Global Beverage Cans Market - Key Trends & Drivers Summarized

Why Are Beverage Cans Experiencing a Global Resurgence Across All Drink Categories?

Beverage cans are witnessing a significant resurgence worldwide, driven by their practicality, portability, and rising consumer demand for sustainable, on-the-go packaging solutions. While cans have long been staples for beer and carbonated soft drinks, they are now rapidly expanding into emerging beverage categories like flavored water, cold brew coffee, energy drinks, hard seltzers, kombucha, and ready-to-drink (RTD) cocktails. The modern consumer prioritizes convenience and functionality, and cans offer lightweight, shatterproof portability alongside fast chilling and longer shelf life, making them ideal for active, urban lifestyles. Furthermore, manufacturers and brands are increasingly choosing aluminum cans over plastic and glass due to their superior recyclability and reduced environmental impact. With consumers paying more attention to eco-conscious choices, cans - particularly those made from recycled aluminum - are resonating with younger, environmentally aware audiences. Innovations in can design, such as resealable lids, slim and sleek formats, and eye-catching 360-degree printing, are also enhancing shelf appeal and marketing opportunities. Cans serve not only as a protective vessel but as a branding canvas that enhances visibility in retail spaces. Events like music festivals, outdoor gatherings, and sports stadiums are favoring cans due to their safety and ease of disposal. As a result, beverage companies across the globe are increasingly adopting can packaging as a way to align with changing consumer habits, regulatory pressures, and the drive toward circular economies.How Are Technological Innovations Transforming the Beverage Can Industry?

Technological innovation is playing a critical role in revitalizing the beverage can industry by improving manufacturing efficiency, enhancing sustainability, and enabling greater customization. Modern can production lines are capable of incredibly high speeds, producing thousands of units per minute while consuming less energy and water than ever before. Advances in digital printing and direct-to-can technology are giving brands the ability to produce small batches with personalized or regional designs, appealing to niche markets and promotional campaigns without incurring the high costs of traditional mass printing. At the materials level, efforts are underway to produce ultra-lightweight cans that reduce raw material use without compromising durability, which also translates into lower shipping costs and smaller carbon footprints. The development of BPA-free internal linings has addressed previous health concerns and expanded can usage into new beverage segments like milk-based drinks, juices, and organic products. Coatings that prevent flavor migration and maintain product integrity are enabling longer shelf life and better taste retention. Reclosable can innovations and dual-chamber designs are also opening up new opportunities in the functional and energy drink space, catering to consumer preferences for portion control and multi-use containers. Automated vision systems, robotics, and AI are being integrated into quality control and packaging lines, improving defect detection and reducing waste. On the sustainability front, advancements in closed-loop recycling systems and partnerships with recycling firms are strengthening aluminum recovery rates. As technology continues to push the boundaries of performance, the beverage can is evolving from a static container to a dynamic, high-tech packaging solution ready to meet modern demands.What Regional and Consumer Trends Are Driving Demand for Beverage Cans?

Global demand for beverage cans is being shaped by distinct regional consumption patterns, evolving lifestyles, and generational preferences that reflect diverse cultural and economic drivers. In North America and Europe, consumers are increasingly gravitating toward beverages in cans due to rising environmental awareness, the growing popularity of craft beverages, and shifting attitudes toward plastic waste. In these regions, regulatory initiatives - such as bans on single-use plastics and deposit-return schemes - are encouraging the use of aluminum cans, which boast a much higher recycling rate than glass or PET. In the Asia-Pacific region, rapid urbanization, a growing middle class, and the expansion of modern retail channels are fueling demand for canned energy drinks, teas, and juices. Countries like China, Japan, and South Korea are seeing a surge in on-the-go consumption, and consumers in these markets often value compact, aesthetically pleasing, and technologically advanced packaging. Meanwhile, Latin America and the Middle East are embracing canned packaging due to its affordability, durability, and resistance to contamination in hot climates. Across the globe, Gen Z and millennial consumers are key drivers of canned beverage growth, especially in lifestyle and wellness segments like sparkling water, hard kombucha, and protein shakes. These younger demographics value innovation, design, and sustainability - traits that modern beverage cans are well positioned to deliver. In addition, the rise of direct-to-consumer and online grocery channels has made it easier for niche beverage brands to distribute canned products nationally and internationally, enabling greater market reach and diversification. These evolving regional and consumer dynamics are reinforcing beverage cans as a global packaging solution for a new generation of drinkers.What Is Fueling the Growth in the Global Beverage Cans Market?

The growth in the global beverage cans market is driven by a confluence of environmental imperatives, changing consumer behavior, and a rapidly diversifying beverage industry. One of the most powerful growth drivers is the increased awareness of sustainability and the urgent need to reduce single-use plastic waste. Aluminum cans, which are infinitely recyclable and already part of efficient recycling infrastructures in many countries, present a compelling alternative. This aligns with the goals of both governments and eco-conscious brands aiming to meet ESG (environmental, social, and governance) targets and appeal to sustainability-focused consumers. The proliferation of new beverage categories - especially in health, wellness, and indulgence - has created fresh opportunities for can usage, from low-calorie energy drinks and botanical elixirs to craft beers and RTD coffee. The pandemic has also reshaped consumption patterns, with more people choosing single-serve, shelf-stable formats for safety, convenience, and portion control - needs perfectly met by cans. Strategic investments by can manufacturers in expanding production capacity and localizing supply chains are reducing lead times and increasing market responsiveness. Retailers, too, are supporting the growth by offering more shelf space to canned beverages due to their ease of stacking, lower breakage risk, and attractive presentation. Marketing trends, including influencer partnerships, limited-edition packaging, and lifestyle-oriented branding, have further enhanced consumer engagement with canned drinks. Additionally, advancements in material science, logistics, and automation are reducing costs and making canned beverages more economically viable across both developed and emerging markets. As innovation, sustainability, and demand converge, beverage cans are not only reclaiming their relevance - they are poised to become the preferred packaging format in a rapidly evolving global beverage landscape.Report Scope

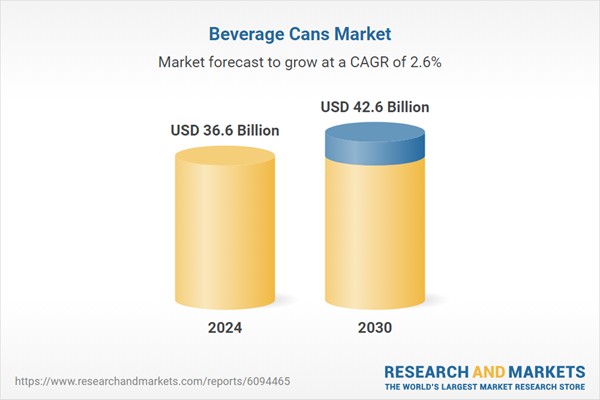

The report analyzes the Beverage Cans market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Aluminum Material, Steel Material); Application (Non-Alcoholic Beverages Application, Alcoholic Beverages Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aluminum Material segment, which is expected to reach US$30.7 Billion by 2030 with a CAGR of a 3%. The Steel Material segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10 Billion in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $8.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Beverage Cans Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Beverage Cans Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Beverage Cans Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agropur Cooperative, Alfa Chemistry, AMCO Proteins, Arla Foods amba, BOC Sciences and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Beverage Cans market report include:

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- Baosteel Metal Co., Ltd.

- Can-One Berhad

- Can-Pack S.A.

- CCL Industries Inc.

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Envases Universales Group

- Hindustan Tin Works Ltd.

- Kian Joo Can Factory Berhad

- Massilly Holding S.A.S.

- Nampak Ltd.

- Orora Limited

- Showa Denko K.K.

- Silgan Holdings Inc.

- Toyo Seikan Group Holdings, Ltd.

- Universal Can Corporation

- Visy Industries Holdings Pty Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- Baosteel Metal Co., Ltd.

- Can-One Berhad

- Can-Pack S.A.

- CCL Industries Inc.

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Envases Universales Group

- Hindustan Tin Works Ltd.

- Kian Joo Can Factory Berhad

- Massilly Holding S.A.S.

- Nampak Ltd.

- Orora Limited

- Showa Denko K.K.

- Silgan Holdings Inc.

- Toyo Seikan Group Holdings, Ltd.

- Universal Can Corporation

- Visy Industries Holdings Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 36.6 Billion |

| Forecasted Market Value ( USD | $ 42.6 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |