Global Sewer Cameras Market - Key Trends & Drivers Summarized

Why Are Sewer Cameras Gaining Strategic Significance Across Municipal Infrastructure, Industrial Maintenance, and Residential Drainage Applications?

Sewer cameras are becoming indispensable diagnostic tools for non-invasive inspection of underground pipelines, drainage systems, and sewage networks. Their ability to visually identify blockages, cracks, corrosion, and root intrusions in real time - without excavation - offers substantial time, cost, and labor savings for municipalities, contractors, and utility operators. These camera systems enable preventive maintenance, rapid fault localization, and documentation of underground asset condition, making them critical for proactive infrastructure management.With aging sewer systems in urban centers and growing demand for water conservation, sewer cameras are instrumental in leak detection, infiltration/exfiltration assessments, and compliance with environmental regulations. Their usage extends beyond municipal utilities into industrial facilities, commercial buildings, and residential plumbing, where accurate pipeline visualization is essential for service efficiency and structural preservation. As infrastructure modernization and sanitation upgrades become global imperatives, sewer cameras are positioned as strategic enablers of smart, data-informed maintenance programs.

How Are Imaging Technologies, Robotic Platforms, and Data Integration Advancing Sewer Camera Capabilities?

Technological advancements in sewer cameras focus on improving image quality, maneuverability, and data analytics. High-definition (HD), pan-and-tilt, and 360-degree imaging capabilities allow detailed visual inspections of pipe interiors, enabling accurate identification of structural anomalies and flow obstructions. Enhanced LED lighting, wide-angle lenses, and low-light sensors support effective operation in dark, debris-laden environments.Integration with robotic crawler systems and flexible push rod designs expands usability across various pipe diameters and lengths. Compact and self-propelled units equipped with inclinometer sensors, distance counters, and laser profiling tools deliver precise spatial data and pipe deformation analysis. Real-time video transmission, cloud-based storage, and compatibility with geographic information systems (GIS) enable centralized inspection management. AI-based software solutions are being adopted to automate defect classification, generate condition reports, and support predictive maintenance workflows.

Which End-User Segments, Regional Markets, and Distribution Strategies Are Driving Sewer Camera Deployment?

Municipal water and wastewater departments represent the largest user base, deploying sewer cameras for routine inspection, emergency response, and asset lifecycle planning. Private plumbing companies use these systems to diagnose household and commercial drain issues, while industrial facilities rely on them to ensure compliance with waste discharge regulations and maintain operational continuity. Construction and civil engineering firms utilize camera inspections during pre- and post-installation phases of pipeline infrastructure.North America and Europe lead global adoption due to well-established sanitation infrastructure, regulatory enforcement, and routine maintenance practices. Asia-Pacific is witnessing accelerated growth driven by urban expansion, rising investments in water management, and infrastructure rehabilitation programs in countries such as China, India, and Australia. Latin America, the Middle East, and Africa are emerging markets with increasing demand for cost-efficient, non-destructive pipeline inspection technologies amid growing urbanization and sanitation needs.

Distribution strategies include both direct sales to municipalities and contractors, as well as through specialized equipment dealers, rental companies, and e-commerce platforms. Product differentiation is focused on portability, ease of use, battery life, image resolution, and multi-pipe compatibility. Vendors are enhancing value through bundled inspection software, cloud services, training programs, and maintenance support to drive customer retention and expand field service applications.

What Are the Factors Driving Growth in the Sewer Cameras Market?

The sewer cameras market is expanding as asset-intensive sectors prioritize infrastructure resilience, regulatory compliance, and operational efficiency. Their ability to reduce downtime, lower maintenance costs, and enhance situational awareness is making them essential tools in underground utility management and urban sanitation strategies.Key growth drivers include aging water infrastructure, increasing urban population density, rising adoption of trenchless technologies, integration with AI-powered diagnostics, and regulatory pressure for early defect detection. Growth is further supported by demand for smart inspection tools in predictive maintenance programs and expanding construction activity in developing markets.

As cities confront mounting infrastructure challenges and the need for resilient underground networks, could sewer cameras evolve into critical linchpins in the global shift toward intelligent, sustainable, and cost-effective utility diagnostics?

Report Scope

The report analyzes the Sewer Cameras market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Push Rod Cameras, Robotic Crawlers & Tractors); Application (Municipal, Industrial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Push Rod Cameras segment, which is expected to reach US$251.5 Million by 2030 with a CAGR of a 2.8%. The Robotic Crawlers & Tractors segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $93.1 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $83.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sewer Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sewer Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sewer Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

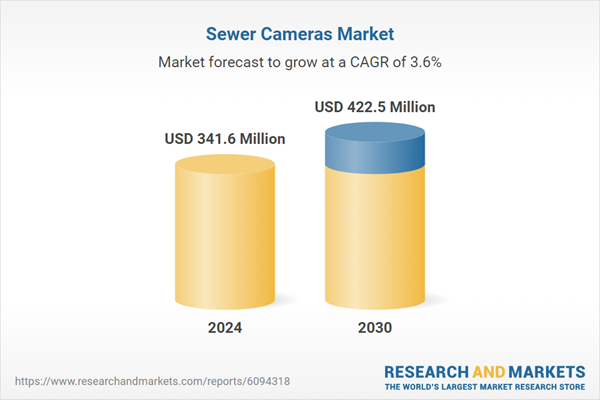

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alliance Memory, Cypress Semiconductor (now part of Infineon Technologies), EON Silicon Solution Inc. (ESMT), GigaDevice Semiconductor Inc., Infineon Technologies AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Sewer Cameras market report include:

- Aries Industries, Inc.

- CUES, Inc.

- EasyCAM LLC

- Electro Scan Inc.

- Flyability SA

- Forbest Products Co.

- General Pipe Cleaners

- Hathorn Corporation

- Insight Vision Cameras

- Pearpoint (a division of Radiodetection)

- Ratech Electronics Ltd.

- Rausch Electronics USA, LLC

- RIDGID (Emerson Electric Co.)

- Testrix Systems Pty Ltd.

- TvbTech Co., Ltd.

- USA Borescopes

- VEVOR

- Videology Imaging Solutions

- Wopson Electronics Co., Ltd.

- Xcam Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aries Industries, Inc.

- CUES, Inc.

- EasyCAM LLC

- Electro Scan Inc.

- Flyability SA

- Forbest Products Co.

- General Pipe Cleaners

- Hathorn Corporation

- Insight Vision Cameras

- Pearpoint (a division of Radiodetection)

- Ratech Electronics Ltd.

- Rausch Electronics USA, LLC

- RIDGID (Emerson Electric Co.)

- Testrix Systems Pty Ltd.

- TvbTech Co., Ltd.

- USA Borescopes

- VEVOR

- Videology Imaging Solutions

- Wopson Electronics Co., Ltd.

- Xcam Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 341.6 Million |

| Forecasted Market Value ( USD | $ 422.5 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |