Global Agriculture Technology-as-a-Service Market - Key Trends & Drivers Summarized

Why Is Agriculture Technology-as-a-Service (Agri-TaaS) Reshaping Access to Innovation, Operational Agility, and Input Efficiency Across Farming Models?

Agriculture Technology-as-a-Service (Agri-TaaS) is redefining the way farmers access and deploy advanced tools by shifting capital-intensive technologies - such as precision equipment, satellite imaging, AI-powered analytics, and autonomous machinery - from ownership-based models to subscription-based, pay-per-use, or outcome-linked services. This transition allows producers, especially small- to mid-sized farmers, to utilize cutting-edge digital agriculture solutions without the prohibitive upfront investment or complex integration demands traditionally associated with high-tech farming.Agri-TaaS democratizes innovation by enabling broader access to scalable expertise, real-time monitoring, and data-driven insights across diverse agricultural settings. From drone-enabled crop scouting to remote irrigation management and predictive yield modeling, these services offer operational flexibility and rapid deployment, empowering farmers to make better-informed decisions, optimize inputs, and improve productivity with minimal technical burden. The model is gaining particular traction in regions undergoing rapid digital transformation or facing labor and climate-related pressures.

How Are Platform Ecosystems, IoT Integration, and Analytics-Driven Offerings Fueling Agri-TaaS Market Growth?

The backbone of Agri-TaaS lies in robust platform ecosystems that bundle hardware, software, analytics, and support services into cohesive, user-centric solutions. Cloud-native architectures and open APIs allow seamless integration of multisource data - from soil sensors and drones to satellite imagery and weather forecasts - into unified dashboards that deliver actionable insights. Subscription tiers are increasingly being customized by crop type, farm size, geography, and desired outcomes, enabling hyper-personalized service delivery.IoT connectivity and real-time telemetry further elevate the value proposition by enabling continuous equipment performance monitoring, remote diagnostics, and automated decision support. AI and machine learning engines embedded within service layers refine predictive capabilities for pest outbreaks, irrigation needs, or nutrient planning, enhancing return on investment over time. As digital literacy among farmers increases, intuitive user interfaces and localized content delivery are becoming crucial enablers of sustained adoption and service engagement.

Which Farming Segments, Regional Economies, and Service Models Are Catalyzing Demand for Agriculture Technology-as-a-Service?

Row crop producers, horticulture farms, and dairy operations are key adopters of Agri-TaaS, particularly those managing complex input-output dynamics and seeking operational scalability. In large-acreage farms, service-based precision tools help streamline planting, spraying, and harvesting processes, while in smallholder-dominated regions, cooperative and government-subsidized TaaS models are expanding access to smart tools for yield improvement and risk mitigation.North America and Western Europe are mature markets emphasizing advanced analytics, carbon tracking, and autonomous machinery-as-a-service. Meanwhile, Asia-Pacific, Africa, and Latin America are witnessing strong growth through public-private partnerships, agri-tech startups, and NGO-led initiatives focused on sustainable intensification. Service delivery formats are evolving to include mobile-first platforms, drone-as-a-service, sensor network leasing, and full-season agronomy packages tied to performance-based pricing.

What Strategic Role Will Agri-TaaS Play in Enabling Scalable Digitization, Inclusive Innovation, and Climate-Responsive Farming Systems?

Agri-TaaS is positioned to become the operating model of choice for digital agriculture, allowing farmers to remain agile and competitive without being burdened by capital, complexity, or obsolescence risk. By abstracting infrastructure ownership into flexible, service-based access, it supports rapid technology diffusion, continuous upgrades, and lifecycle cost optimization. Its modular and on-demand structure aligns well with the cyclical, risk-prone nature of agriculture, providing tailored solutions that evolve alongside crop cycles and climatic realities.In the broader context of climate adaptation, food security, and rural economic development, Agri-TaaS offers a strategic vehicle for integrating sustainability into everyday farm management. It fosters transparent data ecosystems, supports traceability mandates, and bridges the digital divide across farm sizes and regions. Could Agriculture Technology-as-a-Service emerge as the key enabler of a globally inclusive, digitally intelligent, and climate-resilient farming future?

Report Scope

The report analyzes the Agriculture Technology-as-a-Service market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Software-as-a-Service, Equipment-as-a-Service); Application (Harvest Dynamics Monitoring Application, Soil Management & Testing Application, Crop Health Monitoring Application, Irrigation Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software-as-a-Service segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 5.9%. The Equipment-as-a-Service segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agriculture Technology-as-a-Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agriculture Technology-as-a-Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Agriculture Technology-as-a-Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGCO Corporation, Ag Leader Technology, AgJunction, Arable Labs Inc., Auroras Srl and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Agriculture Technology-as-a-Service market report include:

- 365FarmNet GmbH

- Accenture PLC

- AGCO Corporation

- Agrivi Ltd.

- CLAAS KGaA mbH

- CNH Industrial N.V.

- CropIn Technology Solutions Pvt. Ltd.

- Deere & Company

- Fujitsu Limited

- Hexagon AB

- IBM Corporation

- Kubota Corporation

- Microsoft Corporation

- Naïo Technologies

- Raven Industries Inc.

- Robert Bosch GmbH

- SZ DJI Technology Co. Ltd.

- Topcon Corporation

- Trimble Inc.

- Yanmar Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 365FarmNet GmbH

- Accenture PLC

- AGCO Corporation

- Agrivi Ltd.

- CLAAS KGaA mbH

- CNH Industrial N.V.

- CropIn Technology Solutions Pvt. Ltd.

- Deere & Company

- Fujitsu Limited

- Hexagon AB

- IBM Corporation

- Kubota Corporation

- Microsoft Corporation

- Naïo Technologies

- Raven Industries Inc.

- Robert Bosch GmbH

- SZ DJI Technology Co. Ltd.

- Topcon Corporation

- Trimble Inc.

- Yanmar Co., Ltd.

Table Information

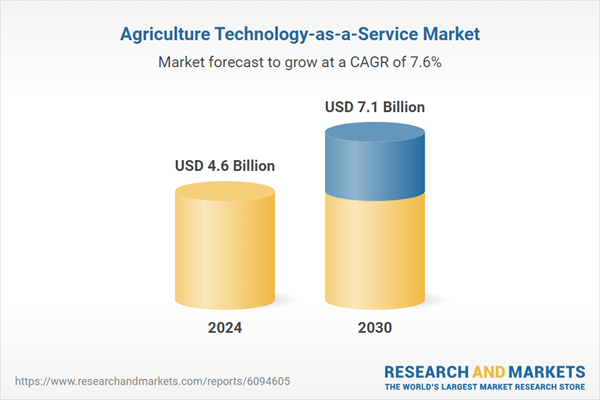

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |