Global 'Simulated Train' Market - Key Trends & Drivers Summarized

How Are Simulated Trains Revolutionizing Modern Rail Training And Infrastructure Planning?

Simulated trains have emerged as a cornerstone in the modernization of railway operations, serving both as high-fidelity training platforms for personnel and strategic tools for infrastructure planning. Unlike traditional methods, these systems replicate real-world train environments - from physics-based movement to route signaling and weather conditions - with astounding accuracy. Rail operators are increasingly investing in full-cab simulators and desktop-based virtual systems to upskill drivers, conductors, maintenance staff, and dispatchers without real-world risk. Simulated train platforms drastically reduce costs associated with fuel, track usage, and accident exposure, while improving trainee readiness and procedural accuracy. Governments and transit authorities are mandating simulator hours as part of operator certification in countries such as Germany, Japan, and India. Additionally, simulations aid in modeling traffic flow, signal timing, and emergency responses for rail network expansion, making them crucial for urban planners and infrastructure developers. These systems also simulate passenger behavior and congestion to optimize station design. Integration with digital twins, IoT, and 5G technologies has further enhanced real-time feedback and interactivity. Vendors like Siemens Mobility, Transurb, and Oktal Sydac are leading innovation with immersive VR and AI-enhanced simulators that adapt scenarios based on the learner's performance. The result is a new generation of rail professionals trained for both routine operation and high-stress anomalies in safe, replicable environments.Can Immersive Technologies Like VR And AI Change The Future Of Train Simulations?

Immersive technologies are redefining the boundaries of simulated train environments, turning them into dynamic ecosystems rather than static learning modules. Virtual reality (VR) and augmented reality (AR) are now integral to many training programs, offering 360-degree visibility, motion tracking, and spatial audio to mimic real cab experiences. These technologies help trainees develop muscle memory and situational awareness, particularly useful in emergency drills and route familiarization. Artificial intelligence (AI) brings an adaptive layer to simulations by generating unpredictable scenarios, simulating human error, or mimicking malfunctions that demand real-time decision-making. Machine learning algorithms also analyze user performance to personalize difficulty levels and training paths. Voice recognition systems are being embedded to simulate communication with control centers and passengers, enhancing realism. Simulations are increasingly cloud-based, enabling remote access and collaborative training across geographies. Advanced physics engines now simulate factors like wheel-slip, braking lag, and terrain resistance, offering hyper-realistic feedback. Multi-sensory elements, such as haptic controls and motion platforms, replicate G-forces and vibrations to increase immersion. These innovations are not only enhancing skill retention but also reducing training duration, making programs more cost-efficient. In maintenance training, AR overlays allow technicians to interact with 3D holograms of train components, enabling hands-on practice without dismantling equipment. The convergence of VR, AI, and big data analytics is rapidly propelling simulated trains into high-demand applications well beyond basic driver instruction.How Is Market Demand Shaped By Shifting Transportation Goals And Safety Standards?

The demand for simulated train systems is being reshaped by strategic shifts in public transportation policies, sustainability goals, and regulatory compliance. As cities strive to expand mass transit networks to reduce emissions and urban congestion, the need for highly trained personnel becomes critical - and simulators provide a scalable, efficient training modality. With many rail operators facing a generational shift in their workforce, simulators are essential to rapidly onboard new recruits without sacrificing safety. Regulatory bodies are tightening safety and competency requirements, necessitating frequent simulation-based certifications, particularly in regions like the EU and Asia-Pacific. In the context of increasing railway automation, operators must now also train for human-machine interaction - a growing focus area for simulators. Furthermore, cross-border rail traffic within the EU has pushed the need for multilingual, interoperable simulation platforms that can model diverse signaling and operational protocols. Simulation is also playing a vital role in high-speed rail (HSR) expansion, allowing operators to test braking dynamics, signal integration, and energy consumption across different terrains and speeds. Additionally, simulated train solutions are being deployed to test cyber-resilience, a growing concern with the digitization of railway systems. The rise in public-private rail projects in emerging economies is also creating new demand for simulation systems that can help plan and visualize network growth, test system compatibility, and assess ridership patterns. This convergence of safety, speed, scale, and regulation is redefining the market's trajectory.What Factors Are Driving The Rapid Growth In The Simulated Train Market?

The growth in the simulated train market is driven by several factors related to technological sophistication, evolving end-use scenarios, and shifting behavioral and policy landscapes. First, the global emphasis on railway modernization - especially in Asia-Pacific, Europe, and the Middle East - is driving demand for scalable and localized simulation platforms for operator training, route testing, and performance evaluation. Second, increasing investment in high-speed rail projects and urban metro systems is generating new use cases where simulations are essential for planning, staff training, and risk mitigation. Third, the advent of smart railways and autonomous trains is creating a new layer of operational complexity, necessitating simulators that can model human-machine interactions and AI-assisted decision-making. Fourth, the rising frequency of climate-related disruptions has prompted the use of simulators to train for scenarios such as floods, landslides, and heat-related track deformations. Fifth, the post-pandemic labor shift - with mass retirements and onboarding of younger, tech-savvy rail operators - is creating preference for digital-first training approaches that simulators can fulfill efficiently. Sixth, procurement trends in defense and emergency services are expanding to include railway simulation for strategic mobility and logistics planning. Finally, collaborative government initiatives and public-private partnerships aimed at smart mobility and carbon reduction are pushing simulation into the mainstream. These sector-specific forces are rapidly propelling the simulated train market forward, transforming it from a niche training aid to a critical pillar in global rail infrastructure development and workforce transformation.Report Scope

The report analyzes the Simulated Train market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Hardware, Software, Services); Simulator Type (Driving Simulators, Signal Simulators, Traffic Simulators, Disaster Simulators, Other Simulator Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$10.2 Billion by 2030 with a CAGR of a 20.5%. The Software Component segment is also set to grow at 18.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 25.7% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Simulated Train Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Simulated Train Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Simulated Train Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACS Material, LLC, Advanced Nano Products Co., Ltd., Blue Nano, Inc., C3Nano, Cambrios Advanced Materials and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Simulated Train market report include:

- Alstom SA

- AnyLogic

- Berkeley Simulation Software, LLC

- Bombardier Transportation

- CORYS

- CRRC Corporation Limited

- Dovetail Games

- FAAC Incorporated

- Gamma Technologies

- Indra Sistemas SA

- Lander Simulation & Training Solutions

- MOSIMTEC LLC

- Optym

- PSTech (PS Technology)

- Run8 Studios

- Savronik

- Siemens AG

- SIM Factor

- SYSTRA

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alstom SA

- AnyLogic

- Berkeley Simulation Software, LLC

- Bombardier Transportation

- CORYS

- CRRC Corporation Limited

- Dovetail Games

- FAAC Incorporated

- Gamma Technologies

- Indra Sistemas SA

- Lander Simulation & Training Solutions

- MOSIMTEC LLC

- Optym

- PSTech (PS Technology)

- Run8 Studios

- Savronik

- Siemens AG

- SIM Factor

- SYSTRA

- Thales Group

Table Information

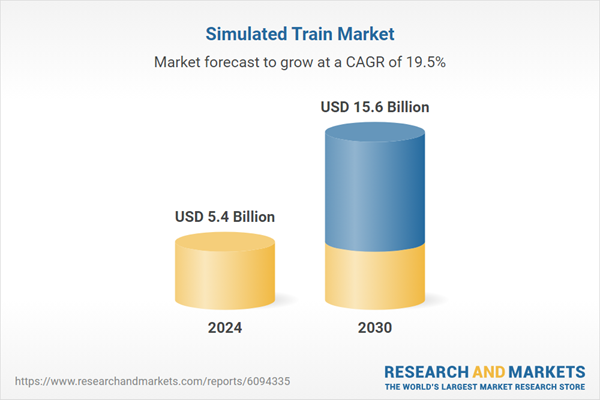

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 15.6 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |