Global 'UAV Satellite Communications' Market - Key Trends & Drivers Summarized

How Are Satellites Enabling the Next Generation of Beyond-Visual-Line-of-Sight (BVLOS) UAV Operations?

The rapid expansion of UAV operations into longer-range and higher-altitude missions has made satellite communications (SATCOM) indispensable, particularly in scenarios where terrestrial communication infrastructure is limited or unavailable. Traditional UAVs have been restricted to line-of-sight control using radio frequency (RF) systems, limiting their operational range and effectiveness in remote or hostile terrains. The integration of SATCOM technologies has revolutionized this landscape by enabling real-time, beyond-visual-line-of-sight (BVLOS) communication between UAVs and control stations located thousands of kilometers away. This capability is especially critical for long-endurance UAVs used in defense surveillance, maritime monitoring, and disaster response, where persistent connectivity is essential. SATCOM-equipped UAVs can transmit high-resolution imagery, telemetry data, and video feeds to command centers with minimal latency, regardless of ground-based infrastructure. Moreover, dual-use systems capable of switching between terrestrial and satellite networks based on connectivity availability are gaining prominence, offering redundancy and operational flexibility. The advancement of low Earth orbit (LEO) satellite constellations is further accelerating this transition, providing higher bandwidth, lower latency, and global coverage at a fraction of the cost traditionally associated with geostationary satellite services.In What Ways Are Defense And Commercial Applications Shaping SATCOM-UAV Demand?

The demand for SATCOM-enabled UAVs is being driven simultaneously by military and commercial sectors, though the applications and specifications vary significantly across these domains. In defense, UAVs equipped with SATCOM capabilities are being deployed for strategic ISR (intelligence, surveillance, and reconnaissance) missions, border security, and unmanned combat operations. These drones rely on high-throughput satellite links to stream encrypted, mission-critical data to ground command units in real time. Governments are increasingly investing in SATCOM-based UAV systems that can interoperate with other aerial, naval, and ground assets, creating an integrated battlefield ecosystem. In contrast, commercial demand is surging in industries like oil and gas, mining, and logistics, where UAVs conduct aerial surveys, monitor pipelines, and track shipments across vast, uninhabited geographies. For instance, UAVs monitoring offshore rigs or inspecting infrastructure in deserts or arctic zones cannot rely on cellular networks, making satellite connectivity essential. Humanitarian organizations and environmental researchers are also adopting SATCOM drones for rapid damage assessment, wildlife tracking, and delivering aid in inaccessible regions. These varied applications are broadening the scope of SATCOM systems and fueling demand for smaller, lighter, and more power-efficient terminals specifically designed for UAV integration.How Are Technological Advances Enhancing the Viability and Affordability of UAV SATCOM?

Technological innovations in both satellite systems and UAV design are drastically improving the feasibility, performance, and cost-effectiveness of SATCOM-enabled UAV operations. The miniaturization of satellite terminals and antennas has enabled the integration of SATCOM systems even into small- and mid-sized UAVs without compromising payload capacity or flight time. Electronically steerable antennas (ESAs), which can rapidly track multiple satellites without moving parts, are replacing bulky mechanical dishes, reducing drag and maintenance requirements. At the same time, the proliferation of LEO satellite constellations, such as those developed by SpaceX (Starlink), OneWeb, and Amazon's Project Kuiper, is introducing a new era of global, high-speed broadband access for mobile platforms like drones. These LEO networks are designed to deliver lower latency and higher data throughput than legacy geostationary satellites, making them particularly suitable for real-time UAV operations. Simultaneously, software-defined radios (SDRs) and adaptive communication protocols are enhancing link resilience and bandwidth utilization, ensuring consistent performance even in contested or high-interference environments. All these factors are converging to democratize SATCOM access for UAV operators, previously limited by high costs and bulky hardware.What's Fueling the Surge in Global Adoption of SATCOM for UAVs?

The growth in the UAV satellite communications market is driven by several factors that reflect a confluence of operational needs, technological breakthroughs, and shifting regulatory landscapes. One of the primary drivers is the global surge in BVLOS UAV missions, particularly in sectors such as defense, maritime, energy, and remote logistics, where uninterrupted communication is mission-critical. Secondly, the accelerating deployment of low Earth orbit satellite networks is providing affordable, low-latency broadband coverage, unlocking new opportunities for UAV connectivity across geographies previously deemed unreachable. Thirdly, evolving air traffic management standards and regulatory frameworks, particularly in the U.S., EU, and Asia-Pacific, are formalizing requirements for BVLOS operations, which often mandate SATCOM or equivalent robust communication systems. Another significant factor is the miniaturization and power optimization of UAV-compatible SATCOM terminals, making them suitable even for medium-sized drones. Additionally, the commercial availability of plug-and-play SATCOM modules is allowing integrators and OEMs to rapidly equip UAVs without extensive custom engineering. Lastly, the increasing need for secure, encrypted communication links in defense and intelligence missions is reinforcing SATCOM's role as a non-negotiable enabler for modern UAV fleets. Together, these dynamics are not only driving market growth but also transforming SATCOM from a niche capability into a mainstream requirement across global UAV operations.Report Scope

The report analyzes the UAV Satellite Communications market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Fixed Wing, Medium-Altitude Long-Endurance, High-Altitude Long-Endurance, Mini UAVs, VTOL, Rotary Wing, Single-Rotor, Multi-Rotor); Component (Amplifier, Analog-To-Digital Converter, Antennae, Casing, Decoder, Demodulator, Demultiplexer, Descrambler, Digital-To-Analog Converter); Application (Agriculture & Forestry, Cinematography, Civil Surveillance, Disaster Management, Industrial Inspection & Monitoring, Marine Surveillance, Surveying & Mapping, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

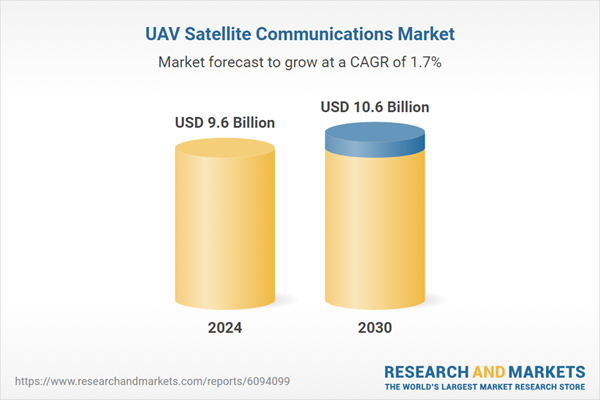

- Market Growth: Understand the significant growth trajectory of the Fixed Wing UAV segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of a 1.7%. The Medium-Altitude Long-Endurance UAV segment is also set to grow at 1.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 1.6% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global UAV Satellite Communications Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global UAV Satellite Communications Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global UAV Satellite Communications Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as APC Propellers, ARRIS, Carter Aviation Technologies, Electravia - E-Props, Falcon Propellers and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this UAV Satellite Communications market report include:

- Airbus Defence and Space

- Anduril Industries

- Cobham Aerospace Communications

- EchoStar Corporation

- Gilat Satellite Networks

- Honeywell International Inc.

- Hughes Network Systems

- Inmarsat Global Ltd.

- Iridium Communications Inc.

- L3Harris Technologies

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orbit Communication Systems

- RTX Corporation

- SES S.A.

- SKY Perfect JSAT Corporation

- SKYTRAC Systems Ltd.

- Telesat

- Thales Group

- Viasat Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- Anduril Industries

- Cobham Aerospace Communications

- EchoStar Corporation

- Gilat Satellite Networks

- Honeywell International Inc.

- Hughes Network Systems

- Inmarsat Global Ltd.

- Iridium Communications Inc.

- L3Harris Technologies

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orbit Communication Systems

- RTX Corporation

- SES S.A.

- SKY Perfect JSAT Corporation

- SKYTRAC Systems Ltd.

- Telesat

- Thales Group

- Viasat Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 10.6 Billion |

| Compound Annual Growth Rate | 1.7% |

| Regions Covered | Global |