Global B2B2C Insurance Market - Key Trends & Drivers Summarized

Why Is the B2B2C Insurance Model Disrupting Traditional Insurance Distribution?

The B2B2C (Business-to-Business-to-Consumer) insurance model is redefining how insurance products are delivered and consumed, breaking away from traditional agent-based distribution by embedding coverage into broader consumer ecosystems. In this model, insurers partner with third-party businesses - such as retailers, e-commerce platforms, fintechs, automakers, telecom companies, and travel agencies - to offer insurance products directly to end consumers at the point of sale or service. This embedded approach enables seamless, context-relevant insurance offerings that are tightly integrated into everyday purchases or experiences. For example, purchasing a smartphone might come bundled with device protection coverage, or booking a flight might include optional travel insurance, all powered by a behind-the-scenes insurer. This not only simplifies the customer journey but also increases conversion rates, as the insurance is presented at the moment of need with minimal friction. Moreover, the B2B2C model allows insurers to access large customer bases without incurring high customer acquisition costs, while distribution partners benefit from added revenue streams and enhanced customer loyalty. By blending the agility of digital platforms with the security of traditional underwriting, B2B2C insurance is disrupting legacy models and positioning itself as a vital strategy for insurers looking to scale and stay relevant in an increasingly digital economy.How Are Digital Platforms and APIs Powering the Growth of B2B2C Insurance?

Digital technology is the backbone of the B2B2C insurance model, enabling real-time product integration, customization, and scalability across diverse ecosystems. APIs (Application Programming Interfaces) are particularly crucial, allowing insurers to embed their services directly into partner platforms - whether it's an e-commerce checkout page, a banking app, or a car dealership CRM. This API-driven integration facilitates automated underwriting, real-time pricing, seamless policy issuance, and instant claims processing, all while keeping the user experience smooth and consistent. Insurers can now offer microinsurance, parametric policies, and pay-as-you-go models, dynamically adjusting based on user behavior, purchase history, or geolocation data provided by the platform partner. Data analytics and AI also play a significant role, enabling insurers to personalize offers, assess risks more accurately, and identify the most opportune moments to engage customers. For distribution partners, embedded insurance via APIs creates an opportunity to offer added value without having to manage the complexities of insurance regulation or claims servicing. The speed and flexibility afforded by these digital tools are helping insurers move away from static, one-size-fits-all policies and toward dynamic, modular products tailored to each customer journey. As digital transformation accelerates across industries, the B2B2C insurance model, powered by APIs and cloud-based architectures, is unlocking new revenue channels and redefining the future of insurance distribution.Why Is Demand for B2B2C Insurance Surging Across Key Consumer-Centric Sectors?

The surge in demand for B2B2C insurance is closely tied to evolving consumer behavior, rising digital commerce, and the need for contextual, value-added services across multiple industries. In retail and e-commerce, embedded insurance is being used to protect purchases - ranging from electronics and apparel to furniture - giving consumers peace of mind while creating loyalty for the retailer. In the automotive industry, B2B2C models are driving the adoption of bundled insurance with vehicle sales, leasing contracts, or ride-sharing platforms, offering coverage for drivers, passengers, and vehicles alike. In the travel and hospitality sector, booking platforms are increasingly integrating trip protection, cancellation coverage, and medical travel insurance into their customer workflows. The financial services industry is another significant growth area, with banks, fintechs, and digital wallets offering insurance products such as credit protection, cyber insurance, and health microinsurance as part of their value proposition. Mobile network operators and device manufacturers are tapping into B2B2C insurance to provide mobile phone insurance and extended warranties. These partnerships allow insurers to tap into highly engaged user bases while the distribution partners benefit from higher retention and ancillary revenues. The model's scalability and relevance to consumer needs are prompting its adoption in developing and developed markets alike, especially where insurance penetration remains low but mobile and internet usage is high. As convenience and personalization become defining traits of customer experience, the demand for frictionless, embedded insurance offerings is expected to keep rising across every consumer-facing industry.What Forces Are Driving the Continued Growth of the B2B2C Insurance Market Worldwide?

The growth in the global B2B2C insurance market is driven by a convergence of technological, strategic, demographic, and behavioral factors reshaping how insurance is bought and sold. One of the primary drivers is the shift in consumer expectations - modern customers value convenience, speed, and personalization, all of which the B2B2C model is designed to deliver through embedded, just-in-time offerings. The proliferation of digital platforms and e-commerce ecosystems provides insurers with expansive and ready-made distribution networks, significantly lowering customer acquisition costs and improving access to untapped market segments. Additionally, the rise of gig economy platforms, digital nomadism, and short-term service consumption is encouraging insurers to develop flexible, bite-sized insurance products that fit seamlessly into everyday transactions. Regulatory shifts in favor of open finance and digital onboarding - particularly in Asia and Europe - are also making it easier for insurers and third-party platforms to collaborate in compliant and scalable ways. Strategic alliances between insurtechs, traditional carriers, and ecosystem partners are accelerating product innovation and geographic reach. Meanwhile, increased venture capital funding in the embedded insurance space is fueling R&D and expansion efforts. Moreover, insurers are leveraging real-time data analytics to create usage-based and risk-adjusted pricing models that deliver better value for consumers while improving loss ratios for providers. These forces - combined with the rising financial inclusion in emerging markets and the need for diversified revenue models in competitive industries - are ensuring that the B2B2C insurance market continues to evolve as a dominant force in the global insurance ecosystem.Report Scope

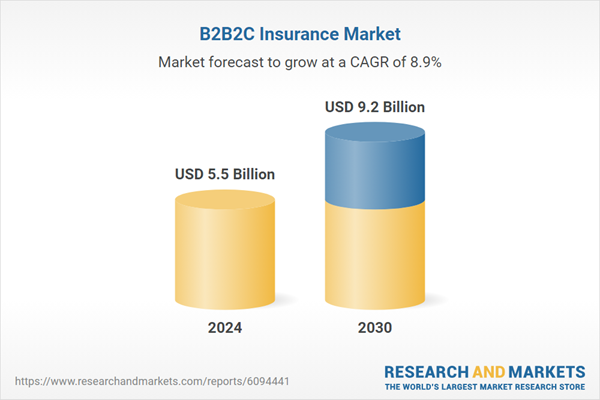

The report analyzes the B2B2C Insurance market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Insurance (Life Insurance, Non-Life Insurance); Organization Size (Large Enterprises, SMEs); Deployment (Online Deployment, Offline Deployment).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Life Insurance segment, which is expected to reach US$6.6 Billion by 2030 with a CAGR of a 10.3%. The Non-Life Insurance segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global B2B2C Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global B2B2C Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global B2B2C Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amdocs Limited, América Móvil, AT&T Inc., BT Group plc, Cellnex Telecom and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this B2B2C Insurance market report include:

- Aditya Birla Group

- Afficiency

- Allianz SE

- Assicurazioni Generali S.p.A.

- Aviva plc

- Bajaj Allianz Life Insurance Co.

- Berkshire Hathaway Inc.

- Bolttech Management Limited

- BridgeNet Insurance

- Bsurance GmbH

- China Life Insurance Group

- DriveWealth LLC

- Edelweiss General Insurance Co.

- ICICI Lombard General Insurance

- Inclusivity Solutions

- Japan Post Holdings Co., Ltd.

- Munich Re Group

- Prudential Financial Inc.

- Tata-AIG General Insurance Co.

- Zurich Insurance Group Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aditya Birla Group

- Afficiency

- Allianz SE

- Assicurazioni Generali S.p.A.

- Aviva plc

- Bajaj Allianz Life Insurance Co.

- Berkshire Hathaway Inc.

- Bolttech Management Limited

- BridgeNet Insurance

- Bsurance GmbH

- China Life Insurance Group

- DriveWealth LLC

- Edelweiss General Insurance Co.

- ICICI Lombard General Insurance

- Inclusivity Solutions

- Japan Post Holdings Co., Ltd.

- Munich Re Group

- Prudential Financial Inc.

- Tata-AIG General Insurance Co.

- Zurich Insurance Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 363 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 9.2 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |