Global Ventilation Equipment Market - Key Trends & Drivers Summarized

Why Is Indoor Air Quality Gaining Unprecedented Importance Worldwide?

The ventilation equipment market is experiencing a profound surge in demand as indoor air quality becomes a central concern across both residential and commercial sectors. Heightened awareness of airborne diseases, including the global impact of COVID-19, has reshaped public health priorities, with governments and organizations enforcing stricter indoor air standards. In response, the market is seeing a shift toward energy-efficient, smart ventilation systems that not only ensure optimal air exchange but also monitor pollutants like carbon dioxide, volatile organic compounds (VOCs), and particulate matter. Advanced HVAC systems integrated with smart sensors and IoT connectivity are rapidly replacing traditional models, particularly in healthcare, education, and office buildings where indoor occupancy density is high. Urbanization is another major contributor - growing city populations are increasingly reliant on high-rise buildings, which necessitate mechanical ventilation to compensate for limited natural airflow. Additionally, evolving building codes in regions such as North America, Europe, and parts of Asia-Pacific now require energy recovery ventilators (ERVs) and heat recovery ventilators (HRVs) to reduce energy loss while maintaining air purity. This combination of public health urgency, building design evolution, and technological sophistication is fueling sustained interest and innovation in the ventilation equipment market.How Are Sustainability Goals Reshaping Equipment Design and Adoption?

Global decarbonization and energy efficiency mandates are transforming how ventilation systems are designed, manufactured, and deployed. The push for net-zero buildings and stricter environmental regulations - such as the European Union's Energy Performance of Buildings Directive (EPBD) and California's Title 24 energy code - are accelerating the adoption of high-performance ventilation solutions. Manufacturers are innovating to deliver equipment that combines lower energy consumption with higher filtration performance, leveraging materials like variable-speed fans, DC motors, and high-efficiency particulate air (HEPA) filters. Demand for decentralized ventilation systems, especially in retrofit applications, is rising as property owners seek flexible, minimally invasive solutions. In commercial settings, systems equipped with CO2 sensors and automated demand-control ventilation (DCV) mechanisms are now preferred for their ability to adapt airflow dynamically based on occupancy levels. Innovations in smart building platforms are further reinforcing this shift - ventilation units are increasingly integrated with centralized building management systems (BMS) that provide real-time analytics, diagnostics, and remote maintenance capabilities. Additionally, green certifications such as LEED, BREEAM, and WELL are incentivizing developers to install sophisticated air handling units that go beyond minimum code compliance to achieve superior indoor environmental quality. This convergence of environmental responsibility and intelligent engineering is becoming a critical growth axis for the industry.What Role Do Industrial and Commercial Applications Play in Market Expansion?

While residential applications remain important, industrial and commercial end-users are at the forefront of driving demand for advanced ventilation systems. In manufacturing environments, ventilation is essential for controlling dust, fumes, and temperature, especially in sectors such as pharmaceuticals, chemicals, and electronics where cleanroom standards are required. Food processing plants, mining operations, and heavy engineering facilities depend on specialized exhaust and supply fans to ensure regulatory compliance and worker safety. Warehouses and logistics hubs, often operating 24/7, are investing in high-capacity ventilation to improve energy use while maintaining airflow in large spaces. Meanwhile, the commercial real estate sector - including malls, hotels, airports, and office complexes - is investing in centralized HVAC and air distribution systems that meet both health and energy standards. Schools and universities are also upgrading legacy ventilation units to comply with post-pandemic ventilation protocols that emphasize increased air changes per hour (ACH) and use of MERV-rated filters. The growing trend of hybrid workspaces and co-working environments is compelling property managers to reevaluate airflow solutions that provide individualized comfort without compromising system efficiency. These multifaceted commercial and industrial applications underscore the expanding scope and complexity of the global ventilation equipment market.What's Powering the Momentum Behind Market Growth Across Regions and Sectors?

The growth in the ventilation equipment market is driven by several factors linked to technology advancement, end-use evolution, regulatory mandates, and consumer health expectations. Technological innovation - especially the integration of AI, machine learning, and IoT in ventilation controls - is enabling more precise, adaptive, and energy-conscious systems that cater to dynamic environmental conditions. In terms of end-use, the proliferation of green building practices and smart infrastructure across urban and semi-urban areas is significantly boosting adoption across commercial and institutional spaces. From a regional perspective, the Asia-Pacific region is witnessing aggressive growth due to rapid urbanization, a burgeoning middle class, and rising investment in infrastructure and real estate. Europe continues to lead in regulatory stringency, pushing manufacturers to design compliant, low-emission ventilation systems. Meanwhile, North America's focus on public health, coupled with investments in education and healthcare infrastructure, is driving demand for high-efficiency and intelligent air systems. Changing consumer behavior - particularly heightened awareness about allergens, airborne pathogens, and the long-term effects of poor air quality - is translating into greater adoption of home ventilation systems as well. All these factors are collectively reshaping the global ventilation equipment landscape, offering a fertile ground for innovation, expansion, and long-term sustainability.Report Scope

The report analyzes the Ventilation Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Data Center Cooling, Centralized Ventilation, Decentralized Ventilation, Range Hood); Equipment Type (Air Filter, Air Handling Unit, Air Purifier, Roof Vents, Axial Fan, Centrifugal Fan); Application (Industrial, Commercial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Data Center Cooling segment, which is expected to reach US$18.5 Billion by 2030 with a CAGR of a 7.9%. The Centralized Ventilation segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.3 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $8.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ventilation Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ventilation Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ventilation Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbiquity Inc., Arada Systems Inc., ASELSAN A.S., Autotalks Ltd., BMW Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Ventilation Equipment market report include:

- ABC Ventilation Systems

- Aerovent

- Air System Components, Inc.

- BELIMO Holding AG

- CaptiveAire Systems

- Carrier Global Corporation

- Cincinnati Fan

- Daikin Industries, Ltd.

- Delta Electronics, Inc.

- ebm-papst Group

- FläktGroup

- Greenheck Fan Corporation

- Honeywell International Inc.

- Howden Group

- Johnson Controls International plc

- Lennox International Inc.

- Lindab International AB

- Loren Cook Company

- Midea Group Co., Ltd.

- Mitsubishi Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABC Ventilation Systems

- Aerovent

- Air System Components, Inc.

- BELIMO Holding AG

- CaptiveAire Systems

- Carrier Global Corporation

- Cincinnati Fan

- Daikin Industries, Ltd.

- Delta Electronics, Inc.

- ebm-papst Group

- FläktGroup

- Greenheck Fan Corporation

- Honeywell International Inc.

- Howden Group

- Johnson Controls International plc

- Lennox International Inc.

- Lindab International AB

- Loren Cook Company

- Midea Group Co., Ltd.

- Mitsubishi Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | February 2026 |

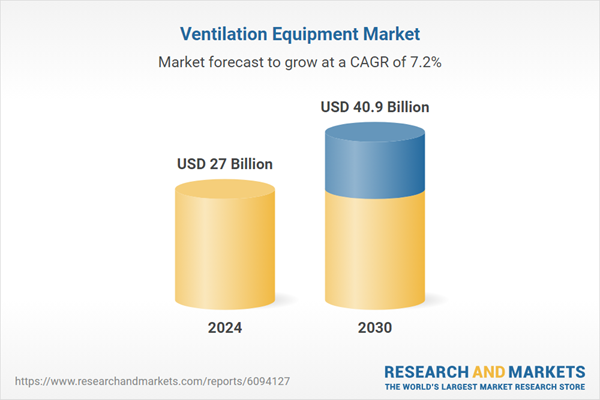

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27 Billion |

| Forecasted Market Value ( USD | $ 40.9 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |