Global 'Transcriptomics Technologies' Market - Key Trends & Drivers Summarized

Why Is Transcriptomics Taking Center Stage in the Era of Precision Medicine?

Transcriptomics - the comprehensive study of RNA transcripts produced by the genome - has rapidly evolved into a cornerstone of modern biomedical research, especially within the expanding domain of precision medicine. By analyzing the dynamic expression of genes in different tissues, cell types, and disease states, transcriptomics offers unparalleled insights into cellular function and pathology. This capability has transformed how scientists diagnose diseases, identify biomarkers, and stratify patients for targeted therapies. The COVID-19 pandemic notably accelerated global awareness of omics technologies, including transcriptomics, as researchers used RNA profiling to track viral evolution and host responses. In oncology, transcriptome sequencing is now frequently used to understand tumor heterogeneity and identify novel drug targets. Additionally, rare disease research has seen breakthroughs through transcriptomic analysis, allowing for better classification and understanding of monogenic disorders. As biopharma companies deepen their investment in personalized therapeutics, the role of transcriptomics in drug discovery, toxicogenomics, and clinical trial optimization has expanded dramatically. This growing clinical and commercial relevance underscores why transcriptomics technologies are now regarded not just as research tools but as foundational to the next generation of diagnostics and therapeutics.How Are Next-Gen Sequencing and Bioinformatics Powering Transcriptomics Innovation?

The explosive growth of transcriptomics owes much to technological breakthroughs in next-generation sequencing (NGS), single-cell RNA sequencing (scRNA-seq), and high-throughput microarray platforms. These tools enable researchers to capture gene expression data at unprecedented resolution and scale, revealing both broad trends and subtle variations in gene activity. Single-cell techniques, in particular, are revolutionizing the field by mapping transcriptomes at the level of individual cells, uncovering previously hidden cell subtypes and disease mechanisms. Meanwhile, advancements in long-read sequencing technologies are addressing limitations in transcript isoform detection and alternative splicing analysis. However, the deluge of data generated from transcriptomics studies requires sophisticated computational tools to manage, interpret, and visualize results. AI and machine learning models are increasingly applied to identify complex patterns, predict gene function, and automate the classification of cell types. Cloud-based bioinformatics platforms and open-source databases have made these powerful tools more accessible to researchers around the world. This integration of wet-lab innovation with dry-lab analytics is not only expanding the utility of transcriptomics but also accelerating the time-to-discovery across multiple therapeutic areas.Can Transcriptomics Technologies Bridge the Gap Between Genomics and Functional Biology?

While genomics reveals the blueprint of life, transcriptomics provides real-time snapshots of how that blueprint is interpreted under varying biological and environmental conditions. This distinction has made transcriptomics essential for functional genomics and systems biology, where understanding gene activity in context is critical. In immunology, for example, transcriptomic profiling is being used to monitor immune cell activation and identify cytokine signatures associated with autoimmune diseases or vaccine responses. Neuroscience research is increasingly reliant on spatial transcriptomics - an emerging method that maps gene expression within tissue architecture - to explore brain cell diversity and neurodegenerative disease pathways. Environmental transcriptomics is another fast-emerging application, helping ecologists assess stress responses in plants and animals to climate change and pollution. Agricultural genomics also benefits from transcriptomics, enabling the breeding of crops with improved yield, stress tolerance, and resistance to pests. These cross-sector applications reflect a growing consensus that transcriptomics bridges the critical gap between static genomic data and dynamic cellular function, making it indispensable not just in healthcare, but across the broader life sciences ecosystem.The Growth in the Transcriptomics Technologies Market Is Driven by Several Factors…

The growth in the transcriptomics technologies market is driven by several factors linked to research demand, technological maturity, and end-user expansion. A key catalyst is the rise of personalized medicine, where RNA profiling plays a central role in identifying patient-specific disease pathways and tailoring treatments. Increased funding for life sciences research - by both governments and private investors - is supporting large-scale transcriptomics studies in areas like oncology, infectious disease, and neurobiology. Technological advancements such as single-cell sequencing, spatial transcriptomics, and high-throughput automation are enabling broader, more detailed transcriptomic analyses at lower costs. Pharmaceutical companies are incorporating transcriptomics into drug development pipelines to de-risk compounds, understand off-target effects, and accelerate regulatory approval processes. Clinical laboratories are beginning to adopt transcriptomic panels as diagnostic tools, particularly in oncology and rare disease testing. Furthermore, the proliferation of bioinformatics platforms and user-friendly data visualization tools has democratized transcriptomics, empowering researchers in academia and industry alike. Regulatory frameworks are gradually adapting to accommodate transcriptomics-based diagnostics, opening new pathways for commercialization. Collectively, these drivers are transforming transcriptomics from a niche scientific method into a vital engine of biomedical and life science innovation.Report Scope

The report analyzes the Transcriptomics Technologies market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Consumables, Instruments, Software, Services); Technology (Microarrays, qPCR, Sequencing Technology); Application (Drug Discovery, Diagnostics & Disease Profiling, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Consumables segment, which is expected to reach US$4.7 Billion by 2030 with a CAGR of a 5.3%. The Instruments segment is also set to grow at 9.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Transcriptomics Technologies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Transcriptomics Technologies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Transcriptomics Technologies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advaxis Inc., Bayer AG, Bellicum Pharmaceuticals, Boston Scientific Corporation, CELGENE Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Transcriptomics Technologies market report include:

- 10x Genomics

- Agilent Technologies Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- BGI Genomics

- Danaher Corporation

- Fluidigm Corporation

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Illumina, Inc.

- LC Sciences, LLC

- Merck KGaA

- NanoString Technologies, Inc.

- PerkinElmer Inc.

- Promega Corporation

- Qiagen N.V.

- Revvity, Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Vizgen, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 10x Genomics

- Agilent Technologies Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- BGI Genomics

- Danaher Corporation

- Fluidigm Corporation

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Illumina, Inc.

- LC Sciences, LLC

- Merck KGaA

- NanoString Technologies, Inc.

- PerkinElmer Inc.

- Promega Corporation

- Qiagen N.V.

- Revvity, Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Vizgen, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

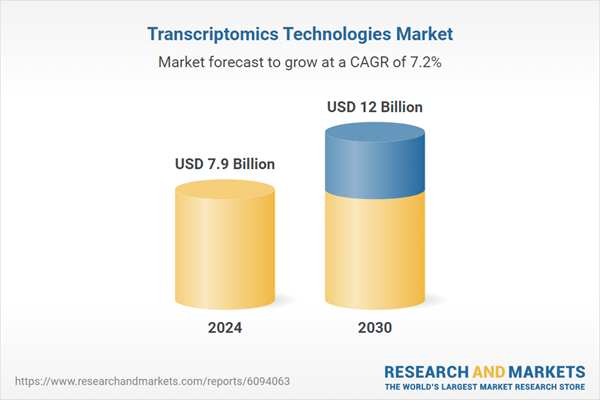

| Estimated Market Value ( USD | $ 7.9 Billion |

| Forecasted Market Value ( USD | $ 12 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |