Global Aerospace Sheets Market - Key Trends & Drivers Summarized

Why Are Aerospace Sheets Gaining Strategic Importance Across Airframe Construction, Lightweight Design, and Lifecycle Maintenance Programs?

Aerospace sheets are flat-rolled metal products - commonly aluminum, titanium, and specialty alloys - used extensively in the fabrication of aircraft structures and subsystems. Their role is foundational across fuselage skins, wing surfaces, fairings, floor panels, and interior structural elements. The aerospace industry's ongoing focus on weight reduction, fuel efficiency, and extended service life is driving increased reliance on sheet materials engineered for optimal strength-to-weight ratios, fatigue resistance, and corrosion performance under demanding operating conditions.Unlike standard industrial sheet metal, aerospace-grade sheets must comply with stringent specifications covering material purity, mechanical properties, and traceability. These requirements are particularly critical in load-bearing zones where structural integrity cannot be compromised. Additionally, aerospace sheets must demonstrate consistent performance across temperature extremes, high G-loads, and environmental exposure - making alloy selection and surface treatment processes essential to material qualification.

With rising aircraft production rates, especially for narrow-body platforms, and an expanding global fleet requiring ongoing maintenance, aerospace sheets are in high demand both for new builds and aftermarket repairs. Their ease of forming, compatibility with automated manufacturing, and availability in a wide range of gauges and alloys make them versatile materials for high-throughput manufacturing as well as on-site field applications.

How Are Alloy Innovations, Process Advancements, and Sustainability Goals Shaping the Evolution of Aerospace Sheet Materials?

Material innovation is redefining the capabilities of aerospace sheets. High-performance aluminum alloys such as 2024, 7075, and 7050 remain widely used due to their balance of strength and machinability, but newer aluminum-lithium (Al-Li) alloys are gaining favor for their lower density, higher stiffness, and improved fatigue resistance. Titanium sheets, particularly Grade 5 (Ti-6Al-4V), are preferred for hot zones, pressure-sensitive structures, and military airframes due to their superior strength-to-weight and corrosion-resistant properties.Advanced forming and heat treatment technologies are enabling tighter tolerances and more complex component geometries while preserving material integrity. Aerospace sheets are increasingly processed through precision rolling, solution heat treating, and aging processes to enhance yield strength and reduce residual stress. These process advancements are supported by real-time quality control, grain structure analysis, and digital documentation for full traceability - critical to meeting AS9100, AMS, and NADCAP standards.

Sustainability is emerging as a key priority across aerospace supply chains. OEMs and tier suppliers are placing greater emphasis on material efficiency, offcut recycling, and sourcing from environmentally responsible mills. The recyclability of aluminum sheets positions them favorably in lifecycle emissions assessments, while innovations in forming and nesting reduce waste. Sheet suppliers are also exploring greener production techniques such as low-carbon smelting and closed-loop supply agreements to align with decarbonization goals.

Which Aircraft Platforms, Application Areas, and Regional Markets Are Driving Demand for Aerospace Sheets?

Demand for aerospace sheets is widespread across commercial, military, and business aviation sectors. In commercial aircraft, sheets are heavily used in fuselage and wing structures, especially in single-aisle jets where cost-efficiency and structural lightness are crucial. Wide-body aircraft also utilize sheet materials in both primary and secondary structural zones, including bulkheads, cargo bays, and wing fairings. Business jets and regional aircraft apply sheet metal in cabin interiors, control surfaces, and undercarriage covers to optimize form and weight.Military aircraft platforms such as fighter jets, reconnaissance planes, and transport aircraft require more specialized sheets - often with tailored heat treatments and alloy compositions - for demanding structural and environmental conditions. Additionally, the satellite and space launch vehicle sectors use thin-gauge aluminum and titanium sheets in payload enclosures, reflectors, and structural skins requiring thermal stability and lightweight durability.

North America dominates the aerospace sheets market due to the region's concentration of OEMs, Tier 1 suppliers, and expansive MRO infrastructure. Europe is a strong contributor, driven by Airbus and regional defense aviation activity. Asia-Pacific is emerging as a high-growth market, supported by fleet expansion, indigenous manufacturing programs, and rising MRO demand in China, India, and Southeast Asia. The Middle East and Latin America are building regional aerospace capabilities, creating new opportunities for sheet suppliers aligned with local assembly and repair hubs.

What Strategic Role Will Aerospace Sheets Play in Supporting Scalable Production, Structural Optimization, and Sustainable Aircraft Engineering?

Aerospace sheets are set to remain integral to the industry's transition toward lighter, stronger, and more efficient aircraft. Their versatility, manufacturability, and compatibility with advanced joining, forming, and machining techniques make them indispensable for scaling aircraft production while maintaining design flexibility and cost efficiency. As composite adoption rises, metallic sheets continue to offer unmatched recyclability, field-repairability, and predictability in fatigue performance - traits that remain essential across mission profiles and aircraft types.Future aerospace designs will increasingly rely on hybrid material architectures that combine composite panels with metal substructures, elevating the role of sheet materials in interfacing, thermal shielding, and mechanical load distribution. At the same time, digital twins, predictive maintenance, and modular manufacturing will demand sheet materials that are easier to trace, modify, and certify across multi-platform lifecycles.

As the aerospace sector redefines its priorities around performance, lifecycle cost, and environmental footprint, could aerospace sheets become the agile material solution that bridges legacy structures, modern design, and next-generation flight platforms?

Report Scope

The report analyzes the Aerospace Sheets market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Aircraft Type (Fixed Wing Aircraft Type, Rotary Wing Aircraft Type); Material (Titanium & Alloys Material, Aluminum & Alloys Material, Steel & Alloys Material, Other Materials); End-Use (Commercial Aviation End-Use, Military Aviation End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fixed Wing Aircraft segment, which is expected to reach US$2 Billion by 2030 with a CAGR of a 3.7%. The Rotary Wing Aircraft segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $744.1 Million in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $701.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aerospace Sheets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aerospace Sheets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aerospace Sheets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.M. Castle & Co., Alcoa Corporation, Hadco Metal Trading, HP Alloys, Reliance Metals Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Aerospace Sheets market report include:

- Aleris Corporation

- Allegheny Technologies Incorporated (ATI)

- Aluminum Corporation of China Limited (Chalco)

- Arconic Corporation

- Boeing

- Carpenter Technology Corporation

- Constellium SE

- DuPont

- Hindalco Industries Limited

- Kaiser Aluminum Corporation

- Lockheed Martin

- Magellan Aerospace

- Materion Corporation

- Mitsubishi Heavy Industries

- Norsk Hydro ASA

- Novelis Inc.

- Plascore Incorporated

- Rolled Alloys

- Toray Industries, Inc.

- VSMPO-AVISMA Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aleris Corporation

- Allegheny Technologies Incorporated (ATI)

- Aluminum Corporation of China Limited (Chalco)

- Arconic Corporation

- Boeing

- Carpenter Technology Corporation

- Constellium SE

- DuPont

- Hindalco Industries Limited

- Kaiser Aluminum Corporation

- Lockheed Martin

- Magellan Aerospace

- Materion Corporation

- Mitsubishi Heavy Industries

- Norsk Hydro ASA

- Novelis Inc.

- Plascore Incorporated

- Rolled Alloys

- Toray Industries, Inc.

- VSMPO-AVISMA Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 367 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

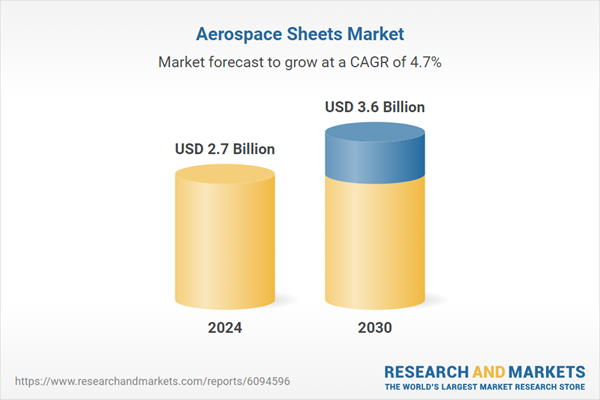

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |