Global Automotive On-Board Diagnostics (OBD) Market - Key Trends & Drivers Summarized

How Has OBD Evolved Into A Digital Lifeline For Modern Vehicles?

Automotive On-Board Diagnostics (OBD) systems have come a long way from their origins as rudimentary diagnostic tools in the 1980s to becoming critical digital lifelines embedded in every modern vehicle. Initially introduced to monitor emission-related faults, OBD systems were mandated by governments to help detect failures in catalytic converters, oxygen sensors, and fuel systems. However, with the rapid evolution of automotive electronics and the advent of increasingly complex vehicle architectures, the scope of OBD has expanded significantly. Today's OBD systems - especially the more advanced OBD-II and OBD-III variants - can track hundreds of vehicle parameters in real time, ranging from engine temperature and throttle position to battery voltage, brake status, and airbag deployment data. They function as centralized communication hubs, continuously collecting and interpreting data from various Electronic Control Units (ECUs) across the vehicle. This level of integration allows OBD to play a key role not just in diagnostics, but in preventive maintenance, emissions control, and even driving behavior analytics. Furthermore, the standardization of the OBD port has enabled third-party devices and applications to interface directly with vehicle data, empowering technicians, fleet operators, and even consumers to monitor performance, diagnose faults, and optimize fuel usage. With the rise of mobile-based diagnostics and telematics platforms, OBD has transcended its original function and is now integral to vehicle health monitoring, remote diagnostics, and connected car ecosystems. Its evolution underscores the broader transformation of vehicles into software-driven, data-rich platforms that depend on continuous self-assessment and real-time operational intelligence.In What Ways Are Emissions Regulations And Sustainability Goals Advancing OBD Integration?

Stricter emissions regulations and global sustainability goals have significantly accelerated the development and integration of advanced On-Board Diagnostics systems in vehicles. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Union (via Euro 6/7 standards), and authorities in Asia-Pacific have established stringent emissions limits that vehicles must adhere to throughout their operational lifespan. To enforce compliance, manufacturers are required to integrate robust OBD systems capable of detecting and reporting malfunctions in emission-critical components like exhaust gas recirculation (EGR), diesel particulate filters (DPF), and catalytic converters. These systems must not only detect failures but also log diagnostic trouble codes (DTCs) and illuminate warning indicators - commonly known as the “check engine” light - to alert drivers and technicians. OBD systems have thus become the first line of defense in identifying emission-related faults before they contribute to environmental harm. In parallel, governments and cities worldwide are introducing low-emission zones and eco-certifications that require vehicles to be in optimal health - verified in part through OBD performance data. Additionally, the integration of OBD with real-time telematics enables remote monitoring of emission levels, allowing fleet operators to comply with environmental standards while optimizing fuel efficiency. In electric and hybrid vehicles, OBD platforms are also being adapted to monitor high-voltage components, battery health, and charging systems to support green transportation mandates. The need for transparency and accountability in emissions control is pushing manufacturers to develop more intelligent, connected OBD systems that go beyond fault detection to offer predictive insights and proactive maintenance alerts. These trends clearly indicate that emissions compliance is not just a regulatory requirement - it is a catalyst for advancing the technological capabilities of OBD and embedding it deeper into the vehicle's operational core.What Technological Innovations Are Revolutionizing The Capabilities Of OBD Systems?

Technological innovation is fundamentally reshaping the capabilities of On-Board Diagnostics systems, transforming them from passive fault loggers into active, intelligent platforms that support real-time analytics, remote access, and cloud connectivity. One of the most significant advances is the integration of OBD with IoT (Internet of Things) frameworks, enabling vehicles to transmit diagnostic data to cloud servers for advanced processing and long-term storage. This connectivity has opened the door to remote diagnostics, allowing manufacturers and service providers to detect issues before they lead to breakdowns, and even deploy software fixes over the air (OTA) in some cases. Modern OBD systems are increasingly leveraging AI and machine learning algorithms to analyze historical and real-time data, offering predictive maintenance insights that reduce downtime and extend vehicle lifespan. These capabilities are particularly valuable in fleet management, where even minor inefficiencies can result in significant operational costs over time. Another key innovation is the miniaturization and wireless enablement of OBD devices, allowing plug-and-play diagnostics through smartphones and tablets via Bluetooth or Wi-Fi. This has empowered end users, from individual car owners to mechanics, with tools that were previously only available in specialized workshops. Moreover, the move toward centralized and zonal E/E architectures in vehicles has allowed OBD systems to access a more comprehensive range of sensor data, enhancing the accuracy and depth of diagnostics. Manufacturers are also developing enhanced cybersecurity protocols to protect the increasing volumes of data collected and transmitted by OBD systems, ensuring that sensitive vehicle and user information remains secure. As vehicles transition into software-defined platforms, OBD is no longer a standalone feature - it is a vital node in a complex digital network that supports diagnostics, compliance, personalization, and system optimization on an ongoing basis.What Are The Main Forces Fueling The Expansion Of The Automotive OBD Market?

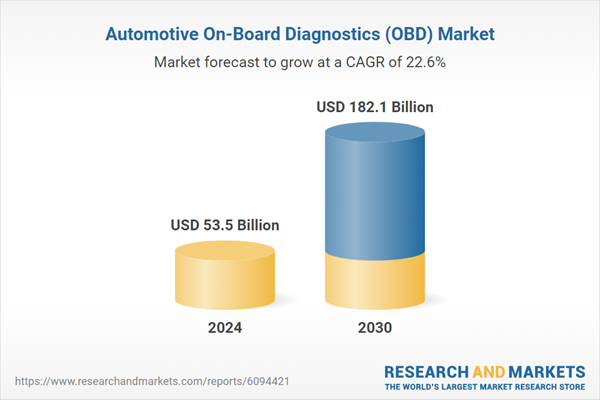

The growth in the automotive On-Board Diagnostics (OBD) market is driven by several interconnected factors rooted in changing regulatory landscapes, technological convergence, and shifting consumer expectations. First and foremost, global regulatory pressure around vehicle emissions and safety standards is compelling automakers to embed advanced OBD systems that can track, diagnose, and report faults in real time, particularly for emission-critical systems. This is especially crucial as countries enforce stricter vehicle inspection regimes, making comprehensive OBD functionality essential for passing mandatory tests and retaining roadworthiness certification. Secondly, the rising adoption of connected and intelligent vehicle platforms is pushing OEMs to integrate OBD systems as part of broader telematics and fleet management solutions. These platforms use OBD data to optimize routing, monitor driver behavior, forecast maintenance needs, and ensure compliance - making them indispensable in logistics, ride-sharing, and mobility-as-a-service (MaaS) operations. The increasing penetration of electric vehicles (EVs) is also a key driver, as these platforms require modified OBD systems capable of managing high-voltage components, energy flow, and battery diagnostics. From a consumer standpoint, there is a growing desire for transparency and control over vehicle health, prompting demand for mobile-compatible OBD devices and apps that provide real-time insights and maintenance alerts. Moreover, the aftermarket for OBD accessories, including GPS trackers, fuel economy monitors, and driving analytics tools, is expanding rapidly, creating new revenue streams for technology providers. The integration of artificial intelligence, big data analytics, and cloud platforms with OBD systems further enhances their value proposition by enabling predictive diagnostics and reducing the need for unscheduled maintenance. As the automotive industry continues to shift toward autonomy, electrification, and connectivity, the role of OBD is becoming more critical - not just as a compliance tool, but as a cornerstone of intelligent vehicle management. These trends collectively point to a robust and sustained expansion of the global OBD market, supported by continuous innovation and a growing ecosystem of applications.Report Scope

The report analyzes the Automotive On-Board Diagnostics (OBD) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Allied Services, OBD Port); Connectivity (Wired Connectivity, Wireless Connectivity); Propulsion (ICE Propulsion, Electric Propulsion).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Allied Services segment, which is expected to reach US$119.3 Billion by 2030 with a CAGR of a 20.9%. The OBD Port segment is also set to grow at 26.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.1 Billion in 2024, and China, forecasted to grow at an impressive 21.5% CAGR to reach $27.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive On-Board Diagnostics (OBD) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive On-Board Diagnostics (OBD) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive On-Board Diagnostics (OBD) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autoliv Inc., Aptiv PLC, Continental AG, Caaresys, Delphi Technologies (Aptiv) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Automotive On-Board Diagnostics (OBD) market report include:

- Actia Group

- Autel Intelligent Technology Co., Ltd.

- AVL List GmbH

- Bosch Automotive Service Solutions

- CarMD.com Corporation

- Continental AG

- Delphi Technologies

- DENSO Corporation

- EASE Diagnostics

- General Motors Co.

- Hella KGaA Hueck & Co.

- Hickok Incorporated

- Innova Electronics Corporation

- iWave Systems Technologies Pvt. Ltd.

- Launch Tech Co., Ltd.

- Magneti Marelli S.p.A.

- Mojio Inc.

- Robert Bosch GmbH

- Snap-on Incorporated

- Vector Informatik GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actia Group

- Autel Intelligent Technology Co., Ltd.

- AVL List GmbH

- Bosch Automotive Service Solutions

- CarMD.com Corporation

- Continental AG

- Delphi Technologies

- DENSO Corporation

- EASE Diagnostics

- General Motors Co.

- Hella KGaA Hueck & Co.

- Hickok Incorporated

- Innova Electronics Corporation

- iWave Systems Technologies Pvt. Ltd.

- Launch Tech Co., Ltd.

- Magneti Marelli S.p.A.

- Mojio Inc.

- Robert Bosch GmbH

- Snap-on Incorporated

- Vector Informatik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 169 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 53.5 Billion |

| Forecasted Market Value ( USD | $ 182.1 Billion |

| Compound Annual Growth Rate | 22.6% |

| Regions Covered | Global |