Global Biopharmaceutical Processing Equipment and Consumables Market - Key Trends & Drivers Summarized

Why Is Biopharmaceutical Processing Equipment and Consumables at the Core of the Next-Generation Drug Manufacturing Boom?

Biopharmaceutical processing equipment and consumables are at the heart of the rapidly expanding global biopharma industry, enabling the precise, sterile, and scalable production of biologically derived therapeutics such as monoclonal antibodies, vaccines, hormones, cell and gene therapies, and recombinant proteins. Unlike traditional small-molecule drugs, which rely on chemical synthesis, biopharmaceuticals are produced using living organisms, requiring highly controlled environments and specialized bioprocessing systems. This makes the equipment and consumables used - such as bioreactors, chromatography columns, filtration units, sensors, tubing, connectors, and sterile bags - essential for maintaining product integrity, safety, and efficacy throughout the production pipeline. From upstream cell culture and fermentation to downstream purification and fill-finish processes, the need for high-quality, validated, and often single-use technologies is critical. With the rising demand for biologics due to chronic diseases, aging populations, and emerging therapies, manufacturers are expanding capacity and investing in advanced equipment that supports flexibility, rapid scale-up, and contamination-free processing. The COVID-19 pandemic further emphasized the importance of robust bioprocessing infrastructure, driving unprecedented global demand for both capital equipment and disposable consumables to support rapid vaccine and therapeutic manufacturing. Today, biopharmaceutical processing tools are no longer just operational necessities - they are strategic assets powering innovation, speed to market, and competitive advantage across the global life sciences ecosystem.How Are Technological Advancements Revolutionizing Biopharmaceutical Manufacturing Tools and Supplies?

The biopharmaceutical processing equipment and consumables landscape is undergoing a technological transformation that is enhancing efficiency, scalability, and process control across production lines. The shift from traditional stainless-steel systems to single-use technologies (SUTs) is one of the most significant developments, offering flexibility, reduced cleaning validation, lower cross-contamination risks, and faster batch turnover - especially important for multi-product and contract manufacturing facilities. Innovations in disposable bioreactors, pre-sterilized filters, and modular processing units are enabling cost-effective and agile manufacturing setups. Real-time monitoring and automation are also reshaping the industry; modern equipment is now equipped with advanced sensors, PAT (Process Analytical Technology) tools, and IoT integration to allow for continuous data capture, automated control, and predictive maintenance. This is further enhanced by AI and machine learning algorithms that optimize process parameters, detect anomalies early, and reduce batch failures. In downstream processing, high-capacity chromatography systems and novel membrane technologies are improving product yield and purity while minimizing processing time and footprint. Customizable single-use assemblies and closed-system designs are increasingly replacing open configurations, particularly in aseptic operations, to ensure compliance with evolving GMP standards. Additionally, advances in materials science are enhancing the chemical compatibility, leachability profile, and integrity of disposable components. These innovations collectively reduce costs, improve speed to market, and support the move toward continuous biomanufacturing - redefining what's possible in pharmaceutical production.Which Segments and Global Markets Are Leading the Surge in Demand for Biopharmaceutical Equipment and Consumables?

The surge in demand for biopharmaceutical processing equipment and consumables spans across multiple therapeutic segments and global regions, with significant momentum in both established and emerging markets. Monoclonal antibodies continue to dominate biopharmaceutical pipelines, driving demand for upstream and downstream equipment capable of supporting high-titer cell culture and efficient purification. The rapid expansion of cell and gene therapies has introduced new requirements for closed-system, small-volume, and aseptically designed equipment that can handle high-value, patient-specific products. Vaccine production, revitalized by the COVID-19 crisis and sustained by pandemic preparedness initiatives, remains a major driver of demand for single-use bioreactors, filtration assemblies, and cold-chain consumables. Contract Development and Manufacturing Organizations (CDMOs) are emerging as pivotal buyers, given their role in serving multiple clients with varied production needs - making flexible, plug-and-play equipment essential. Geographically, North America leads the market, anchored by the U.S., where a strong biotech ecosystem, early adoption of novel therapies, and significant R&D funding fuel equipment and consumables procurement. Europe follows closely, supported by countries like Germany, Switzerland, and the UK, which boast advanced manufacturing hubs and regulatory clarity. Asia-Pacific is witnessing the fastest growth, driven by increasing biologics production in China, South Korea, India, and Singapore, coupled with government incentives to localize biomanufacturing capabilities. Latin America and the Middle East are emerging regions where improvements in healthcare infrastructure and international partnerships are expanding demand. Across these regions, the push for decentralized, modular, and scalable manufacturing is driving uptake of next-generation tools, making this market globally vital and highly dynamic.What Is Fueling the Growth in the Global Biopharmaceutical Processing Equipment and Consumables Market?

The growth in the global biopharmaceutical processing equipment and consumables market is driven by a confluence of biological therapy expansion, innovation in manufacturing technology, regulatory evolution, and shifting industry economics. Chief among these drivers is the rising global burden of chronic diseases and genetic disorders, which is accelerating the development and approval of complex biologics and personalized therapies. The increasing number of biologics in clinical and commercial pipelines directly translates into higher demand for processing tools capable of meeting diverse production scales and regulatory standards. The push for faster time-to-market is compelling manufacturers to adopt flexible, modular equipment and disposable consumables that minimize setup and validation timelines. Regulatory bodies like the FDA and EMA are increasingly supportive of advanced manufacturing practices, including continuous processing and single-use systems, thereby encouraging industry-wide modernization. Furthermore, the trend toward outsourcing and the growth of CDMOs amplify equipment demand, as these organizations need scalable, GMP-compliant tools to serve multiple clients efficiently. Another major driver is cost optimization - single-use systems reduce water, energy, and cleaning costs, making them attractive not only for large pharma but also for emerging biotech firms. Sustainability and risk mitigation also play crucial roles; closed-system, disposable technologies reduce contamination risk and ensure product safety, even in multiproduct facilities. Additionally, increased investments in biomanufacturing facilities, spurred by public health concerns and government funding, are creating new opportunities for equipment suppliers and consumables manufacturers. Altogether, these factors are reinforcing the biopharmaceutical processing market as a central pillar of the global healthcare infrastructure - one that will continue to expand as biologics take a larger role in modern medicine.Report Scope

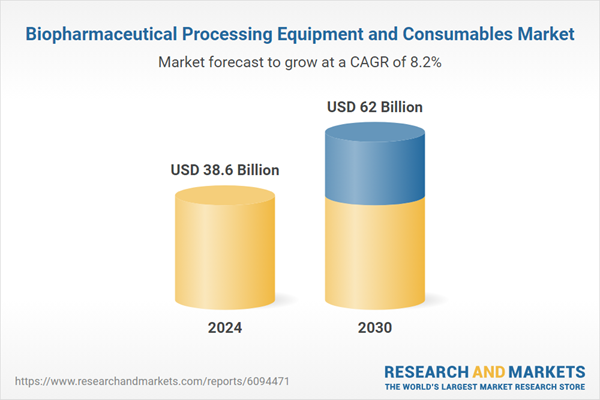

The report analyzes the Biopharmaceutical Processing Equipment and Consumables market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Filtration Systems, Chromatography Equipment & Consumables, Bioreactors, Cell Culture Products, Bioprocessing Containers, Biosafety Cabinets, Other Types); Application (Commercial Bioproduction Application, Research Bioproduction Application); End-Use (Pharma & Biopharma Companies End-Use, Contract Development & Manufacturing Organizations End-Use, Academic & Research Institutes End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Filtration Systems segment, which is expected to reach US$19.5 Billion by 2030 with a CAGR of a 10.7%. The Chromatography Equipment & Consumables segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.5 Billion in 2024, and China, forecasted to grow at an impressive 13.2% CAGR to reach $13.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biopharmaceutical Processing Equipment and Consumables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biopharmaceutical Processing Equipment and Consumables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biopharmaceutical Processing Equipment and Consumables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Biomass Secure Power Inc., Concord Blue, Cosan, Drax Group plc, Energex Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Biopharmaceutical Processing Equipment and Consumables market report include:

- 3M Company

- Agilent Technologies, Inc.

- Asahi Kasei Corporation

- Bio-Rad Laboratories, Inc.

- Bosch Packaging Technology

- Corning Incorporated

- Danaher Corporation

- Eppendorf AG

- Fujifilm Holdings Corporation

- General Electric Company

- Heidolph Instruments GmbH

- Krones AG

- Lonza Group AG

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- Shimadzu Corporation

- Solaris Biotechnology Srl

- Stevanato Group

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Agilent Technologies, Inc.

- Asahi Kasei Corporation

- Bio-Rad Laboratories, Inc.

- Bosch Packaging Technology

- Corning Incorporated

- Danaher Corporation

- Eppendorf AG

- Fujifilm Holdings Corporation

- General Electric Company

- Heidolph Instruments GmbH

- Krones AG

- Lonza Group AG

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- Shimadzu Corporation

- Solaris Biotechnology Srl

- Stevanato Group

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 38.6 Billion |

| Forecasted Market Value ( USD | $ 62 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |