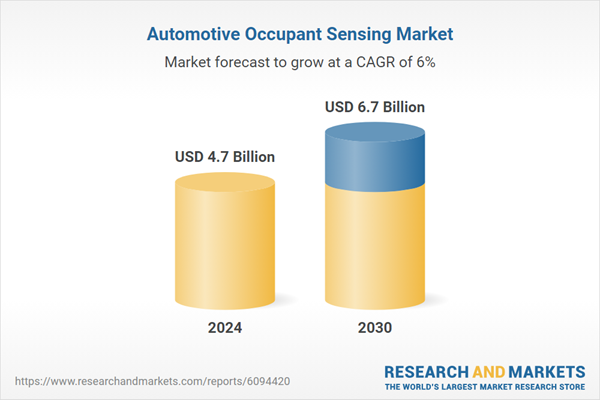

Global Automotive Occupant Sensing Market - Key Trends & Drivers Summarized

Why Is Occupant Sensing Technology Becoming Crucial In Vehicle Safety Systems?

Automotive occupant sensing systems are increasingly recognized as vital components in the modern vehicle safety ecosystem, driven by the dual demands of enhanced passenger protection and regulatory compliance. These systems are designed to detect the presence, position, and classification of vehicle occupants - be it adults, children, or pets - primarily to enable smarter deployment of safety devices such as airbags, seatbelt tensioners, and alert mechanisms. Initially, occupant sensors were limited to weight-based detection mechanisms embedded in passenger seats to disable airbags for small children. However, advancements in sensor technologies, including ultrasonic, capacitive, infrared, and radar-based systems, have significantly expanded their capabilities. Modern systems can determine not just presence, but also motion, posture, and biometric indicators like respiration and heartbeat. These inputs are essential for tailoring safety responses in real time, particularly in crash scenarios where proper airbag deployment can mean the difference between injury and survival. Additionally, as vehicles transition toward semi-autonomous and fully autonomous configurations, occupant sensing plays a pivotal role in understanding how many passengers are inside, where they are seated, and whether they are alert or engaged - allowing the vehicle to adapt driving behaviors, infotainment settings, and emergency responses accordingly. Automakers are also integrating these sensors with HVAC systems to optimize in-cabin climate control based on occupancy. Moreover, occupant detection is becoming crucial in post-crash scenarios, where it can help first responders assess how many people are in the vehicle and which areas were most impacted. As the automotive industry continues its march toward intelligent, responsive, and context-aware safety systems, occupant sensing is no longer an optional luxury - it has become a fundamental technology underpinning vehicle intelligence and survivability.How Are Regulations And Child Safety Mandates Driving Adoption Of Occupant Sensing Systems?

Government regulations and global safety mandates are among the most significant forces accelerating the deployment of automotive occupant sensing systems. Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the United States and the European New Car Assessment Programme (Euro NCAP) have introduced increasingly stringent safety standards that encourage or require the use of occupant classification and detection systems in passenger vehicles. One key focus area has been the prevention of airbag-induced injuries, particularly to children and small adults seated in the front passenger seat. To meet these requirements, automakers are compelled to implement smart airbag systems that rely on accurate occupant classification - identifying whether a child seat or small occupant is present and adjusting the airbag's deployment force accordingly. Another crucial regulatory push comes from child presence detection mandates. In recent years, there has been a tragic rise in hot car deaths due to children being accidentally left unattended in vehicles. In response, governments and safety advocates have called for mandatory child detection systems that can issue alerts or trigger automatic emergency calls if a child is detected in an unoccupied, locked vehicle. The U.S. Congress and European Union have proposed or enacted legislation requiring such systems in all new vehicles within specific time frames. These mandates are not only shaping the design and functionality of occupant sensing systems but also influencing procurement and platform decisions at the OEM level. In addition, commercial fleets, ride-sharing services, and public transportation operators are incorporating occupant detection to ensure compliance with safety policies and to enhance customer confidence. Overall, regulatory momentum is serving as both a compliance necessity and a catalyst for innovation in the occupant sensing market, prompting deeper integration and more advanced sensor fusion within the vehicle architecture.What Technological Innovations Are Transforming Occupant Sensing Capabilities?

Technological advancement is revolutionizing automotive occupant sensing systems, enabling unprecedented levels of accuracy, responsiveness, and integration. Traditional systems that relied primarily on pressure mats or seatbelt engagement indicators are being rapidly replaced by multi-modal sensor arrays that combine infrared cameras, millimeter-wave radar, ultrasonic sensors, and time-of-flight (ToF) detectors. These newer technologies provide a far more comprehensive understanding of occupant presence, movement, and condition. For instance, interior radar systems can detect micro-movements such as breathing and heartbeats, making them effective for identifying sleeping children or unconscious adults, even when obscured by blankets or car seats. Meanwhile, near-infrared cameras with AI-based image processing are being used to distinguish between different types of objects (e.g., a bag vs. a child), assess occupant posture, and detect head and limb positions to inform adaptive restraint systems. Additionally, occupant sensing is being tightly integrated with in-cabin monitoring systems that track driver alertness and passenger engagement, forming part of a broader push toward holistic cabin intelligence. This convergence of sensing and AI is enabling vehicles to deliver more personalized experiences, such as automatically adjusting seat positions, ambient lighting, and infotainment based on who is present. On the connectivity front, real-time data collected from occupant sensing systems is increasingly being transmitted to cloud platforms for analytics, predictive maintenance, and fleet management optimization. As vehicles evolve into interconnected digital platforms, occupant sensors are also being tasked with cybersecurity features - ensuring that only authorized individuals can start or operate the vehicle. With continuous improvements in sensor miniaturization, power efficiency, and cost-effectiveness, the range of applications for occupant sensing continues to expand. These innovations are pushing the boundaries of what in-vehicle intelligence can achieve, positioning occupant sensing systems as a central component in the next generation of automotive design and user experience.What Are The Key Drivers Behind The Rising Demand For Automotive Occupant Sensing Systems?

The growth in the automotive occupant sensing market is driven by several interrelated factors linked to technological shifts, end-user demands, and evolving industry dynamics. One of the most significant growth drivers is the automotive industry's ongoing transition toward higher levels of automation, which requires advanced cabin awareness as a foundation for safe and responsive vehicle operation. As vehicles gain semi-autonomous or autonomous capabilities, the need to monitor occupant behavior, readiness to take control, and seating configuration becomes essential - fueling demand for real-time occupant sensing. Another powerful growth factor is the increasing emphasis on occupant-centric design, as consumers seek personalized, responsive, and safer in-cabin experiences. Vehicles are no longer seen solely as transportation tools but as intelligent living spaces, and manufacturers are responding by incorporating systems that automatically recognize and adjust to the people inside. This trend is particularly prominent in premium and electric vehicles, where differentiation often hinges on intelligent cabin features. The rise of shared mobility and ride-hailing platforms is also contributing to market expansion, as fleet operators require enhanced security and monitoring systems to track passenger presence, ensure seatbelt compliance, and log user activity. Moreover, safety-driven consumers are demanding vehicles equipped with child presence detection and post-crash assistance capabilities, both of which rely on robust occupant sensing. Advances in AI, sensor fusion, and cloud connectivity are enabling scalable and affordable solutions, making it feasible for mass-market automakers to adopt occupant sensing in mainstream models. Meanwhile, the increasing standardization of occupant sensing as part of global NCAP protocols is turning it from a competitive advantage into a regulatory requirement, further driving adoption. With the convergence of electrification, automation, and digital user experience design, occupant sensing systems are emerging as a critical enabler of both safety and innovation - leading to sustained and diversified growth across global automotive markets.Report Scope

The report analyzes the Automotive Occupant Sensing market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Cameras Type, Strain Gauges Type, Pressure Mats Type, Ultrasonic Sensors Type); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cameras segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 7.3%. The Strain Gauges segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Occupant Sensing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Occupant Sensing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Occupant Sensing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Automotive Occupant Sensing market report include:

- Autoliv Inc.

- Aptiv PLC

- Continental AG

- Caaresys

- Delphi Technologies (Aptiv)

- Denso Corporation

- Faurecia S.A.

- Flexpoint Sensor Systems, Inc.

- Furukawa Electric Co., Ltd.

- Grammer AG

- Hamamatsu Photonics K.K.

- Hella KGaA Hueck & Co.

- Hyundai Mobis Co., Ltd.

- IAV GmbH

- Joyson Safety Systems

- Lear Corporation

- LeddarTech Inc.

- Nidec Corporation

- NIRA Dynamics AB

- Robert Bosch GmbH

- Schneider Electric

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autoliv Inc.

- Aptiv PLC

- Continental AG

- Caaresys

- Delphi Technologies (Aptiv)

- Denso Corporation

- Faurecia S.A.

- Flexpoint Sensor Systems, Inc.

- Furukawa Electric Co., Ltd.

- Grammer AG

- Hamamatsu Photonics K.K.

- Hella KGaA Hueck & Co.

- Hyundai Mobis Co., Ltd.

- IAV GmbH

- Joyson Safety Systems

- Lear Corporation

- LeddarTech Inc.

- Nidec Corporation

- NIRA Dynamics AB

- Robert Bosch GmbH

- Schneider Electric

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 366 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.7 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |