Global Beta-Lactoglobulin Protein Market - Key Trends & Drivers Summarized

Why Is Beta-Lactoglobulin Protein Gaining Prominence Across Nutrition and Functional Food Sectors?

Beta-lactoglobulin protein, the primary whey protein found in bovine milk, is increasingly gaining attention as a functional and nutritional powerhouse, widely used across sports nutrition, dietary supplements, infant formulas, and medical foods. This globular protein accounts for approximately 50-60% of total whey protein and boasts a complete amino acid profile, particularly rich in branched-chain amino acids (BCAAs) such as leucine, isoleucine, and valine - key building blocks for muscle synthesis, repair, and recovery. Its high biological value, excellent digestibility, and rapid absorption make it highly sought-after by athletes, fitness enthusiasts, and individuals pursuing protein-rich diets. Moreover, beta-lactoglobulin's ability to bind and transport small hydrophobic molecules, such as vitamins and fatty acids, adds to its functional appeal in health formulations. In the food and beverage industry, it plays a critical role as a gelling, foaming, and emulsifying agent, enhancing texture, stability, and mouthfeel in products such as protein bars, shakes, yogurts, and meal replacements. With consumer demand shifting toward clean-label, protein-fortified, and performance-driven products, beta-lactoglobulin has emerged as a preferred ingredient due to its versatility, nutritional density, and low allergenicity compared to casein. The ongoing global emphasis on high-protein diets - fueled by health awareness, aging populations, and rising rates of obesity and muscle degeneration - is further cementing beta-lactoglobulin's importance in the evolving landscape of food technology and human nutrition.How Are Technological Innovations Elevating the Quality and Applicability of Beta-Lactoglobulin?

Technological advancements in dairy processing, protein isolation, and functional food formulation are dramatically enhancing the purity, bioactivity, and application range of beta-lactoglobulin protein. Ultrafiltration, microfiltration, ion-exchange chromatography, and enzymatic hydrolysis are now commonly employed to extract and refine beta-lactoglobulin from whey, allowing manufacturers to produce highly concentrated isolates and hydrolysates tailored to specific end uses. These techniques not only increase protein yield and digestibility but also reduce potential allergenic responses by removing or modifying immunogenic epitopes. Enzymatic hydrolysis, in particular, helps break down beta-lactoglobulin into bioactive peptides with specific health benefits such as antihypertensive, antioxidant, and immune-modulating effects - creating opportunities in the functional and medical nutrition sectors. Spray-drying and nanoencapsulation technologies are also improving shelf stability and solubility, making it easier to incorporate beta-lactoglobulin into powdered drink mixes, clinical nutrition blends, and even ready-to-drink beverages. Meanwhile, innovations in protein texturization and ingredient blending are allowing manufacturers to mask its natural flavor and integrate it seamlessly into culinary applications. Clean-label product development has also led to demand for non-GMO, hormone-free, and antibiotic-free sources of beta-lactoglobulin, prompting dairy producers to adopt more sustainable and traceable sourcing practices. With these technologies, beta-lactoglobulin is evolving from a commodity byproduct of cheese production into a high-value, functional ingredient with broad market appeal and enhanced consumer benefits.What Consumer Trends and End-Use Markets Are Driving Demand for Beta-Lactoglobulin?

The expanding market for beta-lactoglobulin protein is being driven by a dynamic shift in consumer preferences and the growth of high-protein applications across multiple sectors. In sports and active lifestyle nutrition, beta-lactoglobulin's rapid absorption and rich BCAA content make it ideal for post-workout recovery formulas, muscle-building shakes, and endurance-boosting blends. Professional athletes, bodybuilders, and recreational gym-goers alike are seeking performance-oriented supplements that deliver immediate nutritional benefits - needs well met by beta-lactoglobulin. In the broader health and wellness market, middle-aged and elderly consumers are increasingly turning to protein supplementation to combat sarcopenia (age-related muscle loss), improve mobility, and support metabolic health. Beta-lactoglobulin is also gaining favor in pediatric and infant nutrition, where its structural similarity to human milk whey protein makes it suitable for infant formulas and follow-on milks. In clinical nutrition, it is used to support patients with chronic illnesses, malnutrition, or post-surgical recovery due to its digestibility and high nutrient density. The functional food and beverage sector is another fast-growing avenue, with beta-lactoglobulin being used in fortified snacks, dairy drinks, smoothies, and protein-enriched baked goods. Regional trends are also playing a role - while North America and Europe remain leading markets, Asia-Pacific is experiencing rapid growth due to rising income levels, health awareness, and the popularity of Western-style fitness and dietary habits. Whether it's through performance supplementation, wellness-focused formulations, or convenience-oriented foods, beta-lactoglobulin is meeting a wide spectrum of consumer needs, fueling demand across demographics and regions.What Is Fueling the Growth in the Global Beta-Lactoglobulin Protein Market?

The growth in the global beta-lactoglobulin protein market is driven by several interlinked factors spanning consumer demand, nutritional science, food innovation, and industrial scalability. At the forefront is the global protein boom, where consumers are actively seeking high-quality, complete protein sources to support their physical, metabolic, and cognitive health. Beta-lactoglobulin stands out for its superior amino acid profile, rapid bioavailability, and diverse functional benefits, making it highly desirable across the food, nutraceutical, and pharmaceutical industries. Continued scientific validation of its health-promoting properties - ranging from muscle protein synthesis to immune modulation - is enhancing consumer confidence and product integration. Advances in dairy processing and whey fractionation are making beta-lactoglobulin extraction more efficient, cost-effective, and environmentally sustainable, while also improving consistency and scalability for commercial use. Furthermore, the rise of personalized nutrition and dietary customization is creating opportunities for beta-lactoglobulin to be formulated into targeted products for fitness, aging, pediatrics, and clinical care. Strategic collaborations between dairy cooperatives, biotech firms, and food manufacturers are accelerating innovation pipelines and broadening distribution channels. Regulatory clarity and safety assessments are also supporting market expansion, especially in regions adopting stricter food labeling and quality standards. E-commerce, health influencers, and digital marketing are bringing beta-lactoglobulin products to wider audiences, further boosting global visibility and consumer adoption. As these market forces continue to align, beta-lactoglobulin is evolving into a cornerstone ingredient for modern nutrition, poised for sustained growth as part of the next generation of functional and performance-based protein products.Report Scope

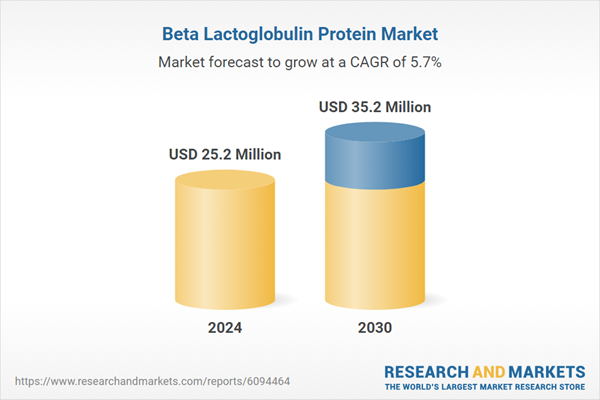

The report analyzes the Beta Lactoglobulin Protein market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Form (Dry Form, Liquid Form); Distribution Channel (Supermarkets / Hypermarkets, Drugstores & Pharmacies, Specialty Stores, Online Distribution Channel, Other Distribution Channels); Application (Sports Nutrition & Dietary Supplements Application, Food & Beverages Processing Application, Medical & Pharmaceuticals Application, Infant Formula Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Form segment, which is expected to reach US$25.3 Million by 2030 with a CAGR of a 6.7%. The Liquid Form segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.9 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $7.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Beta Lactoglobulin Protein Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Beta Lactoglobulin Protein Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Beta Lactoglobulin Protein Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazing Nutrition, Best Naturals, BioBotanical Research Inc., Dr. Martin's Nutrition, Gaia Herbs and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Beta Lactoglobulin Protein market report include:

- Agropur Cooperative

- Alfa Chemistry

- AMCO Proteins

- Arla Foods amba

- BOC Sciences

- Cargill Inc.

- Davisco Foods International, Inc.

- Farbest Brands

- Fonterra Co-operative Group Limited

- FrieslandCampina N.V.

- Glanbia plc

- Hilmar Ingredients

- Kerry Group plc

- Lactalis Ingredients

- Merck KGaA

- MuscleBlaze

- Nutrimed Healthcare Pvt. Ltd.

- Saputo Inc.

- Shanghai Aladdin Biochemical Technology Co. Ltd.

- Sigma-Aldrich Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agropur Cooperative

- Alfa Chemistry

- AMCO Proteins

- Arla Foods amba

- BOC Sciences

- Cargill Inc.

- Davisco Foods International, Inc.

- Farbest Brands

- Fonterra Co-operative Group Limited

- FrieslandCampina N.V.

- Glanbia plc

- Hilmar Ingredients

- Kerry Group plc

- Lactalis Ingredients

- Merck KGaA

- MuscleBlaze

- Nutrimed Healthcare Pvt. Ltd.

- Saputo Inc.

- Shanghai Aladdin Biochemical Technology Co. Ltd.

- Sigma-Aldrich Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 379 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.2 Million |

| Forecasted Market Value ( USD | $ 35.2 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |