Global 'SLS, SLES and LAS' Market - Key Trends & Drivers Summarized

Why Are SLS, SLES, And LAS Still Dominating The Surfactants Industry Despite Clean Beauty Trends?

Sodium Lauryl Sulfate (SLS), Sodium Laureth Sulfate (SLES), and Linear Alkylbenzene Sulfonate (LAS) remain the workhorses of the global surfactants market, thanks to their exceptional foaming, emulsifying, and cleansing properties. Despite the increasing consumer shift toward sulfate-free and “clean label” personal care products, these compounds continue to dominate industrial and mass-market formulations. SLS is widely used in personal care products like shampoos, toothpastes, and facial cleansers due to its excellent lathering and detergent qualities. SLES, a milder derivative of SLS, is preferred where lower skin irritation is desired, often appearing in products marketed as gentle yet effective. Meanwhile, LAS - primarily used in household and institutional cleaners - is one of the most cost-effective and biodegradable anionic surfactants on the market, making it indispensable in laundry detergents and dishwashing liquids. Their ability to deliver high-performance cleaning at low cost keeps them at the forefront of formulations in both developed and emerging economies. Moreover, the infrastructure for sourcing, production, and global distribution of these surfactants is deeply entrenched, allowing manufacturers to meet industrial-scale demand efficiently. Regulatory frameworks in many regions still permit their use within safe concentration thresholds, further supporting their prevalence across a wide range of sectors despite growing calls for greener alternatives.How Are Manufacturing Advancements And Feedstock Developments Enhancing Efficiency And Sustainability?

Technological innovation and improvements in raw material sourcing are reshaping the production landscape of SLS, SLES, and LAS, making them more sustainable and cost-efficient. Traditionally derived from petrochemical sources like n-paraffins and ethylene oxide, manufacturers are increasingly incorporating plant-based or bio-alternatives such as coconut or palm kernel oil to produce fatty alcohols - a key precursor in SLS and SLES synthesis. While these feedstocks are not entirely free from sustainability concerns, particularly regarding deforestation and biodiversity, advancements in certified sustainable palm oil (CSPO) and RSPO-compliant sourcing are mitigating environmental impact. Additionally, process optimization using ethoxylation and sulfonation technologies is reducing waste, energy use, and by-product generation during production. Continuous processing and closed-loop recycling systems are also being adopted to enhance efficiency in large-scale manufacturing plants. In the case of LAS, modern catalytic processes are achieving higher yields with improved biodegradability and minimal toxicity. Moreover, the development of low-1,4-dioxane SLES (to meet California's Proposition 65 and similar regulations) is gaining momentum, particularly in the U.S. market. Innovations in packaging, including concentrated liquid formats and waterless powders, are helping reduce overall surfactant usage while maintaining efficacy. These advancements are ensuring that while alternative surfactants grow in popularity, SLS, SLES, and LAS remain competitive - not just on price and performance, but also on evolving environmental metrics.What Consumer Trends And Industry Demands Are Influencing Formulation Choices?

The surfactants market is increasingly driven by a dual consumer narrative: performance loyalty and eco-conscious scrutiny. Mass-market consumers, especially in price-sensitive regions, continue to favor products formulated with SLS, SLES, and LAS due to their affordability, foaming ability, and cleansing efficiency - qualities that sulfate-free alternatives often struggle to replicate. However, rising global demand for skin-friendly and environmentally responsible products is pushing brands to re-evaluate their formulations. In the personal care sector, a growing percentage of consumers are seeking “sulfate-free” labels, especially in North America and Europe, where wellness culture and ingredient transparency dominate purchasing behavior. Consequently, while SLS/SLES remain present in many products, their concentrations are being reduced or replaced with milder alternatives such as sodium cocoyl isethionate or glucosides in premium lines. In contrast, the home care industry continues to rely heavily on LAS due to its superior soil removal capacity and cost efficiency in high-volume products. Institutional and industrial cleaning sectors are maintaining demand as hygiene and disinfection requirements intensify in a post-pandemic world. Emerging markets in Asia, Africa, and Latin America continue to show robust demand for traditional surfactants, driven by urbanization, rising middle-class incomes, and expanding hygiene awareness. This fragmented consumer landscape - split between cost-efficiency and sustainability - is pushing manufacturers toward tiered product lines, where traditional and alternative surfactants coexist to meet regional and demographic-specific needs.What Factors Are Driving The Growth And Continued Relevance Of The SLS, SLES, And LAS Market?

The growth in the SLS, SLES, and LAS market is driven by several distinct and interlinked factors related to industrial scalability, end-use consistency, regulatory compliance, and cost-performance balance. First, the expansive application base - from personal care and oral hygiene to household cleaning and industrial degreasers - ensures continuous demand across multiple verticals. Second, the unmatched cost-to-performance ratio of these surfactants makes them a preferred choice for manufacturers aiming to deliver high-quality formulations at scale, particularly in competitive FMCG markets. Third, improving production technologies and adoption of sustainable feedstocks are enabling environmental compliance without sacrificing commercial viability. Fourth, increasing hygiene awareness - amplified by COVID-19 and its aftermath - has boosted demand for soaps, sanitizers, and detergents, all of which rely heavily on these surfactants. Fifth, the regulatory landscape in most countries allows continued usage within safe limits, and new innovations like low-dioxane SLES and biodegradable LAS are aligning with stricter environmental guidelines. Sixth, emerging markets are exhibiting robust consumption growth, driven by rising disposable incomes, population expansion, and urban lifestyle shifts - all requiring accessible, effective cleaning agents. Seventh, the robust global supply chain infrastructure, including established suppliers and integrated manufacturing hubs, ensures dependable and economical production. These specific, industry-anchored factors - rather than general chemical demand - are fueling the sustained relevance and growth of the SLS, SLES, and LAS market on a global scale.Report Scope

The report analyzes the SLS, SLES and LAS market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (SLS, SLES, LAS); Application (Detergents & Cleaners, Personal Care, Oilfield Chemicals, Textile & Leather, Paints & Coatings, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SLS segment, which is expected to reach US$7.4 Billion by 2030 with a CAGR of a 4%. The SLES segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global SLS, SLES and LAS Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global SLS, SLES and LAS Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global SLS, SLES and LAS Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Amgen Inc., AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this SLS, SLES and LAS market report include:

- Acme-Hardesty Co.

- Alpha Chemicals Pvt. Ltd.

- BASF SE

- Bodal Chemicals Ltd.

- Chemmax Chemical Co. Ltd.

- Clariant AG

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- Fengchen Group Co. Ltd.

- Formosan Union Chemical Corp.

- Galaxy Surfactants Ltd.

- Godrej Industries Ltd.

- Hansa Group AG

- Huntsman International LLC

- Kao Corporation

- Lion Specialty Chemicals Co. Ltd.

- Nouryon

- Solvay SA

- Stepan Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme-Hardesty Co.

- Alpha Chemicals Pvt. Ltd.

- BASF SE

- Bodal Chemicals Ltd.

- Chemmax Chemical Co. Ltd.

- Clariant AG

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- Fengchen Group Co. Ltd.

- Formosan Union Chemical Corp.

- Galaxy Surfactants Ltd.

- Godrej Industries Ltd.

- Hansa Group AG

- Huntsman International LLC

- Kao Corporation

- Lion Specialty Chemicals Co. Ltd.

- Nouryon

- Solvay SA

- Stepan Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

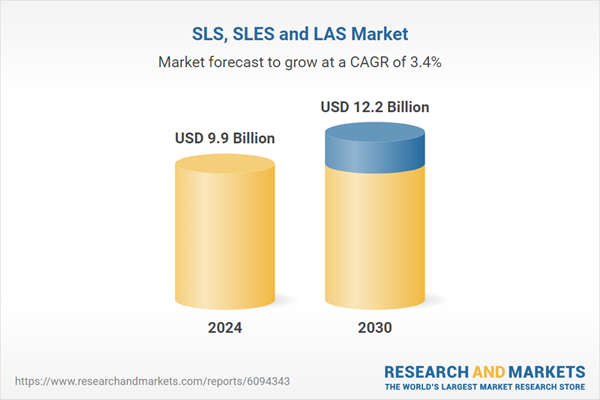

| Estimated Market Value ( USD | $ 9.9 Billion |

| Forecasted Market Value ( USD | $ 12.2 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |