Apparel, Accessories, Footwear, Other Product Types); Distribution Channel (Online, Offline, Other Distribution Channels); Textile Source (Organic, Recycled, Reused, Natural Materials, Other Textile Sources); Consumer Group (Millennials, Generation X, Generation Z, Baby Boomers, Other Consumer Groups); End-Use (Men, Women, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Apparel segment, which is expected to reach US$5.9 Billion by 2030 with a CAGR of a 6.6%. The Accessories segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Circular Fashion Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Circular Fashion Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Circular Fashion Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allegion plc, Anviz Global, ASSA ABLOY, Beijing Certificate Authority Co., Ltd., BIO-key International and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Circular Fashion market report include:

- Adidas AG

- Allbirds, Inc.

- Eileen Fisher, Inc.

- Everlane, Inc.

- Fast Retailing Co., Ltd. (Uniqlo)

- Girlfriend Collective

- H&M Group

- Levi Strauss & Co.

- Lululemon Athletica Inc.

- MUD Jeans International B.V.

- Nike, Inc.

- Outerknown, LLC

- Patagonia, Inc.

- PUMA SE

- Reformation

- Rothy's, Inc.

- Stella McCartney Ltd.

- Tentree International Inc.

- The North Face (VF Corporation)

- Thousand Fell

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adidas AG

- Allbirds, Inc.

- Eileen Fisher, Inc.

- Everlane, Inc.

- Fast Retailing Co., Ltd. (Uniqlo)

- Girlfriend Collective

- H&M Group

- Levi Strauss & Co.

- Lululemon Athletica Inc.

- MUD Jeans International B.V.

- Nike, Inc.

- Outerknown, LLC

- Patagonia, Inc.

- PUMA SE

- Reformation

- Rothy's, Inc.

- Stella McCartney Ltd.

- Tentree International Inc.

- The North Face (VF Corporation)

- Thousand Fell

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 328 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

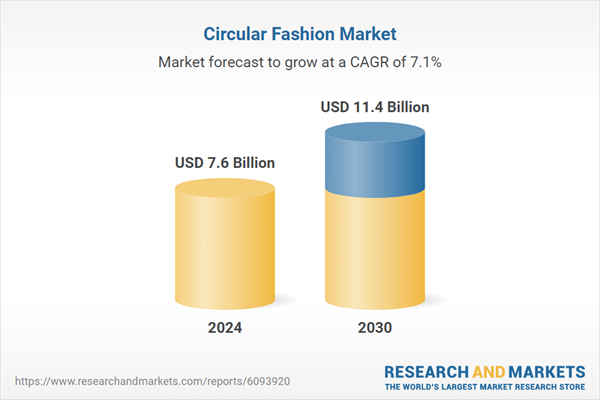

| Estimated Market Value ( USD | $ 7.6 Billion |

| Forecasted Market Value ( USD | $ 11.4 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |