Global 4G LTE Devices Market - Key Trends & Drivers Summarized

Why Are 4G LTE Devices Continuing to Dominate Global Connectivity Despite the Emergence of 5G Networks?

4G LTE devices remain the global standard for mobile and wireless broadband connectivity, offering widespread coverage, mature infrastructure, and a favorable cost-performance ratio. While 5G is gaining momentum in developed markets, 4G LTE continues to provide the foundational network layer for billions of users, particularly in emerging regions. Devices supporting LTE - ranging from smartphones and tablets to routers, dongles, and IoT modules - facilitate seamless voice, video, and data services with high reliability and speed.The vast installed base of 4G infrastructure ensures continued relevance of LTE-enabled devices in markets where 5G deployment is incomplete or economically unviable. Many operators are pursuing LTE Advanced and LTE Advanced Pro upgrades to extend the lifecycle of their 4G networks, further boosting the performance of devices without requiring new spectrum. Additionally, the cost-efficiency and energy optimization of LTE devices make them the preferred choice in industrial, rural, and mission-critical communication scenarios where affordability and stability are paramount.

Moreover, 4G LTE serves as the fallback technology for 5G non-standalone networks, ensuring uninterrupted service and backward compatibility for users transitioning between coverage zones. As a result, demand for LTE-enabled hardware continues to persist across consumer, enterprise, and government segments, reinforcing its role as a globally dominant connectivity solution in the medium term.

How Are Device Innovation, Feature Optimization, and Modular Integration Advancing 4G LTE Utility Across Diverse Applications?

Device manufacturers are optimizing LTE hardware to cater to a wide range of use cases, balancing performance, price, and battery efficiency. Smartphones now feature multi-band LTE modems, dual SIM capabilities, and enhanced VoLTE support for clearer voice communication. Wearables and tablets with embedded LTE connectivity offer greater mobility for consumers, while enterprise-grade LTE routers and CPEs are engineered for remote work, failover connections, and industrial network resilience.In the IoT space, 4G LTE modules are being miniaturized and embedded into sensors, meters, trackers, and cameras for real-time data transmission. Low-power LTE variants such as Cat-M1 and NB-IoT are supporting massive device connectivity for smart cities, agriculture, healthcare, and asset management. These modules deliver long-range, low-latency, and energy-efficient connectivity, helping enterprises achieve operational visibility and automation without the cost and complexity of 5G adoption.

Additionally, modular integration of LTE connectivity into drones, vehicles, point-of-sale systems, and consumer electronics is expanding deployment scenarios. Advanced chipset designs and eSIM support are simplifying provisioning and lifecycle management, while software-defined radio capabilities are enhancing adaptability across geographies. As demand rises for ubiquitous, always-on connectivity, 4G LTE devices are evolving to address nuanced needs across verticals without sacrificing stability or affordability.

Which User Segments, Deployment Scenarios, and Regional Markets Are Sustaining Demand for 4G LTE Devices?

The consumer electronics segment remains the largest market for 4G LTE devices, driven by sustained smartphone demand in emerging markets and budget-sensitive user groups in developed economies. Feature-rich yet cost-effective LTE phones are enabling mobile-first digital lifestyles, especially in regions where fixed-line broadband penetration is low. Entry-level and mid-tier device portfolios are critical in high-growth geographies such as India, Indonesia, Nigeria, and Brazil, where smartphone adoption continues to accelerate.Enterprise demand is robust across logistics, utilities, retail, and field services, where LTE-enabled routers, tablets, and M2M devices support remote connectivity, mobile workforce applications, and edge computing. In rural and underserved regions, LTE-based fixed wireless access (FWA) solutions are bridging digital divides by providing broadband-like services without the need for fiber deployment. Public sector initiatives - ranging from smart agriculture to connected education - are increasingly reliant on LTE hardware to deliver scalable, resilient digital services.

Regionally, Asia-Pacific dominates LTE device shipments, led by a mix of consumer volume and industrial diversification. Africa and Latin America are witnessing rapid LTE expansion as 3G networks are gradually phased out. Meanwhile, North America and Europe, while progressing toward 5G, continue to rely on LTE for enterprise solutions, IoT infrastructure, and as a fallback layer for hybrid network architectures. Global chip shortages and economic constraints have also led some carriers and users to prioritize 4G-based rollouts over costlier 5G alternatives in the short term.

What Is Driving the Enduring Strategic Role of 4G LTE Devices in the Future of Global Wireless Connectivity?

4G LTE devices are positioned as a pragmatic, cost-effective, and globally deployable solution for sustained mobile connectivity during a prolonged 5G transition period. Their adaptability across consumer, commercial, and industrial ecosystems ensures they remain essential in driving digital inclusion, especially where infrastructure limitations or affordability constraints persist. As 5G continues to evolve, LTE serves as a complementary layer that ensures network reliability and wide-area coverage.Ongoing enhancements in LTE performance - such as carrier aggregation, improved spectral efficiency, and MIMO integration - are keeping the technology competitive for latency-sensitive and bandwidth-intensive applications. The ability of LTE devices to function efficiently on existing infrastructure extends their relevance in edge computing, connected mobility, and low-power IoT contexts. Furthermore, their role in disaster response, public safety, and mission-critical communication underscores their utility beyond consumer telecommunications.

Sustained global reliance on 4G LTE devices reflects not technological stagnation but strategic pragmatism. As digital transformation initiatives outpace 5G rollout in many regions, could 4G LTE devices remain the most scalable and accessible bridge to a truly connected world?

Report Scope

The report analyzes the 4G LTE Devices market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Device Type (Smartphones Device, Tablet Device); Distribution Channel (Multi-Brand Stores, Single Brand Stores, Online Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Smartphones Device segment, which is expected to reach US$47.4 Billion by 2030 with a CAGR of a 4.3%. The Tablet Device segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.6 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $10.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 4G LTE Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 4G LTE Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 4G LTE Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Chassis King Inc., Cheetah Chassis Corporation, CIE Manufacturing, CIMC (China International Marine Containers), DCLI (Direct ChassisLink Inc.) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this 4G LTE Devices market report include:

- Airspan Networks

- Alcatel-Lucent

- Altair Semiconductor (Sony Semiconductor Israel)

- Apple Inc.

- ASUS

- Cavli Wireless

- Cisco Systems, Inc.

- D-Link Corporation

- Ericsson

- GCT Semiconductor, Inc.

- Google LLC

- HTC Corporation

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Intel Corporation

- Lenovo Group Limited

- LG Electronics Inc.

- Motorola Mobility LLC

- NETGEAR, Inc.

- Nokia Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airspan Networks

- Alcatel-Lucent

- Altair Semiconductor (Sony Semiconductor Israel)

- Apple Inc.

- ASUS

- Cavli Wireless

- Cisco Systems, Inc.

- D-Link Corporation

- Ericsson

- GCT Semiconductor, Inc.

- Google LLC

- HTC Corporation

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Intel Corporation

- Lenovo Group Limited

- LG Electronics Inc.

- Motorola Mobility LLC

- NETGEAR, Inc.

- Nokia Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

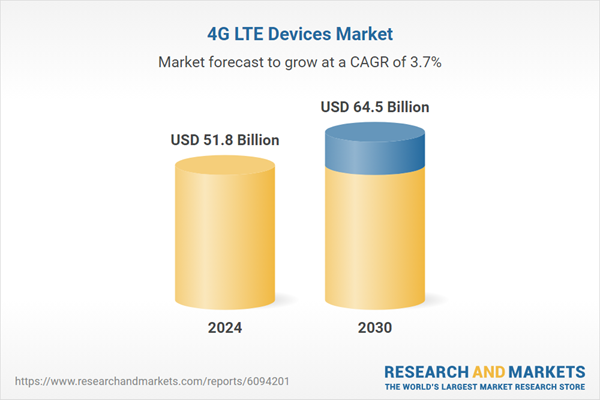

| Estimated Market Value ( USD | $ 51.8 Billion |

| Forecasted Market Value ( USD | $ 64.5 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |