Global 'Ultrasonic Position Sensors' Market - Key Trends & Drivers Summarized

Why Are Ultrasonic Position Sensors Gaining Strategic Importance Across Industrial Automation?

Ultrasonic position sensors are rapidly becoming indispensable across a wide spectrum of industries due to their ability to provide accurate, non-contact measurement in complex environments where traditional sensors struggle. These devices work by emitting high-frequency sound waves and calculating the time it takes for the echo to return after bouncing off an object, enabling precise distance measurement. Unlike optical or laser-based sensors, ultrasonic position sensors are unaffected by dust, smoke, moisture, or ambient light, making them especially valuable in harsh industrial settings. As manufacturing and automation processes become more dynamic and flexible, there is a growing need for sensors that can adapt to varying materials, surfaces, and environmental conditions. Ultrasonic sensors fit this niche perfectly, enabling accurate object detection, proximity sensing, level monitoring, and robotic guidance without degradation in performance. Industries such as automotive, packaging, pharmaceuticals, and food processing are increasingly integrating these sensors into production lines to enhance operational efficiency, minimize downtime, and meet strict quality control standards. Their resilience, versatility, and cost-effectiveness make them an essential component in the ongoing global shift toward Industry 4.0.How Is Technological Advancement Elevating Sensor Capabilities and Applications?

The evolution of ultrasonic position sensors is being driven by key innovations in signal processing, miniaturization, and digital integration. Modern sensors now feature embedded microcontrollers that enable real-time signal filtering and compensation for temperature, humidity, and pressure variations, resulting in improved measurement reliability. Enhanced firmware capabilities are allowing sensors to self-calibrate, detect multiple targets, and eliminate false readings - functionalities critical in dynamic industrial environments. Furthermore, multi-sensor arrays are being deployed in advanced robotics and automated guided vehicles (AGVs) for obstacle avoidance and path planning, leveraging sensor fusion techniques for improved spatial awareness. Integration with industrial communication protocols such as IO-Link, CANopen, and EtherCAT allows ultrasonic sensors to seamlessly interface with centralized control systems, enabling predictive maintenance and real-time diagnostics. There is also a growing trend toward smart sensors that not only collect data but also process and transmit it to cloud platforms, contributing to predictive analytics and digital twin models. These enhancements are broadening the application scope beyond traditional manufacturing into areas like autonomous agriculture, logistics, construction automation, and even medical robotics.In What Ways Are End-Use Industries Adapting to Ultrasonic Sensing Technologies?

The rising adoption of ultrasonic position sensors across end-use sectors is closely tied to the digital transformation of operations, particularly where precision and environmental resilience are paramount. In the automotive industry, these sensors are utilized for part positioning, assembly verification, and parking assist systems. The food and beverage sector employs them to monitor fill levels in opaque containers and manage conveyor-based sorting without contact contamination. In agriculture, smart farming equipment uses ultrasonic sensors to detect plant spacing and guide autonomous tractors with minimal soil disruption. Meanwhile, the logistics and warehousing sectors are leveraging these sensors for pallet positioning, bin level detection, and mobile robot navigation. The construction and mining industries, often challenged by dust and vibration, favor ultrasonic sensors for machine alignment, equipment safety, and materials handling. Additionally, healthcare and biomedical device manufacturers are experimenting with ultrasonic sensors for non-invasive measurements in lab automation and robotic surgery. This widespread, cross-sector uptake is driven by the sensor's adaptability, which reduces the need for multiple sensing technologies and simplifies integration in heterogeneous environments.What Forces Are Powering the Global Growth of the Ultrasonic Position Sensors Market?

The growth in the ultrasonic position sensors market is driven by several factors that reflect advancements in technology, shifting industrial demands, and evolving consumer expectations. First, the rising automation across sectors such as manufacturing, logistics, agriculture, and healthcare is necessitating reliable and versatile sensing solutions capable of operating in variable and often harsh environments. Second, the miniaturization of components combined with cost-efficient manufacturing is making ultrasonic sensors more accessible to small and mid-sized enterprises seeking to automate without extensive capital outlay. Third, the increasing need for real-time monitoring and intelligent feedback systems in smart factories and digital supply chains is propelling the integration of network-ready ultrasonic sensors. Fourth, advancements in IoT and cloud-based analytics are encouraging the deployment of smart sensors that contribute valuable operational data for optimization and decision-making. Additionally, the transition toward electric vehicles (EVs) and autonomous mobility platforms is creating new demand for ultrasonic sensors in ADAS (Advanced Driver Assistance Systems) and battery assembly lines. Finally, supportive government policies for smart manufacturing and subsidies for industrial modernization in regions such as Asia-Pacific and Eastern Europe are catalyzing adoption. These multifaceted drivers are reinforcing the role of ultrasonic position sensors as a foundational technology in the global automation revolution.Report Scope

The report analyzes the Ultrasonic Position Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Range (Medium Range, Short Range, Long Range); Application (Automotive, Industrial, Healthcare, Consumer Electronics, Food & Beverages, Aerospace & Defense, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Medium Range Sensors segment, which is expected to reach US$62.8 Million by 2030 with a CAGR of a 2.2%. The Short Range Sensors segment is also set to grow at 1.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $27.2 Million in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $20.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ultrasonic Position Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ultrasonic Position Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ultrasonic Position Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

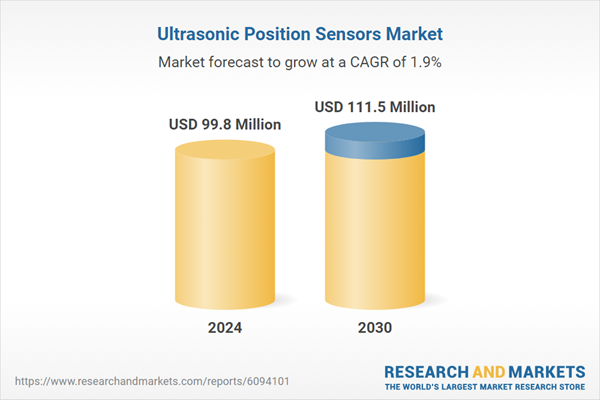

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Actaris, Apator S.A., Badger Meter Inc., BMETERS Srl, Carlo Gavazzi Holding AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Ultrasonic Position Sensors market report include:

- Balluff GmbH

- Banner Engineering Corp.

- Baumer Group

- Bosch Mobility

- Contrinex AG

- Endress+Hauser Group

- FRABA Group (POSITAL)

- GE Measurement & Control

- Honeywell International Inc.

- ifm electronic GmbH

- Ixthus Instrumentation Ltd.

- Massa Products Corporation

- Miran Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Pepperl+Fuchs SE

- Rockwell Automation, Inc.

- SensComp Inc.

- Siemens AG

- Sonair AS

- Turck Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Balluff GmbH

- Banner Engineering Corp.

- Baumer Group

- Bosch Mobility

- Contrinex AG

- Endress+Hauser Group

- FRABA Group (POSITAL)

- GE Measurement & Control

- Honeywell International Inc.

- ifm electronic GmbH

- Ixthus Instrumentation Ltd.

- Massa Products Corporation

- Miran Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Pepperl+Fuchs SE

- Rockwell Automation, Inc.

- SensComp Inc.

- Siemens AG

- Sonair AS

- Turck Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 292 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 99.8 Million |

| Forecasted Market Value ( USD | $ 111.5 Million |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |