Global 'Smart Food and Beverage Labels' Market - Key Trends & Drivers Summarized

Why Are Smart Labels Reshaping The Food And Beverage Packaging Experience?

Smart food and beverage labels are redefining how consumers and manufacturers interact with products, turning static packaging into a dynamic source of real-time information and enhanced traceability. Unlike traditional labels, smart labels incorporate technologies such as RFID (Radio Frequency Identification), NFC (Near Field Communication), QR codes, time-temperature indicators (TTIs), and even biosensors to monitor, communicate, and verify the condition, authenticity, and lifecycle of food products. With growing concerns around food safety, counterfeiting, spoilage, and supply chain transparency, these intelligent labels offer a powerful solution for stakeholders across the value chain. Consumers can scan smart labels using smartphones to access product origin, freshness, allergens, and sustainability credentials, empowering more informed and confident choices. For manufacturers, these labels support inventory tracking, cold chain monitoring, and recall readiness, significantly reducing waste and operational risks. In an increasingly digitized and health-conscious food ecosystem, smart labels bridge the gap between physical packaging and digital engagement - transforming packaging into a tool for trust, safety, and traceability. As global supply chains become more complex and food fraud cases rise, regulatory bodies are also beginning to recognize smart labeling as a viable means to enforce food traceability standards and improve public health outcomes.How Are Technologies Like IoT, Printed Electronics, And Sensors Powering Smart Labels?

Technological innovation is the driving force behind the evolution of smart food and beverage labels, enabling them to provide sensory, tracking, and communicative functions at a micro scale. Printed electronics have become a cornerstone technology, allowing for the integration of flexible sensors, RFID chips, and electronic circuits directly onto label substrates without adding bulk or compromising recyclability. Time-temperature indicators (TTIs), based on colorimetric or thermochromic reactions, are now widely used in perishable goods like dairy, meat, and seafood to signal temperature abuse in the cold chain. Meanwhile, IoT integration through RFID and NFC tags enables real-time tracking and data collection - allowing producers and retailers to trace a product's journey from farm to fork. Smart sensors embedded within the label can detect gas emissions (such as ethylene or ammonia) to indicate spoilage or contamination. QR codes linked to blockchain-based databases are increasingly being used to authenticate provenance claims, particularly in premium segments such as organic, artisanal, or ethically sourced products. Near-field communication (NFC) and augmented reality (AR) interfaces also transform labels into interactive platforms, offering consumers immersive brand storytelling, usage instructions, or loyalty rewards. As component miniaturization, energy efficiency, and cost optimization improve, the next generation of smart labels is becoming commercially viable for mass-market deployment - ushering in a new era of intelligent packaging.What Consumer Behaviors And Industry Pressures Are Accelerating Smart Label Adoption?

Consumer demand for transparency, safety, and sustainability is rapidly accelerating the adoption of smart food and beverage labels. Today's digitally empowered shoppers want more than nutritional facts - they expect packaging to answer questions about origin, ethical sourcing, freshness, environmental impact, and authenticity. Smart labels respond to this demand by delivering information on demand, directly through a smartphone interface, without requiring external apps or platforms. Eco-conscious consumers are also drawn to smart labels that communicate carbon footprint, recyclability, and fair trade practices. In parallel, the food and beverage industry is under mounting pressure to reduce food waste, meet compliance regulations, and protect brand integrity. Smart labels provide tangible solutions - by preventing spoilage through dynamic expiry tracking, enabling targeted recalls via batch-level traceability, and deterring counterfeiting in high-value product segments like wine, baby food, and supplements. Retailers are embracing these labels to optimize stock rotation, reduce losses from expired goods, and offer personalized promotions through customer interaction with the packaging. In the foodservice sector, where safety and shelf life are critical, smart labels streamline inventory and HACCP compliance. Moreover, the rise of direct-to-consumer (DTC) food delivery has elevated the need for quality assurance tools that reassure consumers about product condition upon arrival. These behavioral and industry shifts are creating a strong pull for smart labeling technologies across the entire food ecosystem.What Factors Are Driving The Global Growth Of The Smart Food And Beverage Labels Market?

The growth in the smart food and beverage labels market is driven by several concrete, interconnected factors rooted in technology, regulation, and evolving stakeholder needs. First, increasing global concern over food safety, fraud, and spoilage is pushing manufacturers to adopt labels that offer real-time tracking, temperature monitoring, and authenticity verification. Second, the proliferation of digital supply chains and cold-chain logistics - especially in pharmaceuticals, seafood, and dairy - is fueling demand for condition-monitoring smart labels that ensure product integrity. Third, widespread consumer smartphone adoption is enabling seamless interaction with NFC, QR code, and AR-enabled labels, enhancing customer engagement and data feedback loops. Fourth, regulatory frameworks like the EU's Farm to Fork Strategy, the U.S. Food Safety Modernization Act (FSMA), and China's digital traceability initiatives are incentivizing the use of traceable, intelligent packaging solutions. Fifth, innovations in printed electronics, low-cost sensors, and thin-film batteries are making smart labels more affordable and scalable for mainstream application. Sixth, growing investments in sustainable packaging are promoting the development of biodegradable and recyclable smart label formats, aligning with ESG goals. Seventh, food brands and retailers are leveraging smart labels for supply chain optimization, real-time inventory visibility, and consumer insights analytics. These market-specific drivers - not just general digitization trends - are fueling a robust and sustained expansion of the smart food and beverage labels market globally, transforming packaging into a platform for safety, storytelling, and supply chain intelligence.Report Scope

The report analyzes the Smart Food and Beverage Labels market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (RFID, NFC, Temperature Sensing Labels, Other Product Types); Application (Food, Beverages).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the RFID Technology segment, which is expected to reach US$19.2 Billion by 2030 with a CAGR of a 20.4%. The NFC Technology segment is also set to grow at 14.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 23.9% CAGR to reach $7.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Food and Beverage Labels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Food and Beverage Labels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Food and Beverage Labels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Carrier Global Corporation, Daikin Industries, Ltd., Dyson Ltd., Ecobee Inc., Electrolux AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Smart Food and Beverage Labels market report include:

- Alien Technology, LLC

- Avery Dennison Corporation

- CCL Industries Inc.

- Checkpoint Systems, Inc.

- Confidex Oy

- HID Global Corporation

- Honeywell International Inc.

- Impinj, Inc.

- Invengo Information Technology Co., Ltd.

- Label Insight, Inc.

- Lyngsoe Systems A/S

- NXP Semiconductors N.V.

- Paragon ID

- Qliktag Software Inc.

- SATO Holdings Corporation

- Thin Film Electronics ASA

- UWI Technology Limited

- VCQRU

- VusionGroup

- Zebra Technologies Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alien Technology, LLC

- Avery Dennison Corporation

- CCL Industries Inc.

- Checkpoint Systems, Inc.

- Confidex Oy

- HID Global Corporation

- Honeywell International Inc.

- Impinj, Inc.

- Invengo Information Technology Co., Ltd.

- Label Insight, Inc.

- Lyngsoe Systems A/S

- NXP Semiconductors N.V.

- Paragon ID

- Qliktag Software Inc.

- SATO Holdings Corporation

- Thin Film Electronics ASA

- UWI Technology Limited

- VCQRU

- VusionGroup

- Zebra Technologies Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

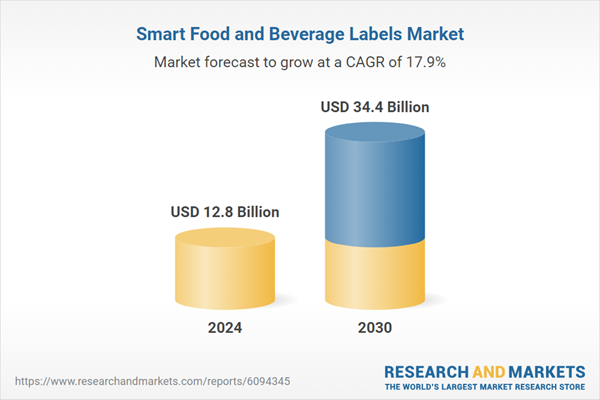

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 34.4 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |