Global Commercial Space Market - Key Trends & Drivers Summarized

How Is the Private Sector Revolutionizing Access to Space?

The commercial space industry is undergoing a seismic shift as private companies rapidly expand their role in launching, operating, and monetizing space assets. What was once the exclusive domain of national space agencies is now an ecosystem dominated by satellite startups, launch providers, and data service companies. A major trend reshaping this market is the decreasing cost of satellite launches, driven by technological innovations in reusable launch vehicles and miniaturization of satellite systems. Companies are no longer dependent on state-owned infrastructure to access orbit, and this democratization is fostering a new era of competition and innovation.Private launch providers are scaling up operations, not only to offer satellite deployment services but also to provide turnkey solutions that include mission management, satellite manufacturing, and in-orbit operations. This has substantially lowered the barrier to entry for small and medium-sized enterprises (SMEs), universities, and emerging nations. The expansion of dedicated rideshare programs and the rise of satellite-as-a-service business models are enabling organizations to access space without developing internal aerospace capabilities, further accelerating market growth.

What Applications Are Driving Commercial Space Investment?

The rapid proliferation of commercial satellites - especially in low Earth orbit (LEO) - is enabling a vast array of new services and revenue streams. Earth observation, climate monitoring, and broadband internet delivery are among the most dominant commercial applications. Companies are leveraging real-time satellite imagery for precision agriculture, logistics optimization, natural disaster management, and urban planning. At the same time, the explosive growth in data consumption and remote connectivity is driving demand for satellite-based internet infrastructure, particularly in underserved and remote regions.In parallel, space-based services are expanding into new territories such as asset tracking, financial market intelligence, and maritime surveillance. Satellite operators are also entering partnerships with telecom companies to develop hybrid networks that integrate terrestrial and space-based infrastructure. The data generated by these services is becoming a highly valuable commodity, driving interest from investors and large technology firms alike. As space becomes a critical enabler of digital transformation across sectors, the commercial value chain is broadening to include data analytics, cloud storage, and artificial intelligence integration.

How Are Infrastructure and Policy Advancements Supporting Market Expansion?

Government support, international collaboration, and regulatory reform are playing essential roles in unlocking commercial opportunities in space. Public space agencies are increasingly partnering with private players through contracts, grants, and joint ventures that reduce financial risks and stimulate innovation. This includes major programs to develop satellite navigation systems, deep space exploration initiatives, and lunar infrastructure - all with commercial participation. At the same time, countries are updating their legal frameworks to facilitate licensing, liability management, and orbital debris mitigation - ensuring a stable and predictable environment for private investment.The build-out of ground segment infrastructure, including global tracking networks, launchpads, mission control centers, and satellite operation facilities, is also driving scalability. Companies are investing in robotic servicing, in-orbit manufacturing, and space traffic management systems to support long-term commercial viability. Space tourism and suborbital flights - once speculative - are now being positioned as premium services within the commercial portfolio, with clear monetization paths through ticket sales, research partnerships, and payload services. These emerging segments are generating fresh momentum for investment in new technologies, workforce development, and ecosystem-wide growth.

The Growth in the Commercial Space Market Is Driven by Several Factors…

The growth in the commercial space market is driven by several factors directly tied to declining launch costs, diversified revenue streams, and policy liberalization. The ability to deploy large satellite constellations at relatively low cost is enabling global coverage for telecommunications, Earth monitoring, and real-time data services. At the same time, advancements in miniaturization, propulsion, and onboard processing have made small satellite platforms more capable and commercially viable, driving adoption across industries.Public-private partnerships and government-backed funding programs are further accelerating innovation by absorbing early-stage risk and encouraging commercialization. The emergence of new application areas - ranging from IoT connectivity and autonomous vehicle guidance to blockchain-based space asset tracking - is attracting venture capital and strategic investments at an unprecedented scale. Additionally, the global expansion of regulatory frameworks and spaceport infrastructure is creating a more conducive environment for private-sector participation. Together, these forces are converging to propel the commercial space market into a dynamic phase of sustained growth, marked by innovation, diversification, and global competitiveness.

Report Scope

The report analyzes the Commercial Space market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Equipment Type (Communications Satellites, Earth Observation Satellites, Launch Vehicles, Other Equipment Types); Solution Type (Satellite IoT, Communications, Geospatial Solution, Other Solution Types); End-Use (Civil, Commercial, Military); Application (Navigation / Agriculture, Surveillance, Earth Environment Monitoring, Space Tourism, Asteroid Mining, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Communications Satellites segment, which is expected to reach US$17 Billion by 2030 with a CAGR of a 2.9%. The Earth Observation Satellites segment is also set to grow at 2.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.1 Billion in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Space Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Space Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Space Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., ADT Inc., Apollo Fire Detectors Ltd., Bosch Security Systems, Carrier Global Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Commercial Space market report include:

- Arianespace

- AST SpaceMobile

- Axiom Space

- Blue Origin

- Boeing

- Capella Space

- China Aerospace Science and Technology Corporation (CASC)

- Firefly Aerospace

- Galactic Energy

- Intuitive Machines

- Lockheed Martin

- Northrop Grumman

- OneWeb

- Planet Labs

- Relativity Space

- Rocket Lab

- Sierra Space

- SpaceX

- Virgin Galactic

- Varda Space Industries

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arianespace

- AST SpaceMobile

- Axiom Space

- Blue Origin

- Boeing

- Capella Space

- China Aerospace Science and Technology Corporation (CASC)

- Firefly Aerospace

- Galactic Energy

- Intuitive Machines

- Lockheed Martin

- Northrop Grumman

- OneWeb

- Planet Labs

- Relativity Space

- Rocket Lab

- Sierra Space

- SpaceX

- Virgin Galactic

- Varda Space Industries

Table Information

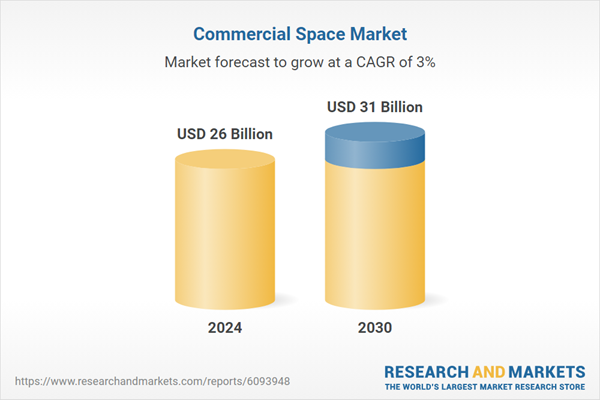

| Report Attribute | Details |

|---|---|

| No. of Pages | 487 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 26 Billion |

| Forecasted Market Value ( USD | $ 31 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |