Global Electric Vehicle Sensors Market - Key Trends & Drivers Summarized

Why Are Sensors Critical to the Performance and Safety of Electric Vehicles?

Electric vehicle (EV) sensors are integral to ensuring the safety, efficiency, and overall performance of electric mobility systems, acting as the 'nervous system' that enables intelligent operation. These sensors monitor and transmit real-time data on a wide range of parameters including temperature, pressure, speed, position, voltage, current, and environmental conditions, which are essential for the functioning of electric drivetrains, battery management systems (BMS), power electronics, and safety mechanisms. For instance, temperature and voltage sensors ensure the optimal performance of high-voltage lithium-ion battery packs by preventing overheating, overcharging, or deep discharging - issues that could lead to battery degradation or thermal runaway. Position sensors help in the precise control of electric motors, supporting smooth acceleration, braking, and torque distribution. Additionally, EVs equipped with advanced driver-assistance systems (ADAS) and semi-autonomous features rely heavily on radar, ultrasonic, LiDAR, and camera sensors for collision avoidance, lane-keeping, and adaptive cruise control. As the complexity of EV architecture grows, so does the demand for sensors that are compact, highly accurate, durable, and compatible with electric-specific conditions such as electromagnetic interference and regenerative braking. Without these sensors, the smart, efficient, and safe operation of electric vehicles would not be possible, making them an indispensable component of the EV ecosystem.How Are Technological Advancements Improving the Capabilities and Applications of EV Sensors?

Technological innovation is rapidly enhancing the capabilities of EV sensors, enabling smarter diagnostics, improved energy management, and seamless vehicle-to-everything (V2X) communication. Advanced material science and miniaturization techniques have led to the development of robust MEMS (Micro-Electro-Mechanical Systems) sensors that are lightweight, highly sensitive, and suitable for integration into tight spaces within the vehicle. New generation Hall-effect and magnetoresistive sensors are improving the precision of speed and position measurements, which are vital for the efficient control of electric motors and regenerative braking systems. Battery sensors are now capable of capturing high-resolution data on cell temperature, internal resistance, and state of charge (SoC) with exceptional accuracy, feeding real-time data into the BMS for predictive maintenance and optimized energy use. Integration with edge computing and AI-driven analytics allows sensors to not only collect data but also process and interpret it on the spot, enhancing responsiveness and reducing data overload on central control units. Optical and radar sensors, once used primarily in luxury vehicles, are becoming more affordable and being widely adopted in mid-range EVs for ADAS applications. Wireless sensor networks are also gaining traction, enabling modular EV architectures and reducing wiring complexity. These innovations are redefining sensor capabilities from simple measurement tools to intelligent components essential for automation, energy optimization, and vehicle intelligence.Why Do Regional EV Adoption Rates and Industry Regulations Influence Sensor Demand and Development?

The demand and development of electric vehicle sensors are deeply influenced by regional EV adoption rates, government regulations, and automotive industry standards. In regions such as Europe and China, where stringent emissions targets and aggressive EV rollouts are backed by government policy, there is high demand for advanced sensor technologies that support both vehicle electrification and automation. Regulatory bodies like the European Commission and China's MIIT (Ministry of Industry and Information Technology) have established safety and environmental benchmarks that necessitate the integration of sensors for emissions compliance, battery safety, and collision avoidance. In the United States, although EV adoption is more state-driven, federal incentives and safety mandates from NHTSA are driving the need for sensors in both battery monitoring and ADAS systems. Meanwhile, in emerging markets like India and Southeast Asia, the adoption of budget EVs and electric two- and three-wheelers is spurring demand for cost-effective, rugged sensors capable of operating in diverse climatic and road conditions. Additionally, regional supply chain strengths affect sensor availability; for example, countries with established electronics manufacturing hubs, such as Japan, South Korea, and Taiwan, are leading sensor innovation and export. These regional dynamics mean that sensor developers must customize their products to align with local performance expectations, regulatory frameworks, and vehicle architectures, while maintaining global scalability and compliance.What Are the Key Drivers Fueling Growth in the Global Electric Vehicle Sensors Market?

The growth in the electric vehicle sensors market is being propelled by a combination of rising EV production, increasing automation levels, technological convergence, and global sustainability goals. One of the most significant drivers is the accelerating global shift toward electric mobility, spurred by climate change concerns, government subsidies, and the phasing out of internal combustion engines in major markets. As automakers scale up EV production, the demand for high-performance sensors across every subsystem - from battery packs and inverters to thermal management and power distribution - continues to climb. The integration of ADAS and autonomous features further fuels the need for environmental sensors like radar, LiDAR, and camera units, which require high-resolution inputs to ensure safety and navigation precision. Consumer expectations for vehicle safety, performance, and connectivity are also encouraging OEMs to incorporate more sensor-based systems, including cabin monitoring for occupant health and driver fatigue detection. Additionally, the emergence of connected and software-defined vehicles is creating new avenues for sensor use in over-the-air updates, real-time diagnostics, and energy usage analytics. The declining cost of sensor components, coupled with advancements in chip fabrication and edge computing, is making sensor integration more feasible across all vehicle segments. As electric and autonomous vehicles become increasingly mainstream, the sensor market is set to become a cornerstone of the future automotive landscape, enabling smarter, safer, and more sustainable mobility worldwide.Report Scope

The report analyzes the Electric Vehicle Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Propulsion Type (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Electric Vehicles); Sensor Type (Temperature Sensors, Current / Voltage Sensors, Pressure Sensors, Position Sensors); Application (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Battery Electric Vehicle Sensors segment, which is expected to reach US$5.5 Billion by 2030 with a CAGR of a 41.4%. The Hybrid Electric Vehicle Sensors segment is also set to grow at 29.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $294.9 Million in 2024, and China, forecasted to grow at an impressive 49.2% CAGR to reach $2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Vehicle Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Vehicle Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Vehicle Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adapt Motors, AG International Pvt Ltd, Ampere Vehicles, Arna Electric Auto Pvt Ltd, BABA E-Rickshaw and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Electric Vehicle Sensors market report include:

- Allegro MicroSystems, Inc.

- Amphenol Advanced Sensors

- ams OSRAM AG

- Analog Devices, Inc.

- Continental AG

- Denso Corporation

- Infineon Technologies AG

- Kohshin Electric Corporation

- LEM Holding SA

- Melexis NV

- NXP Semiconductors NV

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Valeo Group

- Vishay Intertechnology, Inc.

- Zebra Technologies Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allegro MicroSystems, Inc.

- Amphenol Advanced Sensors

- ams OSRAM AG

- Analog Devices, Inc.

- Continental AG

- Denso Corporation

- Infineon Technologies AG

- Kohshin Electric Corporation

- LEM Holding SA

- Melexis NV

- NXP Semiconductors NV

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Valeo Group

- Vishay Intertechnology, Inc.

- Zebra Technologies Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

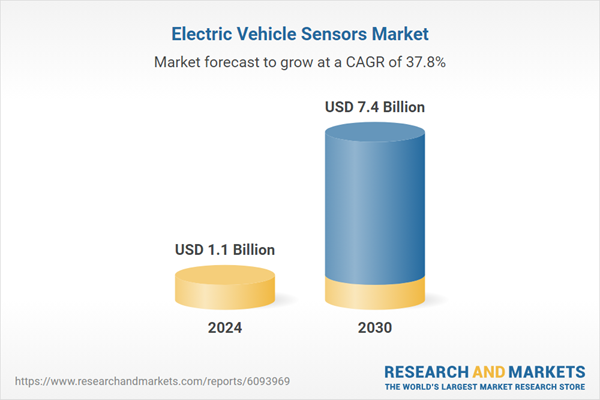

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 37.8% |

| Regions Covered | Global |