Global Automotive Steering Sensors Market - Key Trends & Drivers Summarized

Why Are Steering Sensors a Vital Component in Modern Vehicle Control Systems?

Automotive steering sensors have become critical components in modern vehicle dynamics, serving as the link between driver input and vehicle response in both conventional and advanced driver-assistance systems (ADAS). These sensors measure various steering parameters - such as angle, torque, position, and rate of change - and communicate this data to electronic control units (ECUs), enabling real-time adjustments to power steering, stability control, and lane-keeping functions. As vehicles evolve from purely mechanical systems to mechatronic platforms, steering sensors play a pivotal role in translating human input into digital commands that enhance safety, efficiency, and driving experience. In electric power steering (EPS) systems, for instance, steering angle sensors and torque sensors work together to determine the appropriate level of motor-assisted steering force. This not only improves maneuverability at low speeds but also enhances high-speed stability. The growing reliance on electronic and software-driven controls has made steering sensors indispensable for features like park assist, adaptive cruise control, and collision avoidance. In autonomous driving applications, these sensors ensure the precise and continuous monitoring of steering inputs - whether initiated by a driver or an AI algorithm - to maintain directional accuracy. Furthermore, steering sensors contribute significantly to driver feedback mechanisms, supporting the development of artificial steering feel in steer-by-wire systems. With the integration of safety standards such as ISO 26262 for functional safety and UNECE regulations for autonomous technologies, steering sensors have transitioned from optional performance enhancers to essential safety components. Their precision, responsiveness, and compatibility with diverse steering architectures underline their growing importance in the global automotive landscape.How Are Technological Innovations Shaping the Next Generation of Steering Sensors?

Technological advancements are revolutionizing automotive steering sensors, driving improvements in accuracy, durability, size, and integration capability. Traditional contact-based potentiometers are rapidly being replaced by non-contact technologies such as Hall-effect, magneto-resistive, and inductive sensors, which offer greater longevity, higher sensitivity, and resistance to mechanical wear. These non-contact sensors can operate reliably in harsh automotive environments, including extreme temperatures, vibrations, and exposure to contaminants like oil and dust - making them suitable for both internal combustion engine (ICE) vehicles and electric vehicles (EVs). Additionally, multi-axis steering sensors are emerging to capture a broader range of motion and enable more sophisticated vehicle responses. Innovations in miniaturization and packaging have made it easier to embed steering sensors directly into steering columns, racks, or integrated steering modules without compromising space or design flexibility. At the same time, advancements in signal processing and real-time data transmission enable faster and more accurate communication between sensors and onboard control units, which is critical for time-sensitive ADAS functions like emergency lane keeping and automatic lane centering. The incorporation of digital interfaces such as CAN, SENT, and LIN is enhancing interoperability across vehicle subsystems. Furthermore, with the growing adoption of over-the-air (OTA) software updates, steering sensors are being integrated into a more connected ecosystem that allows for calibration, diagnostics, and firmware upgrades without physical intervention. Machine learning and artificial intelligence are also beginning to influence steering sensor functionality, enabling predictive maintenance, adaptive calibration, and real-time optimization based on driving behavior and road conditions. These innovations are laying the groundwork for next-gen mobility solutions, including Level 4 and Level 5 autonomous vehicles, where steering sensors will need to deliver uncompromised reliability and real-time precision.Why Is the Demand for Steering Sensors Rising Across Vehicle Segments and Regions?

The demand for automotive steering sensors is expanding rapidly across all vehicle categories - ranging from economy cars to luxury models, commercial fleets, and electric vehicles - driven by regulatory compliance, consumer safety expectations, and global automotive trends. In developed markets such as North America, Western Europe, Japan, and South Korea, where ADAS features and electronic steering systems are standard or rapidly becoming standard, steering sensors are indispensable. Government mandates requiring electronic stability control (ESC) and other safety features necessitate the use of accurate steering input data, directly increasing demand for these sensors. Meanwhile, in emerging markets across Asia-Pacific, Latin America, and Eastern Europe, the ongoing shift from hydraulic to electric power steering systems is creating new growth opportunities, particularly as consumers demand more fuel-efficient and technologically advanced vehicles. OEMs are responding by integrating steering sensors into compact cars, crossovers, and commercial vehicles to improve drivability and meet rising expectations for safety and comfort. The rise of shared mobility services and autonomous shuttles is also contributing to this growth, as fleet operators prioritize sensor-based solutions for route optimization, predictive maintenance, and occupant safety. Additionally, electrification trends are pushing steering systems to become more integrated, efficient, and modular - characteristics that require steering sensors with higher precision and seamless compatibility. As global vehicle architectures converge around scalable, electronics-heavy platforms, the role of steering sensors becomes even more pronounced. Consumers are also showing interest in personalization and adaptive driving experiences, where steering responsiveness and feel can be digitally adjusted based on driving modes - again relying heavily on high-performance steering sensors. These converging factors are ensuring strong, sustained demand for steering sensors across both established and emerging automotive markets.What Factors Are Fueling the Growth of the Global Automotive Steering Sensors Market?

