Global Cold Heading Machines Market - Key Trends & Drivers Summarized

How Is the Demand for High-Strength Fasteners Fueling Cold Heading Equipment Adoption?

The growing need for robust and high-strength fasteners in automotive, aerospace, and industrial equipment manufacturing is significantly propelling the adoption of cold heading machines. These machines are essential in forming bolts, screws, rivets, and pins by deforming metal blanks under high pressure without heat - resulting in minimal material waste and enhanced mechanical properties. As OEMs demand higher output, consistent quality, and reduced cycle times, modern cold heading equipment is being designed with multi-die, multi-blow capabilities to produce complex part geometries with high throughput. This is especially important in the production of structural fasteners used in vehicles, aircraft, construction machinery, and appliances, where precision and durability are paramount.Cold heading processes are also gaining favor due to their ability to produce near-net-shape components with superior fatigue resistance and minimal finishing requirements. In industries where fasteners must withstand vibration, torsional stress, or environmental degradation, cold-headed components offer reliable mechanical integrity. These benefits, combined with the material savings and energy efficiency of cold working, are encouraging manufacturers to shift from traditional machining and casting methods to cold forming technologies - placing cold heading machines at the core of high-volume, precision component production strategies.

What Technological Innovations Are Reshaping Cold Heading Machine Capabilities?

Technological evolution is playing a pivotal role in expanding the functionality and performance of cold heading machines. Modern machines now incorporate servo-driven systems, PLC-based automation, and computer-aided process control, enabling fine-tuned forming sequences and real-time adjustment of forming parameters. These enhancements not only improve dimensional accuracy but also reduce setup times and operator dependency. Integration with vision inspection systems and inline part monitoring tools allows for immediate defect detection, increasing output quality and reducing rework or material wastage.Further innovations include die and punch design improvements, advanced lubrication systems, and noise/vibration control features, all of which contribute to greater machine longevity and smoother operation. Cold heading equipment is also becoming more modular and adaptable, allowing manufacturers to switch between part sizes or geometries with minimal downtime. This flexibility is crucial in industries with dynamic product lifecycles and fluctuating order volumes. Additionally, the emergence of hybrid machines capable of integrating threading, trimming, and part transfer functions has consolidated multiple forming steps into a single, efficient operation - thereby enhancing productivity across mass production facilities.

Where Are Emerging Applications and Regional Expansions Driving Market Opportunities?

Beyond traditional automotive and industrial fasteners, cold heading machines are finding increased application in new sectors including electronics, medical devices, and consumer appliances. The miniaturization of components in smartphones, laptops, and wearable electronics has created demand for precision micro-fasteners, which cold heading machines can produce with high consistency. Similarly, in the medical sector, cold-formed components such as surgical pins, dental screws, and orthopedic fasteners require tight tolerances and non-deforming material characteristics - areas where cold heading offers a clear advantage.On a regional level, industrialization and infrastructure development across Asia-Pacific, Latin America, and Eastern Europe are driving demand for domestically produced fasteners, encouraging investment in local cold heading production lines. China, India, and Southeast Asia are seeing increased establishment of fastener manufacturing hubs, backed by automotive and construction industry growth. Additionally, nearshoring trends and supply chain reconfigurations in North America and Europe are leading to modernization and reshoring of cold heading operations, as companies seek to mitigate geopolitical risks and reduce logistics costs. The rise of EV manufacturing, renewable energy infrastructure, and smart consumer appliances across these regions further strengthens long-term demand for cold-formed components.

The Growth in the Cold Heading Machines Market Is Driven by Several Factors…

The growth in the cold heading machines market is driven by several factors directly linked to evolving end-use applications, precision manufacturing trends, and operational efficiency demands. Key among these is the rising requirement for high-strength, uniform, and fatigue-resistant fasteners across automotive, aerospace, and industrial machinery sectors - necessitating the use of advanced cold forming machinery. Second, the push for higher throughput and reduced manufacturing waste has accelerated the shift from traditional machining to cold heading, which offers near-net-shape forming with excellent material utilization.Automation integration, including CNC control, servo actuation, and inline quality inspection, has significantly enhanced machine accuracy and minimized human error, supporting adoption in high-mix, high-volume manufacturing environments. Growth in miniaturized and precision fastening applications in electronics, medical devices, and appliances is also expanding the use of compact and micro cold heading machines. Meanwhile, regional industrial expansion, reshoring trends, and increasing localization of fastener production in emerging economies are driving machinery investments across global markets. Collectively, these forces are reinforcing the strategic value of cold heading machines in modern component manufacturing ecosystems.

Report Scope

The report analyzes the Cold Heading Machines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technique (Upsetting, Extrusion); End-Use (Automotive, Electrical & Electronics, Industrial, Aerospace & Defense, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Upsetting Technique segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of a 4.6%. The Extrusion Technique segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $949.1 Million in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $886.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Heading Machines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Heading Machines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Heading Machines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAK Zipper Co., Ltd., Asahi Zipper Co., Ltd., CB Zipper Co., Ltd., Coats Group plc, Dunlap Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Cold Heading Machines market report include:

- Asahi Sunac Corporation

- Chun Zu Machinery Industry Co., Ltd.

- Cold Heading Company

- GFM GmbH

- Grandeur Fasteners, Inc.

- Harbin Rainbow Technology Co., Ltd.

- Hatebur Umformmaschinen AG

- Jern Yao Enterprises Co., Ltd.

- Lan Dee Woen Factory Co., Ltd.

- Nakashimada Engineering Works, Ltd.

- National Machinery LLC

- Nedschroef Machinery BV

- Ningbo Sijin Machinery Co., Ltd.

- Profiroll Technologies GmbH

- SACMA Limbiate S.p.A.

- Sakamura Machine Co., Ltd.

- Samrat Machine Tools

- Tanisaka Iron Works Co., Ltd.

- Wrentham Tool Group LLC

- Yeswin Machinery Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Sunac Corporation

- Chun Zu Machinery Industry Co., Ltd.

- Cold Heading Company

- GFM GmbH

- Grandeur Fasteners, Inc.

- Harbin Rainbow Technology Co., Ltd.

- Hatebur Umformmaschinen AG

- Jern Yao Enterprises Co., Ltd.

- Lan Dee Woen Factory Co., Ltd.

- Nakashimada Engineering Works, Ltd.

- National Machinery LLC

- Nedschroef Machinery BV

- Ningbo Sijin Machinery Co., Ltd.

- Profiroll Technologies GmbH

- SACMA Limbiate S.p.A.

- Sakamura Machine Co., Ltd.

- Samrat Machine Tools

- Tanisaka Iron Works Co., Ltd.

- Wrentham Tool Group LLC

- Yeswin Machinery Co., Ltd.

Table Information

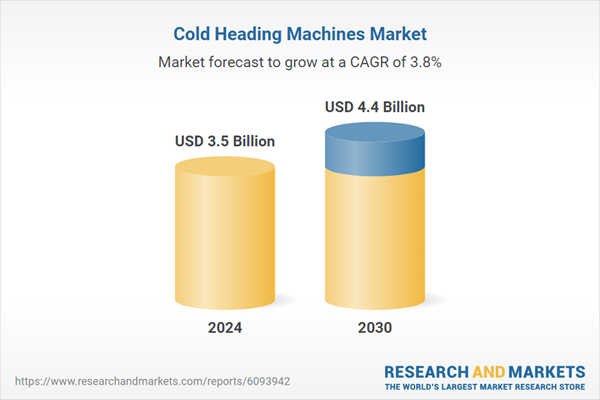

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |