Global Automotive Refrigerants Market - Key Trends & Drivers Summarized

Why Are Automotive Refrigerants Central to Climate Control in Modern Vehicles?

Automotive refrigerants play a critical role in vehicle climate control systems, ensuring passenger comfort by enabling efficient air conditioning performance across a range of temperatures. These specialized chemicals are responsible for absorbing and dissipating heat through a cycle of compression and expansion within a closed-loop system. Historically, chlorofluorocarbons (CFCs) such as R-12 were the industry standard until environmental regulations phased them out due to their ozone-depleting potential. This prompted a transition to hydrochlorofluorocarbons (HCFCs) like R-134a, which, while less damaging, still contribute significantly to global warming. As climate change concerns escalate, automakers and suppliers have been adopting next-generation refrigerants such as hydrofluoroolefins (HFOs), notably R-1234yf, which boasts a dramatically lower Global Warming Potential (GWP) and zero ozone depletion potential. These new refrigerants are now becoming standard in developed markets, especially in North America and Europe, where regulatory pressure is intense. The importance of refrigerants goes beyond environmental compliance; they directly influence vehicle energy efficiency, especially in electric vehicles (EVs), where thermal management is crucial for battery life and charging performance. As cabin comfort becomes a higher priority for consumers - particularly in luxury and electric segments - refrigerants must offer rapid cooling capabilities, stability across a wide range of ambient temperatures, and compatibility with evolving HVAC system designs. Additionally, advancements in sensor technologies and HVAC control algorithms are enabling more precise refrigerant use, reducing waste and enhancing system efficiency. In sum, automotive refrigerants are no longer peripheral components but integral to achieving energy efficiency, regulatory compliance, and consumer satisfaction in modern vehicle design.How Are Environmental Regulations Reshaping the Refrigerants Landscape?

Stringent environmental regulations are fundamentally altering the dynamics of the automotive refrigerants market, acting as both a constraint and a catalyst for innovation. International protocols such as the Montreal Protocol and its Kigali Amendment have laid the foundation for a phasedown of high-GWP refrigerants, compelling automakers and HVAC system manufacturers to invest in more sustainable alternatives. The European Union has been particularly aggressive in enforcing F-Gas regulations, mandating the use of low-GWP refrigerants in all new passenger vehicles, effectively driving the widespread adoption of R-1234yf. In the United States, the Environmental Protection Agency (EPA) has issued similar mandates under the Significant New Alternatives Policy (SNAP) program, influencing both domestic production and import compliance. Meanwhile, Asian markets such as Japan and South Korea are aligning their environmental standards with global benchmarks, further accelerating the transition. These regulatory pressures have sparked a wave of R&D in alternative refrigerants, including natural options like carbon dioxide (CO2/R-744), which is gaining traction due to its negligible environmental footprint and high heat transfer efficiency. However, the adoption of these alternatives introduces new challenges, such as the need for high-pressure systems, material compatibility, and safety precautions, particularly for mildly flammable refrigerants like R-1234yf. Regulatory compliance now goes hand-in-hand with technological readiness, prompting OEMs to overhaul HVAC architectures and collaborate with Tier-1 suppliers to ensure full system integration. Furthermore, refrigerant recycling and recovery mandates are also gaining prominence, necessitating infrastructure upgrades in service centers and training for technicians. Overall, the global regulatory shift is not only transforming refrigerant chemistry but also redefining system design, supply chains, and maintenance protocols across the automotive industry.Why Is the Transition to Next-Generation Refrigerants Gaining Momentum Across Vehicle Segments?

The transition toward next-generation automotive refrigerants is accelerating across vehicle categories, from economy models to high-performance and electric vehicles, driven by the convergence of environmental accountability, consumer expectations, and technological feasibility. In the passenger car segment, OEMs are rapidly phasing out R-134a in favor of R-1234yf due to its significantly lower GWP and regulatory acceptance across multiple regions. R-1234yf offers performance comparable to its predecessor while aligning with the environmental goals of automakers striving for carbon neutrality. In electric vehicles, the stakes are even higher: efficient thermal management directly influences battery performance, cabin comfort, and range. Advanced refrigerants that operate effectively at lower pressures and across varying thermal loads are crucial for EV HVAC systems that must cool batteries, power electronics, and passengers simultaneously. Commercial vehicles, including buses and delivery fleets, are also transitioning to low-GWP refrigerants as part of broader sustainability strategies, often motivated by city-level environmental policies and green fleet incentives. Additionally, hybrid systems and plug-in hybrids introduce unique thermal challenges, requiring refrigerants that can adapt to variable operating cycles and fluctuating cooling demands. The aftermarket is also playing a role, with increased availability of retrofitting kits and technician training enabling older vehicles to switch to more eco-friendly refrigerants. OEM partnerships with chemical manufacturers such as Honeywell and Chemours are fast-tracking the deployment of proprietary low-GWP refrigerants, often bundled with specialized lubricants and leak-resistant components. As the global push toward electrification, sustainability, and efficiency intensifies, refrigerants are transitioning from generic system elements to strategic components that define the environmental and functional performance of modern vehicles.What Forces Are Propelling the Growth of the Automotive Refrigerants Market Globally?

The growth in the automotive refrigerants market is driven by several factors rooted in technological evolution, regulatory transformation, changing consumer demands, and shifts in global vehicle production. At the forefront is the rising penetration of electric and hybrid vehicles, which require advanced and efficient HVAC systems to manage thermal loads across both cabin and drivetrain components. These systems depend on next-generation refrigerants that offer optimal performance, environmental safety, and system compatibility. Additionally, as global warming intensifies, demand for effective vehicle air conditioning is surging, particularly in emerging markets like India, Southeast Asia, Latin America, and Africa, where rising disposable incomes are leading to increased automobile ownership and higher expectations for comfort features. Regulatory mandates across these regions are also catching up, creating a dual pressure to improve cooling performance while reducing environmental impact. OEMs are responding by standardizing R-1234yf in new vehicle platforms and investing in CO2-based systems for future applications. The proliferation of smart climate control systems that rely on advanced sensors and predictive algorithms further enhances refrigerant utilization, making efficient operation a key selling point. In the commercial vehicle sector, fleet operators are adopting low-GWP refrigerants to meet sustainability targets and reduce operating costs, further expanding market scope. Meanwhile, technological advancements in refrigerant containment, leak detection, and system durability are increasing the appeal of modern HVAC systems for both manufacturers and end-users. Global supply chains are also adapting, with major chemical producers scaling up low-GWP refrigerant production and regional players entering the market to serve localized demand. Collectively, these trends ensure that automotive refrigerants remain a vital and growing segment, tightly interwoven with the broader themes of decarbonization, technological innovation, and consumer-centric vehicle design.Report Scope

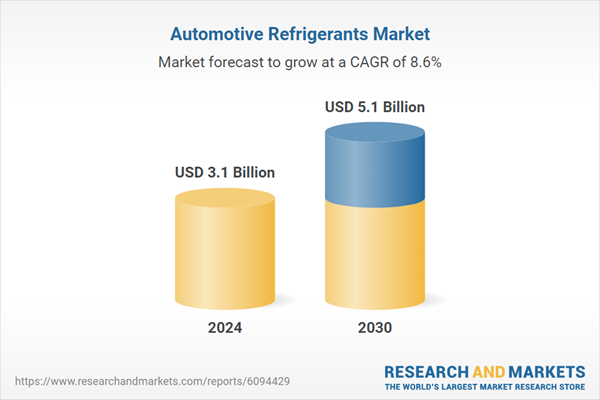

The report analyzes the Automotive Refrigerants market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Refrigerant Type (R134a Refrigerant, R1234yf Refrigerant, Other Refrigerant Types); Distribution Channel (Offline Distribution Channel, Online Distribution Channel); End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the R134a Refrigerant segment, which is expected to reach US$3.1 Billion by 2030 with a CAGR of a 8.1%. The R1234yf Refrigerant segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $843.2 Million in 2024, and China, forecasted to grow at an impressive 13.2% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Refrigerants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Refrigerants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Refrigerants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisin Seiki Co., Ltd., Ashimori Industry Co., Ltd., BorgWarner Inc., China Automotive Systems Inc., Continental AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Automotive Refrigerants market report include:

- A-Gas

- AGC Inc.

- Air International Thermal Systems

- Air Liquide

- Arkema Group

- BorgWarner

- Chemours Company

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- DENSO Corporation

- DuPont de Nemours Inc.

- Eberspächer Group

- Grayson Thermal Systems

- Hanon Systems

- Hitachi Ltd.

- Honeywell International Inc.

- Linde plc

- Mahle Behr GmbH & Co. KG

- National Refrigerants Inc.

- The Chemours Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A-Gas

- AGC Inc.

- Air International Thermal Systems

- Air Liquide

- Arkema Group

- BorgWarner

- Chemours Company

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- DENSO Corporation

- DuPont de Nemours Inc.

- Eberspächer Group

- Grayson Thermal Systems

- Hanon Systems

- Hitachi Ltd.

- Honeywell International Inc.

- Linde plc

- Mahle Behr GmbH & Co. KG

- National Refrigerants Inc.

- The Chemours Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 371 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |