Global 'Sweeteners in Food Additives' Market - Key Trends & Drivers Summarized

Why Are Sweeteners Stealing the Spotlight in the Food Additive Industry?

As health-consciousness becomes mainstream and regulatory scrutiny over sugar content intensifies, sweeteners have emerged as a vital segment of the food additive industry. The global pivot away from refined sugars - driven by rising rates of obesity, diabetes, and metabolic disorders - is reshaping how manufacturers formulate products, leading to a boom in both natural and artificial sweetener adoption. From beverages and baked goods to dairy, sauces, and even pharmaceuticals, sweeteners are now considered essential for maintaining flavor profiles without compromising nutritional objectives. Government-led initiatives, such as sugar taxes in the UK, Mexico, and parts of the U.S., have further fueled demand for sugar alternatives. In response, food producers are leveraging sweeteners like stevia, monk fruit, erythritol, xylitol, and sucralose to create 'better-for-you' product variants. These substitutes offer varying degrees of sweetness, caloric value, and aftertaste, allowing for tailored applications depending on the end product. The diversity of consumer dietary needs - from keto and diabetic-friendly to vegan and organic - has also opened up new avenues for differentiated product development centered around alternative sweeteners.How Are Clean Labels and Natural Claims Influencing Sweetener Preferences?

The shift toward clean-label food products has had a profound impact on sweetener demand and formulation strategies. Consumers are scrutinizing ingredient lists more than ever, avoiding additives they perceive as artificial or chemically processed. This has fueled the rapid ascent of natural-origin sweeteners, particularly stevia and monk fruit extract, which are plant-derived, zero-calorie, and often marketed as more 'wholesome' than synthetic counterparts. These sweeteners are gaining favor in segments such as flavored water, protein bars, yogurts, and plant-based beverages. At the same time, producers are seeking novel sweetener blends that minimize off-flavors often associated with single-ingredient solutions, improving palatability without increasing caloric content. Natural polyols like erythritol and allulose are gaining momentum for their sugar-like taste and reduced glycemic impact. Clean-label pressures are also prompting reformulations to eliminate high-fructose corn syrup (HFCS) and aspartame, ingredients once ubiquitous in processed foods. Major brands are investing in extensive R&D to ensure that replacements meet consumer expectations around taste, texture, and stability, proving that ingredient transparency now holds equal weight to nutritional metrics in consumer decision-making.How Is Innovation Transforming the Sweetener Landscape Across Applications?

The sweeteners market is being revolutionized by innovation in both formulation and delivery technologies, enabling precise sweetness modulation across diverse food and beverage categories. Microencapsulation techniques are improving the stability and release profile of high-intensity sweeteners, ensuring consistent taste even in harsh processing conditions like baking and canning. In the beverage sector, where sugar reduction remains a top priority, ingredient suppliers are introducing patented blends that combine steviol glycosides or monk fruit with bulking agents and acidity regulators to enhance mouthfeel. Meanwhile, dairy and frozen dessert producers are experimenting with hybrid formulations that blend nutritive and non-nutritive sweeteners to preserve flavor while lowering sugar content. Another breakthrough is the use of enzyme-treated stevia derivatives, such as Reb M and Reb D, which offer cleaner taste profiles and broader regulatory acceptance. Precision fermentation and bioengineering are also entering the space, enabling the production of sweet proteins and rare sugars at scale. These innovations are not only addressing formulation challenges but also supporting tailored nutrition and sugar-reduction mandates across global food policies. As a result, sweeteners are increasingly viewed as strategic tools in product reformulation and brand positioning.What Factors Are Driving the Growth of the Sweeteners in Food Additives Market?

The growth in the Sweeteners in Food Additives market is driven by several factors related to health-focused consumer behavior, clean-label trends, regulatory pressure, and technological advancements in ingredient development. The most prominent driver is the escalating global concern over excessive sugar consumption and its link to chronic health conditions, prompting both voluntary and mandated reductions in sugar content across processed foods. Consumer demand for low-calorie, diabetic-friendly, and natural products is also driving adoption of plant-based and naturally derived sweeteners like stevia, allulose, and monk fruit. Regulatory frameworks including sugar taxes, labeling mandates, and recommended intake guidelines are compelling food manufacturers to reformulate products using alternative sweeteners. On the technological front, innovations such as enzyme-modified glycosides, microencapsulation, and biotechnological fermentation are enabling the creation of sweeteners with enhanced stability, taste, and cost-effectiveness. Additionally, the proliferation of specialized diets - such as keto, paleo, and vegan - has expanded the market for sweeteners that can cater to diverse consumer needs. The rapid growth of functional foods, health supplements, and low-sugar beverages further reinforces sweeteners' central role in the food additive sector. Together, these forces are driving sustained market expansion and strategic innovation across the sweetener landscape.Report Scope

The report analyzes the Sweeteners in Food Additives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Sucrose, Starch Sweeteners, Sugar Alcohols, High-Intensity Sweeteners Colorants); Application (Bakery & Confectionery, Beverages, Dairy & Frozen Products, Poultry & Sea Food Products).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sucrose segment, which is expected to reach US$9.8 Billion by 2030 with a CAGR of a 4.3%. The Starch Sweeteners segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.1 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $4.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sweeteners in Food Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sweeteners in Food Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sweeteners in Food Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adidas, Allbirds, Amour Vert, Armedangels, ASOS (ASOS Design) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Sweeteners in Food Additives market report include:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- Celanese Corporation

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- E. I. du Pont de Nemours and Company

- Givaudan

- Ingredion Incorporated

- Kerry Group plc

- Lonza Group

- Merisant

- Naturex

- PureCircle

- Roquette Frères

- Tate & Lyle

- WILD Flavors and Specialty Ingredients

- Zydus Wellness Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- Celanese Corporation

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- E. I. du Pont de Nemours and Company

- Givaudan

- Ingredion Incorporated

- Kerry Group plc

- Lonza Group

- Merisant

- Naturex

- PureCircle

- Roquette Frères

- Tate & Lyle

- WILD Flavors and Specialty Ingredients

- Zydus Wellness Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

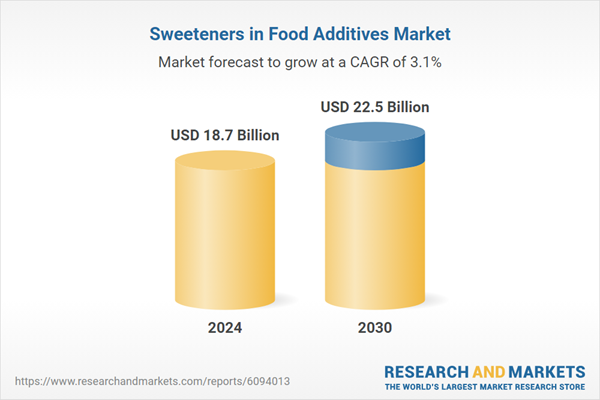

| Estimated Market Value ( USD | $ 18.7 Billion |

| Forecasted Market Value ( USD | $ 22.5 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |