Global RF GaN Devices in Telecom Infrastructure Market - Key Trends & Drivers Summarized

Why Are RF GaN Devices Becoming the Heartbeat of 5G and Beyond?

RF GaN (Gallium Nitride) devices are quickly becoming indispensable in telecom infrastructure as the industry transitions to 5G and prepares for even more advanced wireless networks. Unlike traditional silicon and GaAs semiconductors, GaN delivers superior power density, efficiency, and frequency handling, making it the optimal technology for high-performance base station power amplifiers. As mobile operators scale small cell deployments and densify macrocell networks, GaN's ability to provide linear amplification at high output levels ensures optimal coverage and minimal signal distortion. The explosion in data traffic driven by video streaming, IoT devices, and ultra-reliable low latency communications (URLLC) demands more robust front-end RF hardware, a challenge that GaN is uniquely positioned to meet. In addition, GaN devices support wider bandwidths needed for massive MIMO and carrier aggregation, central to 5G networks. The rising importance of energy efficiency and sustainability in telecom operations is also pushing network equipment vendors to adopt GaN-based solutions that reduce heat generation and energy consumption. Whether in urban macro sites or compact rural installations, GaN technology provides the compactness, ruggedness, and thermal efficiency needed to keep future networks lean and reliable.What Technology Breakthroughs Are Accelerating Commercial Viability?

GaN-on-SiC (silicon carbide) technology is emerging as a major breakthrough in driving commercial deployment of RF GaN devices in telecom. These substrates offer high thermal conductivity and low loss, allowing devices to operate at higher voltages and frequencies without compromising reliability. Enhanced drain efficiency in GaN transistors now reaches beyond 70%, slashing power losses in 5G infrastructure deployments. Integration of GaN MMICs (monolithic microwave integrated circuits) into compact radio units is allowing network OEMs to design smaller, lighter, and more thermally stable radio heads. Envelope tracking and digital pre-distortion technologies are being increasingly paired with GaN PAs to maximize linearity and spectral efficiency. GaN devices are also achieving broader bandwidth support, including up to 1 GHz in some high-frequency 5G bands. Advanced packaging technologies, including air cavity and surface-mount solutions, are improving manufacturability and cost-effectiveness. The development of GaN-on-silicon devices, while still maturing, offers promise for large-scale, lower-cost production. These advances are transforming GaN from a niche solution into a mass-market technology central to the telecom industry's growth agenda.Which Deployment Scenarios Are Driving Demand Growth Globally?

The surge in demand for RF GaN devices is strongest in regions aggressively rolling out 5G infrastructure. Asia-Pacific, particularly China, South Korea, and Japan, is leading deployments of GaN-enabled macro base stations and small cells for urban and semi-rural coverage. North America and Europe are expanding GaN usage in both standalone and non-standalone 5G networks, focusing on sub-6 GHz and mmWave frequencies. Emerging economies in Southeast Asia, Latin America, and the Middle East are investing in GaN-based telecom gear to leapfrog into next-generation wireless systems. Beyond mobile networks, private 5G installations in factories, logistics hubs, and smart campuses are becoming high-potential segments. Defense and homeland security agencies are also procuring GaN-based telecom infrastructure for secure, high-bandwidth battlefield communications. Additionally, GaN is making inroads in wireless backhaul and microwave point-to-point links, where high power and efficiency are essential. As telcos aim for faster ROI and lower OPEX, GaN's performance advantages in high-frequency and high-traffic deployments make it a compelling long-term investment.What's Fueling Market Expansion for RF GaN Devices in Telecom?

The growth in the global RF GaN devices in telecom infrastructure market is driven by escalating data consumption, 5G densification, energy efficiency goals, and evolving radio access technologies. Telecom operators are under pressure to expand capacity and coverage while minimizing power usage, and GaN offers the highest power-added efficiency (PAE) in the industry. The massive deployment of small cells, active antenna systems, and MIMO configurations requires compact, high-performance RF solutions that GaN excels in delivering. Regulatory pressure to reduce carbon emissions from telecom networks is prompting base station vendors to prioritize energy-saving RF front-ends. The continued evolution toward 6G and terahertz communication will further cement the role of GaN, which already supports higher frequency thresholds than legacy semiconductors. Growing investments from governments and telcos in rural broadband and high-speed connectivity initiatives are expanding infrastructure rollouts into underserved areas, adding to GaN adoption. Vendor collaboration across the RF supply chain is reducing costs and accelerating time-to-market for GaN-based systems. These interwoven drivers are laying the groundwork for GaN's long-term dominance in telecom RF power systems.Report Scope

The report analyzes the RF GAN Devices in Telecom Infrastructure market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Module, Discrete); Device Type (Filter, Duplexer, Power Amplifier, Switch, Low Noise Amplifier, Phase Shifters, Oscillators, Attenuators, Couplers, Antenna Tuners, Other Device Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Module segment, which is expected to reach US$881.3 Million by 2030 with a CAGR of a 6.5%. The Discrete segment is also set to grow at 11.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $245.9 Million in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $242.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global RF GAN Devices in Telecom Infrastructure Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global RF GAN Devices in Telecom Infrastructure Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global RF GAN Devices in Telecom Infrastructure Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aethercomm Inc., Ampleon B.V., Analog Devices, Inc., Broadcom Inc., Coherent Corp. (formerly II-VI Inc.) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this RF GAN Devices in Telecom Infrastructure market report include:

- Aethercomm Inc.

- Ampleon B.V.

- Analog Devices, Inc.

- Broadcom Inc.

- Coherent Corp. (formerly II-VI Inc.)

- Efficient Power Conversion Corporation

- Filtronic plc

- GaN Systems Inc.

- Guerrilla RF, Inc.

- Infineon Technologies AG

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Mercury Systems, Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Qorvo, Inc.

- RFHIC Corporation

- Skyworks Solutions, Inc.

- Sumitomo Electric Device Innovations, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aethercomm Inc.

- Ampleon B.V.

- Analog Devices, Inc.

- Broadcom Inc.

- Coherent Corp. (formerly II-VI Inc.)

- Efficient Power Conversion Corporation

- Filtronic plc

- GaN Systems Inc.

- Guerrilla RF, Inc.

- Infineon Technologies AG

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Mercury Systems, Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Qorvo, Inc.

- RFHIC Corporation

- Skyworks Solutions, Inc.

- Sumitomo Electric Device Innovations, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

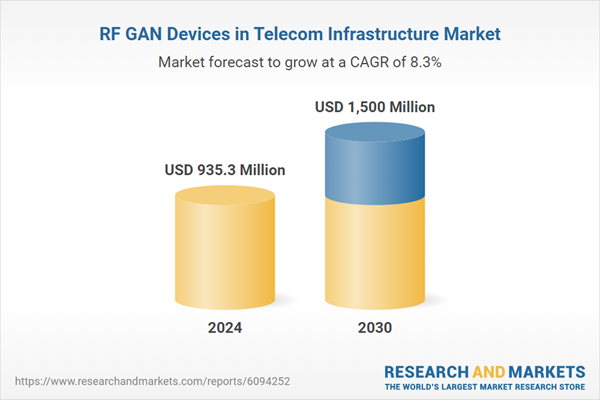

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 935.3 Million |

| Forecasted Market Value ( USD | $ 1500 Million |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |