Global Absorbable Sutures Market - Key Trends & Drivers Summarized

Why Are Absorbable Sutures Gaining Preference in Surgical Wound Closure, Tissue Healing, and Post-Operative Care?

Absorbable sutures are increasingly favored in modern surgical practices due to their ability to naturally degrade within the body, eliminating the need for suture removal and reducing patient follow-up visits. These sutures are designed to maintain tensile strength for a defined period, then gradually hydrolyze or enzymatically break down, depending on the material composition. Their use spans across general surgery, gynecology, urology, orthopedics, dental procedures, and dermatological interventions where internal tissue approximation is required without permanent foreign material retention.The shift toward minimally invasive procedures and enhanced recovery protocols is accelerating demand for absorbable sutures, as they contribute to reduced scarring, lower infection risk, and greater patient comfort. Surgeons prefer them in deep tissue closures and layered suturing where long-term support is not necessary. The growing volume of surgical interventions - driven by aging populations, trauma cases, chronic disease management, and elective procedures - is further reinforcing the utility of absorbable sutures as a standard of care in wound management.

Clinical guidelines increasingly recommend absorbable options in pediatric surgeries, obstetric applications (e.g., C-sections, episiotomies), and gastrointestinal procedures, where suture removal would otherwise pose logistical or physiological challenges. Their broad compatibility with tissue types and anatomical sites, coupled with regulatory approval for use across a wide spectrum of specialties, positions absorbable sutures as a practical and patient-friendly alternative to non-absorbable materials.

How Are Material Innovation, Antibacterial Enhancement, and Knotless Technologies Advancing Absorbable Suture Performance?

Advancements in suture materials are central to improving the functional reliability and clinical outcomes of absorbable sutures. Traditional materials like polyglycolic acid (PGA), polylactic acid (PLA), and polydioxanone (PDO) continue to be refined for better tensile retention, absorption timelines, and biocompatibility. Newer copolymer blends and glycolide-caprolactone formulations offer improved pliability and knot security, catering to surgeon preferences across different procedural settings.Antibacterial absorbable sutures, often coated with triclosan or other antimicrobial agents, are gaining traction in high-risk surgical environments to reduce the incidence of surgical site infections (SSIs). These coatings help inhibit bacterial colonization on the suture surface during the early post-operative period, aligning with global hospital efforts to improve infection control and meet clinical safety standards. As antimicrobial resistance remains a critical concern, such innovations provide an added layer of prophylactic protection in vulnerable patients.

Barbed and knotless absorbable sutures represent another leap forward, streamlining tissue closure by distributing tension more evenly and eliminating the need for traditional knots. This not only reduces procedure time but also minimizes tissue trauma and foreign body reaction. These sutures are particularly useful in laparoscopic and robotic-assisted surgeries, where access and maneuverability are constrained. As precision and workflow efficiency become surgical priorities, such suture technologies are gaining widespread adoption in both hospital and ambulatory surgical center settings.

Which Surgical Specialties, Healthcare Providers, and Global Markets Are Driving Absorbable Suture Demand?

The adoption of absorbable sutures is strongest in general surgery, gynecology, orthopedics, cardiovascular surgery, and dental care. These specialties routinely require layered closures, internal ligatures, and subcutaneous suturing techniques where biodegradability adds clinical and operational value. In gynecological and obstetric procedures, absorbable sutures are used extensively for uterine repair, perineal closure, and laparoscopic incisions. Orthopedic surgeons apply them for soft tissue approximation in ligament and tendon repair, especially in sports medicine and trauma cases.Hospitals and large surgical centers remain the primary purchasers, given their high procedural volumes and broad specialty coverage. However, outpatient clinics, ambulatory surgical centers (ASCs), and dental practices are increasingly adopting absorbable sutures as they expand into more complex procedures previously confined to inpatient settings. The convenience, cost-efficiency, and post-operative benefits of absorbable sutures are well-aligned with the business models of these high-turnover, short-stay facilities.

Regionally, North America and Europe lead in both consumption and innovation, supported by robust healthcare infrastructure, high surgical rates, and favorable reimbursement systems. Asia-Pacific is witnessing strong growth, driven by rising healthcare investments, expanding surgical access, and local manufacturing initiatives. Emerging markets in Latin America, the Middle East, and Africa are adopting absorbable sutures as part of broader medical modernization efforts, particularly in maternal health, trauma care, and general surgery programs supported by public health systems and NGOs.

What Strategic Forces Are Shaping the Future Role of Absorbable Sutures in Surgical Innovation and Global Health Delivery?

The strategic relevance of absorbable sutures is rising as surgical best practices evolve toward minimally invasive, patient-centric, and value-based models of care. Their ability to enhance healing, reduce complications, and streamline post-operative management aligns with health system goals to improve outcomes while lowering resource utilization. As global surgery volumes increase and outpatient procedures become more complex, the demand for versatile, low-maintenance closure materials is poised to grow.Customization of suture properties - such as absorption rate, tensile strength, and antimicrobial protection - is allowing manufacturers to create procedure-specific solutions that improve surgical precision and recovery timelines. Integration with digital surgery platforms, robotic arms, and suture-assist devices is further expanding their application across high-tech operating environments. Meanwhile, sustainability initiatives are encouraging innovation in bio-based materials and eco-friendly packaging to reduce medical waste.

As surgical access expands in developing regions and post-operative protocols prioritize patient convenience and recovery efficiency, absorbable sutures are becoming a cornerstone of modern wound closure strategies. Could their evolution into smarter, multifunctional biomaterials redefine the future of surgical healing across global healthcare systems?

Report Scope

The report analyzes the Absorbable Sutures market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Monofilament Sutures, Braided Sutures); End-Use (Hospitals End-Use, Ambulatory Surgery Centers End-Use, Specialty Clinics End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Monofilament Sutures segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 2%. The Braided Sutures segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $773.2 Million in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $639 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Absorbable Sutures Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Absorbable Sutures Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Absorbable Sutures Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Absorbable Sutures market report include:

- AD Surgical

- Advanced Medical Solutions Group plc

- Assut Medical Sàrl

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Clinisut

- ConMed Corporation

- CP Medical, Inc.

- DemeTECH Corporation

- Ethicon, Inc. (Johnson & Johnson)

- Integra LifeSciences Corporation

- Internacional Farmacéutica S.A. de C.V.

- Lotus Surgicals Pvt. Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Péters Surgical

- Smith & Nephew plc

- Sutures India Pvt. Ltd. (Healthium Medtech)

- Surgical Specialties Corporation

- Teleflex Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AD Surgical

- Advanced Medical Solutions Group plc

- Assut Medical Sàrl

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Clinisut

- ConMed Corporation

- CP Medical, Inc.

- DemeTECH Corporation

- Ethicon, Inc. (Johnson & Johnson)

- Integra LifeSciences Corporation

- Internacional Farmacéutica S.A. de C.V.

- Lotus Surgicals Pvt. Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Péters Surgical

- Smith & Nephew plc

- Sutures India Pvt. Ltd. (Healthium Medtech)

- Surgical Specialties Corporation

- Teleflex Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

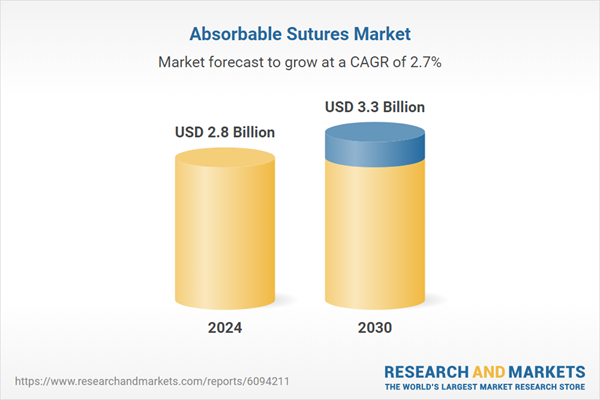

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |