Global 'Vehicle Recycling' Market - Key Trends & Drivers Summarized

Why Is Vehicle Recycling Becoming a Global Imperative in the Automotive Lifecycle?

As global vehicle production and ownership rates soar, end-of-life vehicle (ELV) management is becoming an urgent economic, environmental, and regulatory priority. Each year, tens of millions of vehicles reach the end of their operational lifespan, generating massive volumes of waste - but also unlocking a valuable stream of recyclable materials including steel, aluminum, copper, plastics, glass, and rare earth elements. Vehicle recycling not only helps reduce landfill waste but also conserves natural resources and curbs carbon emissions associated with raw material extraction. In this context, governments worldwide are implementing stringent ELV regulations that mandate recycling quotas, proper dismantling, and recovery practices. Europe's ELV Directive, Japan's Automobile Recycling Law, and similar policies in North America and China are creating a structured framework for responsible disposal and material recovery. The increasing emphasis on circular economy principles is pushing automotive OEMs and recyclers to design vehicles with recyclability in mind, facilitating easier dismantling and greater value extraction from end-of-life assets.How Is Technological Innovation Enhancing Efficiency in Vehicle Recycling?

Modern vehicle recycling is a far cry from the rudimentary scrap yards of the past. Today, it involves highly automated, tech-driven processes that maximize material recovery while ensuring environmental compliance. Advanced vehicle dismantling systems now use robotics, AI, and machine vision to identify and segregate parts with precision. Shredders are equipped with smart separation technologies - including eddy current separators, magnetic sorters, and near-infrared spectroscopy - to recover ferrous and non-ferrous metals efficiently. Innovations in battery recycling are especially critical as electric vehicles become more prevalent; companies are developing closed-loop systems to recover lithium, cobalt, and nickel from spent batteries. Moreover, blockchain and cloud-based inventory systems are improving traceability and regulatory reporting throughout the recycling chain. These technologies reduce labor intensity, enhance yield rates, and lower environmental risk, making vehicle recycling both more profitable and more sustainable. With digital diagnostics and telematics integration, recyclers can now assess the residual value of vehicles and components even before dismantling begins.What Role Do Policy Frameworks and OEM Strategies Play in Market Expansion?

Public policy and industry strategy are working in tandem to drive the growth and formalization of the vehicle recycling sector. Governments are offering subsidies, tax incentives, and compliance credits to authorized treatment facilities (ATFs) that meet environmental and safety standards. Simultaneously, they are cracking down on informal recycling operations that pose environmental hazards and disrupt material markets. At the corporate level, OEMs are embracing 'design for disassembly' and investing in take-back programs to align with circular economy mandates. Some automakers have launched in-house recycling divisions or partnered with recycling specialists to control the full vehicle lifecycle - from production to disposal. Extended Producer Responsibility (EPR) regulations are holding manufacturers accountable for the end-of-life treatment of their products, encouraging deeper collaboration across the value chain. Additionally, global initiatives to reduce carbon emissions and promote sustainability in supply chains are reinforcing the adoption of closed-loop material recovery systems, especially for critical and rare earth elements.What's Fueling the Rapid Growth of the Vehicle Recycling Market Globally?

The growth in the vehicle recycling market is driven by several powerful forces rooted in sustainability mandates, economic opportunity, and shifting consumer and regulatory expectations. The rising number of vehicles reaching end-of-life - fueled by aging fleets and shorter product cycles - is generating a steady supply of recyclable assets. Growing environmental awareness and government regulations around responsible waste management and emissions reduction are compelling businesses to embrace structured recycling processes. The surge in electric vehicles is creating a new frontier in battery and electronics recycling, adding urgency and complexity to the market. Meanwhile, volatile raw material prices and supply chain disruptions are incentivizing manufacturers to recover metals and polymers from existing sources. Consumer demand for greener brands is also influencing automakers to adopt visible, verifiable recycling initiatives. Technological innovations in dismantling, material sorting, and digital asset tracking are making recycling more efficient and commercially viable. These converging trends are not only expanding the scope of vehicle recycling but are also elevating it as a critical pillar of the global automotive and environmental ecosystem.Report Scope

The report analyzes the Vehicle Recycling market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Iron, Aluminum, Steel, Rubber, Copper, Glass, Plastic, Other Materials); Vehicle Type (Passenger Cars Recycling, Commercial Vehicles Recycling); Application (OEMs, Aftermarket).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Iron Material segment, which is expected to reach US$54.4 Billion by 2030 with a CAGR of a 15.4%. The Aluminum Material segment is also set to grow at 14.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.6 Billion in 2024, and China, forecasted to grow at an impressive 18.1% CAGR to reach $41.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vehicle Recycling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vehicle Recycling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vehicle Recycling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGWS (American Guardian Warranty Services), Allianz SE, American Auto Shield, Assurant Inc., Auto TechGuard and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Vehicle Recycling market report include:

- ASM Auto Recycling Ltd.

- Copart Inc.

- Eco-bat Technologies

- EMR (European Metal Recycling)

- Hensel Recycling Group

- INDRA

- Kaiho Sangyo Co., Ltd.

- Keiaisha Co. Ltd.

- LKQ Corporation

- MBA Polymers

- Pull-A-Part LLC

- Radius Recycling (formerly Schnitzer Steel Industries)

- Redwood Materials

- Scholz Recycling GmbH

- SEDA-Umwelttechnik GmbH

- Sims Metal Management Limited

- Stellantis (SUSTAINera)

- Toyota Motor Corporation

- United Recyclers Group LLC

- 3R Recycler

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ASM Auto Recycling Ltd.

- Copart Inc.

- Eco-bat Technologies

- EMR (European Metal Recycling)

- Hensel Recycling Group

- INDRA

- Kaiho Sangyo Co., Ltd.

- Keiaisha Co. Ltd.

- LKQ Corporation

- MBA Polymers

- Pull-A-Part LLC

- Radius Recycling (formerly Schnitzer Steel Industries)

- Redwood Materials

- Scholz Recycling GmbH

- SEDA-Umwelttechnik GmbH

- Sims Metal Management Limited

- Stellantis (SUSTAINera)

- Toyota Motor Corporation

- United Recyclers Group LLC

- 3R Recycler

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

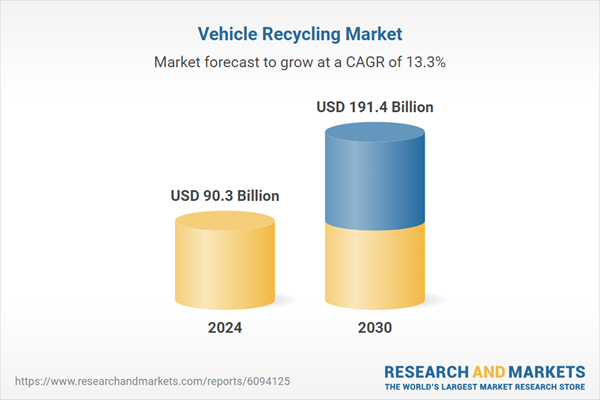

| Estimated Market Value ( USD | $ 90.3 Billion |

| Forecasted Market Value ( USD | $ 191.4 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |