Global Acrylic Powders Market - Key Trends & Drivers Summarized

Why Are Acrylic Powders Gaining Prominence Across Nail Enhancements, Industrial Coatings, and Dental Applications?

Acrylic powders are experiencing rising demand due to their multifunctional roles in personal care, industrial, and medical applications. In the cosmetics industry, these powders form the foundational material in professional nail systems, particularly for sculpted nail extensions and overlays. When combined with liquid monomers, they polymerize into durable, customizable coatings that offer strength, longevity, and aesthetic versatility. Their dominance in nail enhancements is fueled by the global rise in at-home grooming, professional nail salons, and personalization trends in beauty.Beyond cosmetics, acrylic powders serve critical roles in the industrial coatings and adhesives sectors. Their chemical resistance, weatherability, and high-gloss finish make them suitable for protective coatings across automotive, furniture, and consumer goods applications. Their adaptability in formulation allows manufacturers to create surface treatments that balance mechanical durability with decorative appeal, which is especially valuable in high-wear environments.

In dental care, acrylic powders are key ingredients in prosthetics such as dentures, crowns, and orthodontic retainers. Their moldability, biocompatibility, and color-matching capabilities support clinical outcomes while offering comfort and aesthetics to patients. This breadth of use across consumer, commercial, and clinical domains reinforces the strategic relevance of acrylic powders in material innovation and product performance.

How Are Material Science Advancements, Custom Formulations, and Sustainability Trends Influencing the Development of Acrylic Powders?

Continuous innovation in polymer chemistry is expanding the performance boundaries of acrylic powders. The development of copolymer systems enables manufacturers to fine-tune properties such as curing time, flexibility, hardness, and adhesion. In nail care, low-odor, self-leveling, and fast-setting powders are improving user experience and salon productivity. Anti-yellowing, UV-resistant, and pigment-stable formulations are being introduced to meet aesthetic and functional demands.For industrial applications, acrylic powders are being modified with additives that enhance scratch resistance, thermal stability, and solvent tolerance. Customization is key, as end-users require specific powder characteristics tailored to their coating thickness, surface texture, and curing method - whether via heat, UV, or air-dry. Acrylic blends that integrate nanomaterials or hybrid resins are gaining ground for high-performance, low-maintenance surface applications.

Sustainability considerations are prompting a shift toward low-VOC, recyclable, and bio-derived acrylic powders. Manufacturers are exploring green chemistry techniques, such as solvent-free formulations and waste-reducing production methods. Lifecycle analysis and compliance with eco-labels are becoming essential for market differentiation, particularly as environmental regulations tighten in the EU, North America, and advanced Asia-Pacific markets.

Which End-Use Markets, Product Categories, and Regional Trends Are Driving Growth in the Acrylic Powders Market?

In the beauty segment, the global nail care boom - driven by evolving fashion trends, digital beauty content, and increasing self-care expenditures - is the foremost driver of acrylic powder demand. Professional salons, DIY nail kits, and influencer-backed beauty brands are all contributing to rapid product turnover and constant innovation in shades, textures, and performance profiles. Product categories range from classic pink-and-white systems to neon, glitter, and encapsulated designs, reflecting the demand for customization.In industrial sectors, acrylic powders are gaining traction in powder coating systems for metal furniture, fixtures, appliances, and automotive interiors. Their application in powder-based 3D printing is also rising, particularly in prototyping and low-volume manufacturing where material cost-efficiency and surface finish matter. The dental industry continues to show steady demand, supported by aging populations, growth in cosmetic dentistry, and rising disposable incomes.

Regionally, North America and Europe dominate the professional nail and dental acrylic markets, backed by high consumer spending, advanced dental care infrastructure, and strong salon networks. Asia-Pacific is the fastest-growing region, with China, Japan, and South Korea leading beauty innovation and India and Southeast Asia showing expanding middle-class demand. Latin America and the Middle East are emerging as growth zones, especially for affordable and durable coating solutions.

What Strategic Role Will Acrylic Powders Play in the Convergence of Personalization, Performance, and Eco-Responsibility Across Industries?

Acrylic powders are increasingly positioned at the intersection of individual expression, industrial durability, and responsible material sourcing. In beauty, their role in enabling bespoke, creative nail art with salon-grade performance continues to drive brand innovation and customer loyalty. In coatings and dental applications, acrylic powders deliver critical performance outcomes while enabling scalable, cost-efficient manufacturing.As consumer expectations shift toward personalized, high-quality, and sustainable products, acrylic powder manufacturers must align performance with eco-responsibility. This includes developing formulations that balance aesthetics with safety, minimize environmental impact, and meet cross-sector regulatory standards. The ability to offer customization at scale - whether through shade variety, curing behavior, or end-use specificity - will be key to unlocking new markets.

With material science, digital design, and environmental compliance converging, could acrylic powders become foundational materials in the next generation of hybrid beauty, dental, and surface innovation ecosystems?

Report Scope

The report analyzes the Acrylic Powders market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: End-Use (Cosmetics End-Use, Inks End-Use, Automotive End-Use, Plastics End-Use, Other End-Uses); Application (Fingernail Application, Plastisol Production Application, Textile Printing Inks Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cosmetics End-Use segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 5.4%. The Inks End-Use segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $820.1 Million in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $823.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Acrylic Powders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Acrylic Powders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Acrylic Powders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adisseo, Arkema S.A., BASF SE, Beijing Eastern Petrochemical Co., Ltd., Camlin Fine Sciences Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Acrylic Powders market report include:

- Akzo Nobel N.V.

- Allnex

- Anderson Development Company

- Arkema S.A.

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Berger Paints India Ltd.

- Brillux GmbH & Co. KG

- Chemilac Paints Pvt Ltd.

- DIC Corporation

- Dow Inc.

- Evonik Industries AG

- Jotun A/S

- KM Nail Manufacturer

- Makevale Group

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel N.V.

- Allnex

- Anderson Development Company

- Arkema S.A.

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Berger Paints India Ltd.

- Brillux GmbH & Co. KG

- Chemilac Paints Pvt Ltd.

- DIC Corporation

- Dow Inc.

- Evonik Industries AG

- Jotun A/S

- KM Nail Manufacturer

- Makevale Group

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

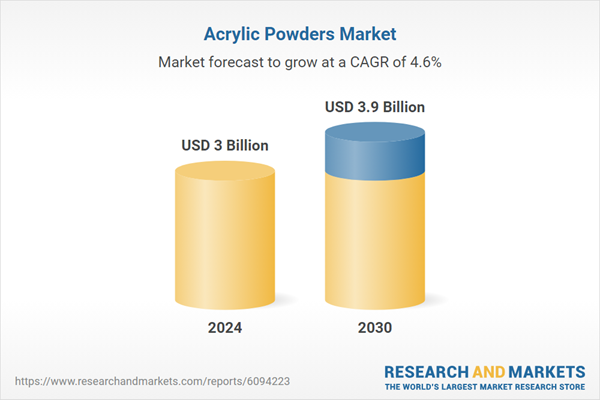

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.9 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |