Global 'Smart Mobility' Market - Key Trends & Drivers Summarized

Is Urban Congestion Forcing A Smart Mobility Revolution? Let's Find Out.

As cities around the world experience explosive growth, urban mobility systems are buckling under the strain. The limitations of traditional transportation models - marked by inefficiencies, congestion, pollution, and poor accessibility - have accelerated interest in smart mobility solutions. Urbanization rates are climbing steadily, with over 68% of the global population projected to live in cities by 2050. This migration puts intense pressure on city infrastructure, requiring smarter, tech-enabled mobility alternatives that reduce traffic, optimize transport flows, and promote sustainability. At the heart of smart mobility is the integration of Internet of Things (IoT), Artificial Intelligence (AI), cloud computing, and data analytics to transform how we move people and goods. Solutions like real-time traffic management, on-demand ride-hailing, micro-mobility (e-scooters, e-bikes), and Mobility-as-a-Service (MaaS) are redefining travel behaviors. Additionally, smart city initiatives and government sustainability mandates are acting as catalysts, encouraging deployment of intelligent transportation systems. For example, cities like Singapore, Amsterdam, and Stockholm are leading the charge with smart mobility blueprints focused on multimodal, connected, and eco-efficient travel. The transformation is not just about moving faster - it's about moving smarter, and reshaping the urban mobility ecosystem into a lean, green, intelligent machine.Could Autonomous And Connected Vehicles Be The Game Changer We've Been Waiting For?

The rise of autonomous vehicles (AVs) and connected car ecosystems is injecting unparalleled dynamism into the smart mobility narrative. Autonomous mobility, powered by deep learning algorithms, LIDAR, radar systems, and advanced sensors, is reshaping expectations around personal and commercial transport. From driverless taxis to automated freight trucks, AVs are unlocking safer and more efficient transportation models. Meanwhile, connected vehicles that communicate with infrastructure (V2I), other vehicles (V2V), and cloud systems are enabling predictive maintenance, collision avoidance, and smart routing. Global automakers and tech giants - like Tesla, Waymo, NVIDIA, and Toyota - are investing billions in R&D and pilot deployments. Simultaneously, 5G connectivity is accelerating the commercial feasibility of connected mobility with ultra-low latency communications and massive bandwidth support. The synergy between autonomous driving and connectivity is especially transformative for shared mobility, logistics automation, and fleet management. Regulatory developments are also moving in tandem, with nations such as the U.S., Germany, and China rolling out AV testing frameworks. As the convergence of autonomy and connectivity intensifies, it's clear that this double-barreled disruption will form the cornerstone of next-gen smart mobility frameworks across public and private sectors.Is Electrification The Key Pillar Of Sustainable Smart Transport? Explore The Energy Shift.

The electrification of mobility stands out as one of the most impactful and fast-moving shifts in the smart mobility domain. With rising fuel prices, environmental concerns, and stricter emissions regulations, electric vehicles (EVs) - ranging from passenger cars to buses and delivery fleets - have surged in popularity. The International Energy Agency (IEA) reports that EV sales surpassed 14 million units globally in 2023, a 35% increase from the previous year. This rapid uptake is fueled by falling battery costs, improved charging infrastructure, and enhanced vehicle ranges. At the same time, investments in grid modernization and renewable energy integration are making electric mobility more sustainable and resilient. Governments are further accelerating the shift through subsidies, tax incentives, zero-emission zones, and internal combustion engine bans slated for the next decade. Startups and legacy OEMs alike are scaling up EV production while integrating features like Vehicle-to-Grid (V2G) and regenerative braking to maximize efficiency. Charging networks are expanding too, with ultra-fast chargers and smart grid connectivity enabling seamless, intelligent energy use. This electric pivot is no longer just about emissions - it's about enabling a scalable, tech-integrated ecosystem that supports the broader smart mobility landscape through cleaner, data-rich, and interoperable platforms.The Growth In The Smart Mobility Market Is Driven By Several Factors Beyond Just Innovation. What's Powering The Surge?

The growth in the smart mobility market is driven by several factors rooted in technological evolution, user adoption, end-use diversity, and shifting economic landscapes. A major growth driver is the increasing demand for integrated mobility services, such as Mobility-as-a-Service (MaaS), which bundles multiple transportation modes into a single accessible digital platform. This meets the rising consumer expectation for seamless, multimodal travel experiences. Additionally, smart mobility is being rapidly adopted across industries including logistics, healthcare, tourism, and public transit systems - each leveraging mobility platforms to improve delivery models and enhance operational efficiency. On the technology front, advancements in AI-driven analytics, blockchain for mobility data security, and geospatial intelligence are expanding the capability and scope of smart mobility frameworks. Consumer behavior is also undergoing a significant shift, with younger demographics showing a strong preference for shared and subscription-based mobility over car ownership. Environmental consciousness is pushing demand for eco-friendly transport modes, while working professionals increasingly prefer app-based, real-time navigation and booking tools. Meanwhile, smart infrastructure development - like intelligent traffic signals and adaptive transport networks - provides the backbone needed for scalable deployment. Venture capital and private equity investments into smart mobility startups are rising sharply, further propelling innovation and market competition. Lastly, government policy shifts toward carbon neutrality and urban livability goals are pushing municipalities to adopt smart mobility solutions at an unprecedented pace, creating a fertile environment for continued market expansion.Report Scope

The report analyzes the Smart Mobility market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Elements (Bike Commuting, Car Sharing, Ridesharing); Solution (Traffic Management, Parking Management, Mobility Management, Other Solutions); Technology (3G & 4G, Wi-Fi, GPS, RFID, Embedded Systems, Other Technologies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bike Commuting segment, which is expected to reach US$69.4 Billion by 2030 with a CAGR of a 19.7%. The Car Sharing segment is also set to grow at 16.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.1 Billion in 2024, and China, forecasted to grow at an impressive 17.8% CAGR to reach $18.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Mobility Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Mobility Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Mobility Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., AlphaStruxure, Bloom Energy, BoxPower Inc., Caterpillar Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Smart Mobility market report include:

- Cisco Systems, Inc.

- Didi Chuxing

- Excelfore Corporation

- Ford Motor Company

- Innoviz Technologies Ltd.

- Lyft Inc.

- MaaS Global Oy

- Mindteck

- Mobileye

- QuaLiX Information System LLP

- Robert Bosch GmbH

- Siemens AG

- Tesla, Inc.

- TomTom International BV

- Toyota Motor Corporation

- Uber Technologies Inc.

- Verra Mobility Corporation

- Volocopter GmbH

- Waymo LLC

- Zipcar Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cisco Systems, Inc.

- Didi Chuxing

- Excelfore Corporation

- Ford Motor Company

- Innoviz Technologies Ltd.

- Lyft Inc.

- MaaS Global Oy

- Mindteck

- Mobileye

- QuaLiX Information System LLP

- Robert Bosch GmbH

- Siemens AG

- Tesla, Inc.

- TomTom International BV

- Toyota Motor Corporation

- Uber Technologies Inc.

- Verra Mobility Corporation

- Volocopter GmbH

- Waymo LLC

- Zipcar Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2026 |

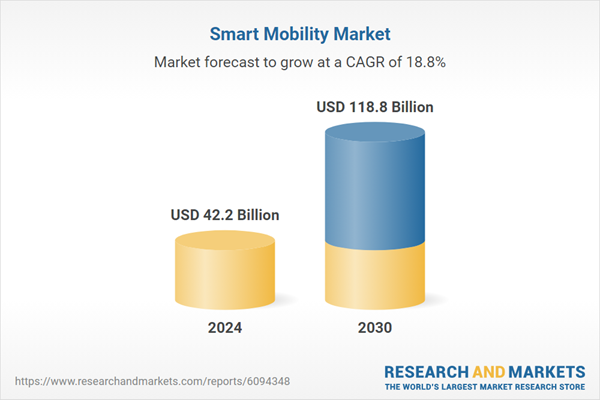

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 42.2 Billion |

| Forecasted Market Value ( USD | $ 118.8 Billion |

| Compound Annual Growth Rate | 18.8% |

| Regions Covered | Global |