Global Aerospace and Defense EMI Shielding Market - Key Trends & Drivers Summarized

Why Is EMI Shielding Gaining Strategic Importance Across Aerospace and Defense Systems, Mission-Critical Communications, and Avionics Integrity?

Electromagnetic interference (EMI) shielding is a vital component of aerospace and defense systems, ensuring the protection and uninterrupted performance of sensitive electronic equipment in electromagnetically dense environments. As military and aerospace platforms become more digitized and reliant on high-frequency electronics ranging from radar and navigation systems to advanced avionics and electronic warfare suites the potential for electromagnetic disturbances has significantly increased. EMI shielding mitigates this risk by preventing cross-talk, data corruption, signal degradation, and equipment malfunction, particularly in mission-critical applications.In both commercial and defense aerospace segments, growing integration of fly-by-wire systems, communication antennas, satellite payloads, and electronic sensors has heightened vulnerability to EMI. Shielding solutions are essential to ensure system stability, passenger safety, and regulatory compliance with strict electromagnetic compatibility (EMC) standards. The deployment of next-generation aircraft and spacecraft further amplifies the need for effective EMI containment, especially as power densities rise and form factors shrink.

Defense applications present additional challenges due to exposure to high-power electromagnetic pulses (EMP), directed energy weapons, and complex signal environments during military operations. Here, EMI shielding is critical not just for reliability, but also for survivability and operational effectiveness. Shielded enclosures, conductive coatings, gaskets, and cable assemblies form a layered defense across platforms such as fighter jets, naval systems, armored vehicles, and satellite ground control stations.

How Are Advanced Materials, Miniaturization, and 5G/High-Frequency Systems Driving Innovation in EMI Shielding Solutions?

Advances in materials science are reshaping EMI shielding capabilities. Lightweight conductive polymers, carbon-based composites, metalized fabrics, and nanomaterials such as graphene and carbon nanotubes are being incorporated into shielding solutions to meet weight and performance demands of aerospace-grade systems. These materials offer high attenuation across wide frequency bands while minimizing additional load, making them suitable for both structural integration and portable electronics protection.As systems become smaller and denser particularly in UAVs, missiles, and space payloads traditional shielding methods are giving way to integrated and form-fitting solutions. Shielding films, conformal coatings, and co-molded housings are being designed to fit seamlessly into compact assemblies without compromising EMI containment. Additive manufacturing techniques are also enabling the production of custom EMI shielding components with complex geometries and optimized electromagnetic behavior.

The emergence of 5G, high-speed data transfer systems, and advanced RF communications in both civilian aerospace and defense communications has shifted focus toward shielding solutions capable of attenuating millimeter-wave frequencies and reducing latency-caused interference. As more systems operate in overlapping spectrums, the need for EMI shielding that accommodates broader and higher-frequency ranges has intensified. Solutions are being developed to handle the thermal load, signal fidelity, and electromagnetic resilience required by these advanced systems.

Which Application Areas, Program Investments, and Regional Markets Are Propelling Growth in Aerospace and Defense EMI Shielding?

Primary applications span electronic enclosures, cables and connectors, radar systems, avionics modules, ground control equipment, and weapon systems. Growth is particularly strong in programs involving the development of stealth aircraft, next-gen fighter jets, missile defense systems, and small satellite constellations. EMI shielding also supports life-support systems, power electronics, and ground-based mobile command units each requiring robust EMI protection in dynamic and high-noise environments.Defense modernization programs globally are accelerating the adoption of EMI shielding across air, sea, space, and land platforms. National security imperatives are driving funding into resilient electronics infrastructure, with specific allocations for EMC and EMP protection. In commercial aviation, OEMs and Tier 1 suppliers are integrating shielding early into design and development stages to meet certification requirements and enhance safety in digital cockpits and fly-by-wire systems.

North America remains the largest regional market, supported by advanced aerospace R&D, established defense manufacturing hubs, and a dense concentration of electronic warfare platforms. Europe is a strong player, with ongoing investments in civil aviation innovation and pan-European defense collaboration. Asia-Pacific is witnessing rapid growth, driven by military expansion, domestic aircraft programs, and rising investments in indigenous space infrastructure, particularly in China, India, South Korea, and Japan.

What Strategic Role Will EMI Shielding Play in Enabling Resilient Electronic Infrastructure, Spectrum Superiority, and Survivability in Contested Electromagnetic Domains?

EMI shielding is becoming a strategic enabler of electronic dominance, ensuring that aerospace and defense platforms can operate reliably, securely, and effectively in highly congested and contested electromagnetic environments. As warfare and communications become increasingly spectrum-dependent, shielding acts as both a defensive mechanism and an operational guarantee protecting signal clarity, sensor data, and mission-critical decision systems.Looking ahead, EMI shielding will not just be about containment but will evolve toward intelligent, adaptive systems that monitor electromagnetic conditions and adjust protection levels in real time. These innovations will be crucial for dynamic battlefield environments, autonomous systems, and multi-domain operations where electromagnetic threats are unpredictable and pervasive. Integration with AI-powered signal monitoring and digital twin-based testing environments will further enhance the strategic utility of EMI shielding.

As aerospace and defense systems push deeper into digital complexity and spectrum convergence, could EMI shielding evolve from a passive safeguard to an active enabler of electronic sovereignty, mission readiness, and spectrum superiority in the age of electronic warfare?

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gaskets segment, which is expected to reach US$437.5 Million by 2030 with a CAGR of a 7.7%. The Cable Over Braids segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $312.0 Million in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $333.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aerospace and Defense EMI Shielding Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aerospace and Defense EMI Shielding Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aerospace and Defense EMI Shielding Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

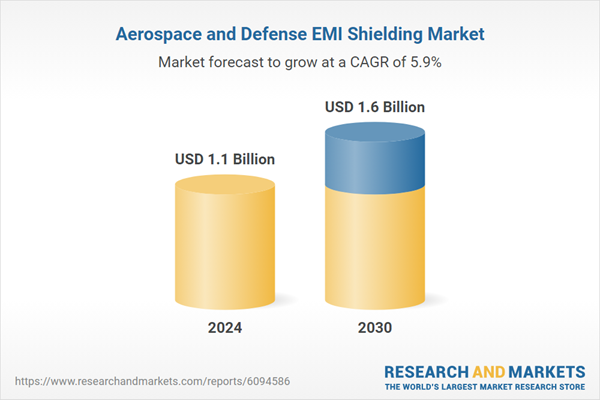

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Amphenol Corporation, Chemtronics (Techspray), Cobham plc, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Aerospace and Defense EMI Shielding market report include:

- 3M Company

- Amphenol Corporation

- Chemtronics (Techspray)

- Cobham plc

- DuPont de Nemours, Inc.

- Elantas PDG

- Honeywell International

- Hubbell Incorporated

- Laird Performance Materials

- LEMO SA

- Molex, LLC

- Parker Hannifin Corporation

- Rogers Corporation

- Rohde & Schwarz GmbH

- Saint-Gobain S.A.

- SCHURTER AG

- TE Connectivity Ltd.

- The Chemours Company

- 3M Company

- W. L. Gore & Associates

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Amphenol Corporation

- Chemtronics (Techspray)

- Cobham plc

- DuPont de Nemours, Inc.

- Elantas PDG

- Honeywell International

- Hubbell Incorporated

- Laird Performance Materials

- LEMO SA

- Molex, LLC

- Parker Hannifin Corporation

- Rogers Corporation

- Rohde & Schwarz GmbH

- Saint-Gobain S.A.

- SCHURTER AG

- TE Connectivity Ltd.

- The Chemours Company

- 3M Company

- W. L. Gore & Associates

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |