Global 'Trusted Platform Modules' Market - Key Trends & Drivers Summarized

Why Are Trusted Platform Modules Becoming Critical in Cybersecurity Frameworks?

Trusted Platform Modules (TPMs) have swiftly moved from niche security enhancements to essential components in digital security infrastructures worldwide. These specialized microcontrollers, embedded into devices, provide hardware-based security functions that are foundational for secure boot processes, encryption key storage, and system integrity monitoring. In an era of heightened cyber threats, from ransomware to nation-state attacks, the demand for tamper-resistant security hardware like TPMs is surging. Notably, the 2021 enforcement of TPM 2.0 as a mandatory requirement for Windows 11 installations sparked widespread awareness and rapid integration across enterprise and consumer computing environments. Beyond operating systems, cloud service providers, financial institutions, and defense sectors are embedding TPMs into endpoint devices to ensure cryptographic functions are performed in isolated, secure environments. Their ability to securely generate, store, and manage cryptographic keys ensures they are foundational to secure authentication, identity management, and digital rights management. As digital transformation accelerates, TPMs are becoming indispensable for enterprises aiming to establish zero-trust architectures. Additionally, their usage is extending into securing IoT devices, autonomous vehicles, and industrial control systems, which are especially vulnerable to cyber intrusions due to their vast connectivity and minimal user interfaces. With cyber resilience now a board-level priority, TPMs are not just enabling secure computing - they're becoming synonymous with it.How Is the Regulatory Landscape Shaping the TPM Integration Boom?

Governments and international regulatory bodies are playing a pivotal role in driving the adoption of TPMs by embedding cybersecurity mandates into critical infrastructure regulations. Frameworks such as the European Union's Cybersecurity Act and the U.S. Executive Order on Improving the Nation's Cybersecurity have elevated the importance of hardware-based security. These mandates emphasize cryptographic protections and immutable device identity - capabilities that TPMs deliver with precision. Furthermore, global standards bodies like ISO/IEC and the Trusted Computing Group (TCG) have standardized TPM specifications, making integration easier for OEMs and software developers. Compliance requirements for sectors like banking, defense, healthcare, and telecommunications now often reference TPMs as part of recommended or required hardware security modules. In addition to public mandates, industry-specific standards such as PCI-DSS and FIPS 140-2 are being updated to reflect TPM-enabled safeguards. This regulatory push is compelling device manufacturers to include TPMs in laptops, desktops, servers, and embedded systems to ensure eligibility for procurement and deployment in sensitive environments. Moreover, cloud service providers are leveraging TPM-backed attestation mechanisms to validate the security posture of virtual machines and edge devices. This deepening compliance entrenchment is driving the TPM market to transition from being optional to operationally imperative.In What Ways Are OEMs and Cloud Providers Expanding TPM Use Cases?

The integration of TPMs is no longer limited to enterprise workstations or government systems - original equipment manufacturers (OEMs) and hyperscale cloud providers are now embedding them across a vast spectrum of devices and services. OEMs are pre-installing TPM chips in a wide array of consumer and commercial laptops, tablets, and servers, enabling secure authentication, disk encryption (e.g., BitLocker), and device integrity verification. In the enterprise realm, TPMs serve as the cornerstone for hardware-based root-of-trust mechanisms, which form the first layer of defense against firmware and BIOS-level attacks. Cloud providers are adopting TPM-based remote attestation to validate the trustworthiness of client devices accessing sensitive workloads, especially in hybrid and multi-cloud environments. TPMs are also seeing significant uptake in edge computing, where they safeguard data generated by distributed sensors and processing units operating in often unsecure locations. In the automotive sector, TPMs are being integrated into vehicle control units to secure vehicle-to-everything (V2X) communication, enabling safe and authenticated interactions between cars, infrastructure, and pedestrians. As digital identity and authentication gain prominence in fintech and blockchain applications, TPMs are being explored as secure vaults for storing private keys and digital certificates. This broadening range of applications demonstrates that TPMs are no longer just an enterprise security feature - they're evolving into a ubiquitous digital trust enabler.The Growth in the Trusted Platform Modules Market Is Driven by Several Factors…

The expansion of the trusted platform modules market is underpinned by a dynamic set of drivers spanning technological innovation, end-user demand shifts, and macro-environmental pressures. At the technological level, the proliferation of zero-trust network architectures is fueling the demand for hardware-rooted security frameworks, with TPMs providing an ideal foundation. The growth of connected devices across industries - from smart cities to Industry 4.0 manufacturing lines - requires robust embedded security, making TPMs a critical component in IoT deployment strategies. On the end-user side, the shift toward hybrid work models and BYOD (Bring Your Own Device) culture has heightened the need for endpoint security solutions, which TPMs enable through device integrity checks and secure credential storage. Moreover, the expanding adoption of blockchain technology and secure digital identities is prompting enterprises to leverage TPMs for cryptographic key management. The automotive industry's transition toward connected and autonomous vehicles is further driving TPM integration, as secure communication and data protection become critical for road safety. Consumer behavior is also evolving, with increasing awareness and demand for privacy-focused devices, compelling OEMs to highlight TPM presence as a selling point. Government-led modernization programs, cyber insurance policy requirements, and cybersecurity awareness across all levels of society are collectively reinforcing TPM adoption. Together, these factors are shaping a robust growth trajectory for the trusted platform modules market, transforming them into an indispensable part of the global cybersecurity arsenal.Report Scope

The report analyzes the Trusted Platform Modules market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Discrete, Integrated); Application (Mobile Security, Automotive, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Discrete Modules segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 12.3%. The Integrated Modules segment is also set to grow at 8.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $855.6 Million in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $935.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Trusted Platform Modules Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Trusted Platform Modules Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Trusted Platform Modules Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Volvo, Aptiv PLC, Aurora Innovation, Bendix Commercial Vehicle Systems, Continental AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Trusted Platform Modules market report include:

- Advanced Micro Devices, Inc.

- Atmel Corporation

- Broadcom Inc.

- Fujitsu Limited

- Hewlett-Packard Company

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Lenovo Group Limited

- Microchip Technology Inc.

- Microsoft Corporation

- Nationz Technologies Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Rockchip Electronics Co., Ltd.

- Samsung Electronics Co., Ltd.

- Security Innovation Inc.

- Sinosun Technology Co., Ltd.

- STMicroelectronics N.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro Devices, Inc.

- Atmel Corporation

- Broadcom Inc.

- Fujitsu Limited

- Hewlett-Packard Company

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Lenovo Group Limited

- Microchip Technology Inc.

- Microsoft Corporation

- Nationz Technologies Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Rockchip Electronics Co., Ltd.

- Samsung Electronics Co., Ltd.

- Security Innovation Inc.

- Sinosun Technology Co., Ltd.

- STMicroelectronics N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | January 2026 |

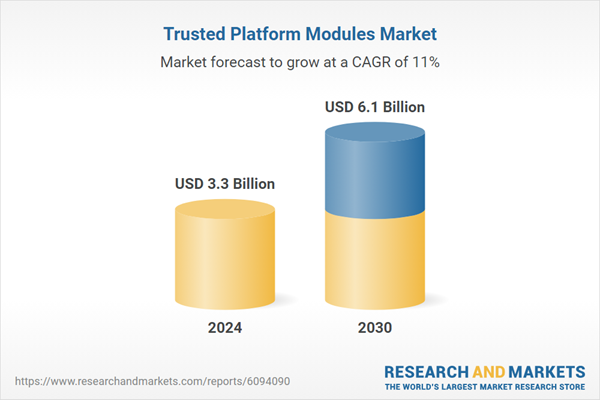

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |