Global Automotive Blind Spot Detection Market - Key Trends & Drivers Summarized

Why Is Blind Spot Detection Becoming a Must-Have Feature in Modern Vehicles?

Blind spot detection (BSD) systems have rapidly evolved from luxury add-ons to essential safety components across various vehicle segments. These systems are designed to alert drivers of objects or vehicles that are not visible in the side mirrors, particularly in adjacent lanes, thereby significantly reducing the risk of lane-change accidents. As urban traffic becomes denser and driving conditions more unpredictable, drivers increasingly rely on assistance technologies to make quick, informed decisions. BSD systems are addressing this critical visibility gap with high accuracy and real-time feedback, making them indispensable for modern driving. The global rise in road accidents, combined with a growing emphasis on passive and active safety, is creating a strong case for BSD integration. Furthermore, consumer preferences are shifting toward vehicles that enhance situational awareness and reduce stress behind the wheel. Automakers are responding by making BSD systems standard or optional features even in compact cars, signaling widespread acceptance and anticipated ubiquity in future vehicle platforms.What Technological Innovations Are Enhancing System Precision and Reliability?

Technological strides in radar, ultrasonic, and camera-based sensors are elevating the capabilities of blind spot detection systems. Most BSD systems now rely on short- and mid-range radar sensors installed in the rear bumpers, capable of monitoring adjacent lanes with exceptional accuracy under varied weather and lighting conditions. Advanced signal processing algorithms filter out irrelevant objects, reducing false alarms and improving user trust in the system. Newer models integrate BSD with other safety systems such as lane keeping assistance, rear cross-traffic alert, and emergency steering support to create a comprehensive driver-assist framework. Some cutting-edge BSD systems incorporate artificial intelligence to analyze driving patterns and environmental variables, enhancing predictive accuracy. Vehicle-to-vehicle (V2V) communication is also being tested as a supplement to sensor-based systems, offering early warnings about fast-approaching vehicles in the blind zone. These innovations ensure that blind spot detection systems not only detect but also anticipate potential hazards, taking proactive safety to the next level.How Are Regulatory Trends and Consumer Behavior Shaping Market Dynamics?

Regulatory frameworks worldwide are increasingly mandating the use of advanced driver assistance systems, including blind spot detection, in both passenger and commercial vehicles. In regions such as the European Union and North America, safety assessments by agencies like Euro NCAP and NHTSA are strongly influenced by the inclusion of BSD systems, prompting automakers to standardize their presence across models. Meanwhile, consumers are growing more informed about vehicular safety technologies, often prioritizing these features when making purchasing decisions. The demand for BSD is especially strong among older drivers and those in urban environments, where visibility challenges are more pronounced. Automakers are capitalizing on this trend by integrating BSD systems into their marketing strategies and safety narratives. Fleet operators, too, are increasingly equipping their vehicles with blind spot detection to reduce liability and improve driver accountability. The push from both ends - regulatory and consumer - has created a high-growth environment for the BSD market, with innovations continuing to emerge in response to safety imperatives and usability expectations.What Are the Primary Drivers Fueling Market Expansion?

The growth in the automotive blind spot detection market is driven by several factors. A key driver is the rising incidence of lane-change and merging-related accidents, which BSD systems are specifically designed to mitigate. The expanding production of passenger and commercial vehicles globally, particularly in urbanized and high-density traffic regions, is also contributing to increased demand. Technological advancements in radar and imaging sensors have made BSD systems more accurate and affordable, enabling deployment in a broader range of vehicle categories. Integration of BSD with comprehensive ADAS suites is further enhancing its value proposition for consumers. Growing consumer preference for vehicles equipped with intelligent safety features, especially among younger and safety-conscious buyers, is also pushing OEMs to include BSD as standard equipment. In the commercial vehicle segment, the focus on driver safety and fleet management efficiency is encouraging fleet owners to retrofit BSD systems. Additionally, the rise of electric and semi-autonomous vehicles, which prioritize enhanced situational awareness, is further accelerating BSD adoption, solidifying its role as a foundational technology in the evolution of automotive safety systems.Report Scope

The report analyzes the Automotive Blind Spot Detection market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Ultrasound Technology, Radar Technology, Camera Technology); Propulsion (ICE Propulsion, Electric Propulsion); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Light Commercial Vehicles End-Use, Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ultrasound Technology segment, which is expected to reach US$7.8 Billion by 2030 with a CAGR of a 14.9%. The Radar Technology segment is also set to grow at 12.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 18.6% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Blind Spot Detection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Blind Spot Detection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Blind Spot Detection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ayonix Corporation, BioEnable Technologies Pvt Ltd, BioID GmbH, Cognitec Systems GmbH, Daon and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Automotive Blind Spot Detection market report include:

- Aptiv PLC

- Autoliv Inc.

- Bosch (Robert Bosch GmbH)

- Continental AG

- Denso Corporation

- FLIR Systems (Teledyne FLIR)

- Gentex Corporation

- Hella GmbH & Co. KGaA

- Hyundai Mobis

- Infineon Technologies AG

- Magna International Inc.

- Mobileye (Intel Corporation)

- NXP Semiconductors

- Panasonic Corporation

- Robert Bosch Engineering and Business Solutions

- Samsung Electronics

- Sensata Technologies

- STMicroelectronics

- Valeo

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aptiv PLC

- Autoliv Inc.

- Bosch (Robert Bosch GmbH)

- Continental AG

- Denso Corporation

- FLIR Systems (Teledyne FLIR)

- Gentex Corporation

- Hella GmbH & Co. KGaA

- Hyundai Mobis

- Infineon Technologies AG

- Magna International Inc.

- Mobileye (Intel Corporation)

- NXP Semiconductors

- Panasonic Corporation

- Robert Bosch Engineering and Business Solutions

- Samsung Electronics

- Sensata Technologies

- STMicroelectronics

- Valeo

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 455 |

| Published | January 2026 |

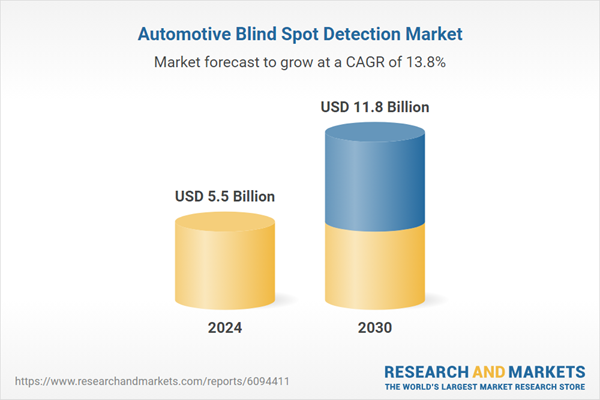

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 11.8 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |