Global 'Smartphone NAND Memory' Market - Key Trends & Drivers Summarized

Can NAND Memory Keep Up With the Exploding Data Needs of Mobile Computing?

As smartphones become the primary computing device for billions, the demand for high-speed, high-capacity storage has skyrocketed - making NAND flash memory a mission-critical component of mobile architecture. Unlike traditional storage systems, NAND memory enables rapid access to vast volumes of data, supporting applications from 4K video to AI-driven image processing. UFS (Universal Flash Storage) and eMMC technologies dominate the smartphone sector, with UFS 3.1 and 4.0 delivering unprecedented speeds. The move toward 5G and cloud-native apps is further stressing the need for low-latency, energy-efficient storage. Multilevel cell (MLC) and triple-level cell (TLC) NAND are commonly used in mid-range and premium phones, while quad-level cell (QLC) is gaining traction in flagship models. Leading manufacturers like Samsung, Kioxia, SK Hynix, and Micron are constantly pushing the limits of 3D NAND, stacking over 200 layers to achieve higher density in smaller footprints. Edge AI processing, on-device machine learning, and mobile gaming are all driving NAND's evolution. Meanwhile, tighter integration between NAND and processors is enabling faster app launches, seamless multitasking, and better battery efficiency. In this high-stakes race, smartphone NAND memory is no longer just storage - it's performance-critical infrastructure.How Is 3D NAND Reshaping the Memory Landscape for Mobile Devices?

The advent of 3D NAND technology has revolutionized memory performance by enabling vertical stacking of memory cells, dramatically increasing storage capacity without expanding device size. 3D NAND allows for significantly improved write endurance, lower power consumption, and faster read/write operations - perfectly suited for the compact and energy-sensitive nature of smartphones. As layers have increased from 64 to over 200 in cutting-edge chips, storage densities have surged to over 1 TB in flagship devices. Innovations such as Charge Trap Flash (CTF) and wordline stacking have allowed for further miniaturization while maintaining data integrity. 3D NAND also enables faster OS boot times, app responsiveness, and lag-free gaming. With UFS 4.0, data speeds up to 4,200 MB/s are now feasible, redefining user expectations. Moreover, the move toward LPDDR5x and on-device AI requires NAND that can work in tandem with RAM and SoCs in real-time. These advances are being rapidly commercialized by top-tier OEMs to enhance multitasking, support AR/VR apps, and future-proof devices for emerging workloads like AI avatars and 8K video processing. As 3D NAND approaches even higher layer counts, the leap from storage to real-time computing enabler is already underway.Are Next-Gen Apps Demanding A Paradigm Shift In Mobile Storage Strategy?

From real-time video editing to large-scale offline maps and AI-powered assistants, the storage needs of modern smartphones are growing more sophisticated and diverse. App sizes have increased significantly, with many requiring over 1 GB of local storage, while cached data and background analytics inflate storage demand exponentially. Users are also capturing more 4K and 8K video, which requires not just more space but faster writing speeds. Social media, now a hub for commerce, livestreaming, and AR filters, necessitates NAND that can handle constant data cycles. In emerging markets, where cloud access may be limited, local storage capacity is even more vital. OEMs are responding by increasing base storage tiers, often starting at 128GB, with 256GB or 512GB becoming standard in premium phones. NAND must now support secure boot, encryption, and real-time telemetry in tandem. Meanwhile, NAND's endurance and failure rates become crucial in regions where devices are used extensively over long lifecycles. This shift in usage patterns demands NAND that is not only fast and capacious but also highly resilient and thermally stable. The smartphone is now a mobile data center - and NAND memory is its foundational layer.The Growth In The Smartphone NAND Memory Market Is Driven By Several Factors - What's Fueling The Expansion?

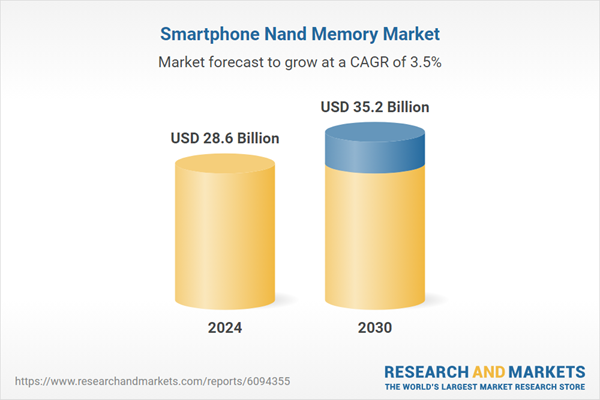

The growth in the smartphone NAND memory market is driven by several factors rooted in technology upgrades, end-use evolution, and data-heavy user behaviors. The shift to 5G is a major driver, as it enables high-speed downloads, AR streaming, and high-resolution uploads - all of which require fast and capacious storage. The rise in premium and mid-tier devices offering 128GB+ default storage is another push factor. Additionally, OEMs are adopting faster NAND standards like UFS 4.0 to support AI imaging, gaming, and real-time analytics. Increasing content creation - especially in video - and offline storage of large apps in emerging markets are further accelerating demand. NAND's integration with SoCs for AI and security operations is also expanding its role from passive storage to active computing support. More broadly, growing smartphone usage in developing economies and longer replacement cycles are encouraging durable, high-endurance NAND designs. Finally, innovations in 3D NAND stacking and falling cost-per-bit metrics are making high-capacity storage more accessible across pricing tiers, collectively powering robust growth in the market.Report Scope

The report analyzes the Smartphone Nand Memory market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (UMCP, EMCP, EMMC, UFS); Application (Smartphones, Tablets).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 44 companies featured in this Smartphone Nand Memory market report include -

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Etron Technology, Inc.

- GigaDevice Semiconductor Inc.

- Greenliant Systems

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Holdings Corporation

- Macronix International Co., Ltd.

- Micron Technology, Inc.

- Powerchip Semiconductor Corp.

- Samsung Electronics Co., Ltd.

- SanDisk (Western Digital)

- SK hynix Inc.

- Solidigm (SK hynix subsidiary)

- STMicroelectronics N.V.

- Transcend Information, Inc.

- Winbond Electronics Corporation

- Yangtze Memory Technologies Co.

- Zhaoxin Semiconductor Co., Ltd.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the UMCP segment, which is expected to reach US$16.2 Billion by 2030 with a CAGR of a 2.7%. The EMCP segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.8 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smartphone Nand Memory Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smartphone Nand Memory Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smartphone Nand Memory Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Control4 Corporation, Crestron Electronics, Inc., Eaton Corporation, General Electric Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 44 Featured):

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Etron Technology, Inc.

- GigaDevice Semiconductor Inc.

- Greenliant Systems

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Holdings Corporation

- Macronix International Co., Ltd.

- Micron Technology, Inc.

- Powerchip Semiconductor Corp.

- Samsung Electronics Co., Ltd.

- SanDisk (Western Digital)

- SK hynix Inc.

- Solidigm (SK hynix subsidiary)

- STMicroelectronics N.V.

- Transcend Information, Inc.

- Winbond Electronics Corporation

- Yangtze Memory Technologies Co.

- Zhaoxin Semiconductor Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Etron Technology, Inc.

- GigaDevice Semiconductor Inc.

- Greenliant Systems

- Intel Corporation

- Kingston Technology Corporation

- Kioxia Holdings Corporation

- Macronix International Co., Ltd.

- Micron Technology, Inc.

- Powerchip Semiconductor Corp.

- Samsung Electronics Co., Ltd.

- SanDisk (Western Digital)

- SK hynix Inc.

- Solidigm (SK hynix subsidiary)

- STMicroelectronics N.V.

- Transcend Information, Inc.

- Winbond Electronics Corporation

- Yangtze Memory Technologies Co.

- Zhaoxin Semiconductor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.6 Billion |

| Forecasted Market Value ( USD | $ 35.2 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |