Global Veterinary Drugs Compounding Market - Key Trends & Drivers Summarized

Why Is Customized Veterinary Medication Rising in Demand Among Pet and Livestock Owners?

Veterinary drug compounding - the practice of preparing customized medications for animals by altering dosage forms, ingredients, or delivery mechanisms - is experiencing a strong surge in global demand. This trend is closely linked to the increasing humanization of pets, as pet owners seek personalized healthcare solutions comparable to those available in human medicine. Standard veterinary drugs often come in limited dosage forms or strengths, making them unsuitable for animals of different sizes, species, or with specific health conditions. Compounding allows veterinarians to tailor medication for diverse animals including dogs, cats, horses, exotic pets, and even livestock. This may involve converting solid tablets into flavored liquids, removing allergens or inactive ingredients, or combining multiple drugs into a single dosage form to improve adherence. The rise of chronic diseases in animals, such as arthritis, diabetes, and dermatological disorders, has further emphasized the need for specialized formulations that cannot be met by mass-produced drugs. In equine medicine, compounding plays a vital role in treating performance horses with conditions requiring specific dosing regimens and palatability. As companion animal ownership increases worldwide - particularly in urban regions of North America, Europe, and parts of Asia-Pacific - the demand for safe, effective, and pet-specific compounded drugs is steadily rising, creating a significant growth channel in the veterinary pharmaceutical industry.How Are Regulatory Developments Shaping the Veterinary Compounding Landscape?

The regulatory framework surrounding veterinary drug compounding is evolving rapidly, aiming to balance the benefits of personalized animal care with the need for safety and quality assurance. In the U.S., the Food and Drug Administration (FDA) has issued guidance to ensure that compounded veterinary drugs are prepared under appropriate conditions by licensed pharmacists or veterinarians and only when no suitable approved alternative exists. Recent developments like the FDA's GFI #256 outline permissible circumstances and quality practices for animal drug compounding from bulk drug substances, thereby formalizing the market and encouraging best practices. Similarly, the European Medicines Agency (EMA) and other regional regulatory bodies are enhancing oversight to ensure that compounded drugs meet defined safety and efficacy standards. In countries with developing pharmaceutical infrastructure, the lack of sufficient veterinary drug options has prompted local governments to promote regulated compounding practices to address unmet needs in rural and agricultural settings. Compliance with Good Compounding Practices (GCP) and adherence to pharmacopeial standards are becoming key differentiators for veterinary compounding pharmacies and service providers. These evolving regulations are encouraging innovation while reinforcing quality control, ultimately legitimizing and institutionalizing veterinary compounding as an integral part of the broader veterinary pharmaceutical market.What Are the Key Segments and Formulations Driving Market Diversification?

The veterinary drugs compounding market is diversifying rapidly across species, dosage forms, therapeutic categories, and distribution models. Companion animals represent the largest segment, with pet owners seeking customized medications for pain management, anxiety, hormone therapy, and dermatological issues. Livestock and poultry producers are also increasingly turning to compounded drugs for herd-specific treatments that adhere to withdrawal period guidelines while addressing region-specific pathogens. In terms of dosage forms, flavored oral suspensions, topical creams, transdermal gels, chewable treats, and sterile injectables are among the most in-demand, offering enhanced compliance and precise dosing. Veterinary dermatology, ophthalmology, cardiology, and oncology are particularly strong application areas due to the complex and varied treatment needs they involve. E-commerce and telemedicine are also driving significant change, with veterinary telehealth platforms partnering with compounding pharmacies to offer door-delivered, pet-specific prescriptions. Innovations in flavor masking, extended-release formulations, and non-invasive delivery mechanisms are pushing the boundaries of what compounded medications can achieve. Additionally, large-scale animal hospitals and veterinary teaching institutions are establishing in-house compounding units to meet specialized treatment needs promptly. These developments collectively underscore a broader shift toward individualized, responsive veterinary care that mirrors the standards of modern human healthcare.What Is Fueling the Strong Growth of the Veterinary Drugs Compounding Market Globally?

The growth in the veterinary drugs compounding market is driven by several factors related to shifting consumer behavior, advanced therapeutic demands, and sector-specific innovations. Rising pet ownership and the humanization of companion animals are creating a strong demand for specialized, pet-centric medication solutions that go beyond conventional treatments. Technological advancements in pharmaceutical compounding - such as precision weighing systems, automated mixers, and sterile environments - are enabling high-quality, scalable production of customized formulations. On the end-use side, the increasing prevalence of chronic and age-related animal diseases is compelling veterinarians to seek out flexible, multi-therapy treatment options that can only be delivered through compounding. The growth of veterinary telemedicine and online pet pharmacies is expanding the reach of compounded medications to remote and underserved regions. Furthermore, heightened awareness among livestock producers regarding drug resistance and residue management is encouraging more targeted, short-duration treatments made possible through compounding. Regulatory refinements in key markets are also creating a more secure environment for investment and innovation in veterinary pharmaceutical services. All these factors - ranging from pet health personalization and production technology to veterinary service models and regulatory infrastructure - are collectively accelerating the global adoption of compounded veterinary drugs across both companion and production animal segments.Report Scope

The report analyzes the Veterinary Drugs Compounding market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Drug Class (CNS Agents, Anti-Infective Agents, Hormones & Substitutes, Anti-Inflammatory Agents, Other Drug Classes); Animal Type (Companion Animals, Livestock Animals); Administration Route (Oral, Injectable, Other Administration Routes).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the CNS Agents segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 7.8%. The Anti-Infective Agents segment is also set to grow at 9.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $554.8 Million in 2024, and China, forecasted to grow at an impressive 12% CAGR to reach $676.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Veterinary Drugs Compounding Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Veterinary Drugs Compounding Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Veterinary Drugs Compounding Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allied High Tech Products Inc., ANDRITZ Group, Baileigh Industrial Holdings LLC, BENIGN ENTERPRISE CO., Buhler Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Veterinary Drugs Compounding market report include:

- Akina Animal Health

- Brava Veterinary Pharmacy

- Central Compounding Center South

- Chewy Inc.

- Covetrus

- Custom Compounding Pharmacy

- Davis Islands Pharmacy & Compounding Lab

- Lorraine's Pharmacy

- Merck Animal Health (MSD Animal Health)

- Miller’s Pharmacy

- Mixlab

- Norbrook Laboratories Ltd

- Northwest Compounders

- Pace Pharmacy

- PetMeds

- Pharmaca

- Specialty Veterinary Pharmacy

- Stokes Pharmacy

- The Pet Apothecary

- Triangle Compounding Pharmacy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akina Animal Health

- Brava Veterinary Pharmacy

- Central Compounding Center South

- Chewy Inc.

- Covetrus

- Custom Compounding Pharmacy

- Davis Islands Pharmacy & Compounding Lab

- Lorraine's Pharmacy

- Merck Animal Health (MSD Animal Health)

- Miller’s Pharmacy

- Mixlab

- Norbrook Laboratories Ltd

- Northwest Compounders

- Pace Pharmacy

- PetMeds

- Pharmaca

- Specialty Veterinary Pharmacy

- Stokes Pharmacy

- The Pet Apothecary

- Triangle Compounding Pharmacy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | January 2026 |

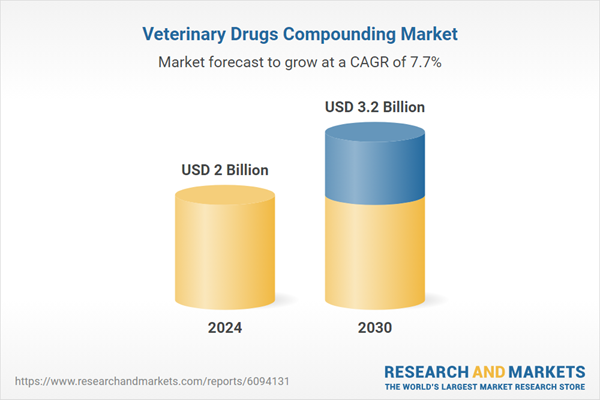

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |