Global Climate and Carbon Finance Market - Key Trends & Drivers Summarized

Why Is Climate and Carbon Finance Becoming a Strategic Lever for Net-Zero Commitments, Green Investment Flows, and Global Policy Alignment?

Climate and carbon finance is gaining prominence as a critical enabler of decarbonization, supporting the mobilization of capital toward low-carbon projects, emissions reduction strategies, and climate resilience infrastructure. This financial mechanism encompasses funding instruments, market-based tools, and investment strategies that price, manage, or mitigate greenhouse gas (GHG) emissions. It includes compliance carbon markets, voluntary carbon offset programs, climate-linked bonds, green lending frameworks, and results-based climate finance. As governments and corporations race to meet net-zero targets and Paris Agreement obligations, climate and carbon finance is being positioned as a vital tool to unlock cross-border capital flows, scale green innovation, and accelerate the transition to a climate-resilient global economy.The market's evolution reflects a broader shift in financial ecosystems, where environmental performance is now directly tied to capital access, risk management, and corporate valuation. The growing integration of environmental, social, and governance (ESG) metrics into mainstream finance is intensifying demand for standardized, scalable, and transparent carbon accounting frameworks that support investment-grade decarbonization strategies.

How Are Carbon Pricing Mechanisms, Financial Instruments, and Risk Analytics Advancing Market Sophistication?

Carbon finance is being driven forward by maturing carbon pricing instruments such as emissions trading systems (ETS), carbon taxes, and cap-and-trade frameworks, which establish market-based incentives for reducing emissions. The expansion of compliance markets - such as the EU ETS, China's national carbon market, and regional schemes in North America and Asia - is creating clearer price signals and regulatory certainty that attract long-term investment into emissions-reducing technologies.In parallel, voluntary carbon markets are undergoing standardization and digitization, enabling the growth of verified carbon offset credits from sectors such as forestry, renewable energy, and carbon capture. Blockchain-enabled registries, satellite monitoring, and AI-driven verification tools are enhancing the integrity and traceability of offset transactions, helping corporates demonstrate carbon neutrality and meet Scope 1-3 reporting obligations.

Climate finance instruments - ranging from green bonds and blended finance vehicles to sustainability-linked loans and climate insurance - are expanding access to capital for mitigation and adaptation projects. These instruments are increasingly supported by climate risk analytics, scenario modeling, and regulatory stress tests that help investors and insurers quantify climate exposure and price climate-related financial risk with greater precision.

Which Sectors, Institutions, and Geographic Regions Are Driving Climate and Carbon Finance Activity?

Leading sectors include energy, transportation, construction, industrial manufacturing, forestry, and agriculture - industries facing high emissions intensity and regulatory scrutiny. Financial institutions, sovereign wealth funds, pension funds, and multinational corporations are at the forefront of climate-aligned capital deployment, driven by shareholder pressure, fiduciary duty, and regulatory mandates. Development finance institutions and multilateral climate funds also play a pivotal role in de-risking private investment in emerging markets.Europe remains the most advanced market, with robust carbon pricing mechanisms, ESG disclosure mandates, and cross-border green finance initiatives. North America is accelerating, particularly with the Inflation Reduction Act in the U.S. and Canada's strengthened carbon tax and transition financing programs. Asia-Pacific is rapidly scaling, led by China's national carbon market and South Korea's ETS, alongside growing voluntary market participation in Southeast Asia. Africa and Latin America are emerging as high-impact regions for nature-based solutions and climate resilience financing through blended capital models and international climate funds.

What Are the Factors Driving Growth in the Climate and Carbon Finance Market?

The climate and carbon finance market is expanding as the urgency of climate action converges with financial innovation and regulatory alignment. Capital markets are increasingly tasked with not only funding the energy transition but also pricing the physical and transition risks associated with climate change.Key growth drivers include the global proliferation of carbon pricing frameworks, increased corporate decarbonization commitments, investor demand for climate-aligned assets, regulatory pressure for climate-related financial disclosures, and advances in digital MRV (measurement, reporting, and verification) tools. The growing recognition of nature-based carbon solutions, coupled with climate risk integration into central bank policy, is also reshaping the capital allocation landscape.

As capital becomes the driving force behind planetary resilience, could climate and carbon finance emerge as the financial architecture underpinning the next phase of global economic transformation?

Report Scope

The report analyzes the Climate and Carbon Finance market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Voluntary, Compliance); Project Type (Renewable Energy Projects, Energy Efficiency Projects, Forest Carbon Projects, Methane Capture & Utilization Projects, Waste Management Projects, Agriculture & Land Use Projects, Other Project Types); Buyer Type (Corporates, Governments, Financial Institutions, Non-Governmental Organizations, Individuals); Participants (Carbon Project Developers, Carbon Market Intermediaries, Carbon Credit Verifiers & Validators, Exchange Platforms); End-Use (Energy & Utilities, Transportation, Manufacturing & Industrial Processes, Agriculture & Forestry, Buildings & Construction, Waste Management, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Voluntary segment, which is expected to reach US$1.6 Trillion by 2030 with a CAGR of a 28.9%. The Compliance segment is also set to grow at 36.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $139.3 Billion in 2024, and China, forecasted to grow at an impressive 30.4% CAGR to reach $421.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Climate and Carbon Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Climate and Carbon Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Climate and Carbon Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adventa Berhad, Ansell Limited, Asiatic Fiber Corporation, Cardinal Health Inc., Careplus Group Berhad and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Climate and Carbon Finance market report include:

- Carbon Streaming Corporation

- Carbon Trust

- Carbonplace

- CDP (Carbon Disclosure Project)

- Climate Impact Partners

- ClimateCare

- ClimatePartner

- EcoAct

- Ecosphere+

- First Climate

- Flowcarbon

- Gold Standard

- Indigo Ag

- MSCI Carbon Markets

- Nori

- PCAF (Partnership for Carbon Accounting Financials)

- South Pole

- The Climate Pledge Fund (Amazon)

- TruCarbon (by TruTerra)

- Verra

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Carbon Streaming Corporation

- Carbon Trust

- Carbonplace

- CDP (Carbon Disclosure Project)

- Climate Impact Partners

- ClimateCare

- ClimatePartner

- EcoAct

- Ecosphere+

- First Climate

- Flowcarbon

- Gold Standard

- Indigo Ag

- MSCI Carbon Markets

- Nori

- PCAF (Partnership for Carbon Accounting Financials)

- South Pole

- The Climate Pledge Fund (Amazon)

- TruCarbon (by TruTerra)

- Verra

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 248 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

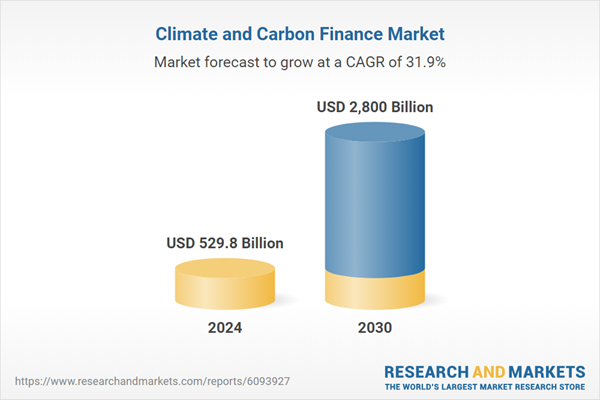

| Estimated Market Value ( USD | $ 529.8 Billion |

| Forecasted Market Value ( USD | $ 2800 Billion |

| Compound Annual Growth Rate | 31.9% |

| Regions Covered | Global |