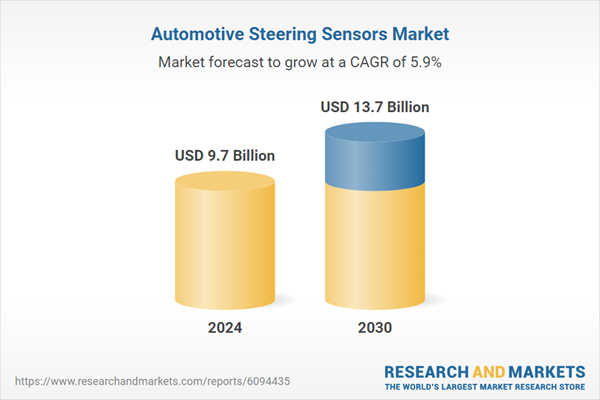

The growth in the automotive steering sensors market is driven by multiple intersecting factors, including the evolution of electronic steering systems, increasing adoption of driver-assistance features, stringent safety regulations, and the acceleration of vehicle electrification. The shift from hydraulic to electric power steering across the automotive industry is one of the primary drivers, as EPS systems depend on precise steering angle and torque inputs to function effectively. Moreover, as automakers race to achieve higher safety ratings and comply with regulations such as the European Union's General Safety Regulation (GSR) or NHTSA mandates, the implementation of ADAS features like lane departure warning, automatic lane keeping, and hands-off detection has become more widespread - all of which require robust steering sensor input. The ongoing electrification of vehicles, including battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and fuel cell electric vehicles (FCEVs), is also contributing to increased demand for sensors that can support steer-by-wire systems and optimize battery usage through intelligent control of steering components. OEMs are investing in integrated steering modules that house multiple sensors for redundancy and performance assurance, particularly for autonomous vehicle development, where fault tolerance is critical. Meanwhile, growing consumer awareness around vehicle safety, comfort, and technological sophistication is pushing automakers to enhance driving feel and responsiveness through smart steering systems. From a manufacturing perspective, the expansion of global production facilities - especially in China, India, and Southeast Asia - is enabling cost-effective sensor deployment in high-volume vehicle segments. Additionally, collaborations between Tier 1 suppliers, semiconductor firms, and AI developers are accelerating innovation cycles and improving sensor functionality. With the automotive industry's growing dependence on precision electronics and data-driven decision-making, steering sensors have become central to achieving the future vision of safe, efficient, and autonomous mobility - ensuring robust growth for the sector well into the next decade.Report Scope

The report analyzes the Automotive Steering Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Sensor Type (Health Monitoring System Sensors, Torque Sensors, Intelligent Multi-Functional Sensors, Position Sensors / Angle Sensors, Other Sensor Types); Technology (Contacting Technology, Magnetic Technology); End-Use (Passenger Cars End-Use, Light Commercial Vehicles End-Use, Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Health Monitoring Sensors segment, which is expected to reach US$4.8 Billion by 2030 with a CAGR of a 5.7%. The Torque Sensors segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.6 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Steering Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Steering Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Steering Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adler Pelzer Group, Ashimori Industry Co., Ltd., Autoheatshield, BOS GmbH & Co. KG, Brica by Munchkin and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Automotive Steering Sensors market report include:

- Alps Alpine Co., Ltd.

- Analog Devices, Inc.

- Aptiv PLC

- Bosch GmbH

- Continental AG

- CTS Corporation

- Delphi Technologies (now part of BorgWarner Inc.)

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Hitachi Metals

- Honeywell International Inc.

- Infineon Technologies AG

- Jopp Group

- Johnson Electric

- Löwe Automobil

- Mando Corporation

- Melexis NV

- Methode Electronics Inc.

- NXP Semiconductors N.V.

- Sensata Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alps Alpine Co., Ltd.

- Analog Devices, Inc.

- Aptiv PLC

- Bosch GmbH

- Continental AG

- CTS Corporation

- Delphi Technologies (now part of BorgWarner Inc.)

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Hitachi Metals

- Honeywell International Inc.

- Infineon Technologies AG

- Jopp Group

- Johnson Electric

- Löwe Automobil

- Mando Corporation

- Melexis NV

- Methode Electronics Inc.

- NXP Semiconductors N.V.

- Sensata Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.7 Billion |

| Forecasted Market Value ( USD | $ 13.7 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |