Global Aircraft Machined Components Market - Key Trends & Drivers Summarized

Why Are Machined Components Foundational to Structural Precision, Performance Reliability, and Airworthiness in Aerospace Manufacturing?

Aircraft machined components - precision-engineered parts fabricated through subtractive processes such as CNC milling, turning, drilling, and grinding - are integral to the assembly and operation of both airframes and propulsion systems. These components include brackets, housings, fasteners, fittings, mounts, landing gear elements, engine cases, and hydraulic system parts, all of which must meet exacting dimensional tolerances and material specifications.Their criticality stems from their role in ensuring load-bearing integrity, system alignment, and functional performance under extreme stress, temperature, and vibration conditions. As aircraft are designed to operate across long cycles and harsh flight environments, machined components serve as the mechanical backbone across fuselage structures, wing assemblies, engine modules, and cockpit systems. High precision and repeatability are essential to meet rigorous airworthiness and safety standards governed by FAA, EASA, and military specifications.

How Are Advanced Alloys, Multiaxis Machining, and Digital Manufacturing Accelerating Evolution in Aircraft Machined Parts?

The market is witnessing a shift toward high-strength, lightweight alloys such as titanium, aluminum-lithium, Inconel, and stainless steels to optimize component performance while reducing structural mass. These materials offer excellent fatigue resistance, corrosion protection, and thermal stability - making them ideal for aerospace applications but also more demanding to machine, prompting the adoption of next-gen tooling, coatings, and coolant systems.Multiaxis CNC machining, particularly 5-axis and 7-axis platforms, is enabling complex part geometries with tighter tolerances and fewer setup stages, improving throughput and reducing waste. Concurrently, digital manufacturing techniques such as CAD/CAM integration, digital twin modeling, and closed-loop quality control systems are streamlining prototyping and production. Additive-subtractive hybrid platforms are also emerging to machine near-net-shaped parts generated through 3D printing, expanding design freedom and lead time agility.

Which Aircraft Systems, Program Types, and Global Regions Are Driving Demand for Machined Components?

Machined components are required across virtually all aircraft systems, including structural assemblies (wing spars, bulkheads), engine modules (compressor casings, turbine blades), interiors (seat structures, mounting frames), and landing gear (struts, actuators). Both commercial and military programs are driving demand, with narrow-body aircraft contributing high production volumes and defense platforms requiring complex, low-volume precision components with enhanced durability and stealth properties.High demand also stems from rotorcraft, business jets, UAVs, and space-grade vehicles where customized, performance-critical machined parts are essential. North America and Europe dominate the market due to the presence of major aerospace OEMs and Tier 1 suppliers, as well as advanced machining infrastructure and skilled labor. Asia-Pacific is witnessing significant growth, driven by indigenized aircraft development in China and India, and expanding supply chain localization initiatives. The Middle East and Latin America are contributing through MRO activity and targeted defense procurement.

What Strategic Role Will Machined Components Play in Supporting Next-Gen Airframe Innovation, Electrified Propulsion, and Resilient Aerospace Supply Chains?

Aircraft machined components will remain vital to ensuring structural performance, platform customization, and manufacturing resilience. As airframers pursue lighter, stronger, and more modular designs - especially in electrified and hybrid-electric aircraft - machined parts will be essential to integrating new subsystems, thermal enclosures, and power distribution structures. Their role is expanding from purely mechanical to electro-mechanical interface components in systems such as electric landing gear and integrated powertrains.In an increasingly cost-sensitive and geopolitically complex supply chain landscape, localized and digitally optimized machining capabilities are becoming strategic assets. Machined components offer the flexibility to support both legacy fleet sustainment and rapid prototyping for new aircraft platforms. Could aerospace-grade machined parts become the precision-engineered core through which innovation, compliance, and production agility converge in the future of advanced air mobility and aerospace manufacturing?

Report Scope

The report analyzes the Aircraft Machined Components market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Aircraft Type (Commercial Aircraft, Helicopter, Military Aircraft, General Aviation); Process Type (Milled Parts Process Type, Turned Parts Process Type, Other Process Types); Application (Airframe Application, Engine Application, Interiors Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Aircraft segment, which is expected to reach US$23.5 Billion by 2030 with a CAGR of a 6.6%. The Helicopter segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.7 Billion in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $9.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Machined Components Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Machined Components Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Machined Components Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIM Altitude, Aviointeriors, Benecke-Kaliko AG, Collins Aerospace, Diehl Aerospace and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Aircraft Machined Components market report include:

- Aero Engineering & Manufacturing Co.

- Aequs Aerospace

- Barnes Aerospace

- Bombardier Inc.

- CAMAR Aircraft Parts Company

- Collins Aerospace

- Ducommun Incorporated

- Eaton Corporation

- Figeac Aero

- GE Aerospace

- GKN Aerospace

- Héroux-Devtek Inc.

- Howmet Aerospace

- IHI Corporation

- ITP Aero

- Lycoming Engines

- Magellan Aerospace

- MTU Aero Engines AG

- Parker Hannifin Corporation

- Precision Castparts Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aero Engineering & Manufacturing Co.

- Aequs Aerospace

- Barnes Aerospace

- Bombardier Inc.

- CAMAR Aircraft Parts Company

- Collins Aerospace

- Ducommun Incorporated

- Eaton Corporation

- Figeac Aero

- GE Aerospace

- GKN Aerospace

- Héroux-Devtek Inc.

- Howmet Aerospace

- IHI Corporation

- ITP Aero

- Lycoming Engines

- Magellan Aerospace

- MTU Aero Engines AG

- Parker Hannifin Corporation

- Precision Castparts Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

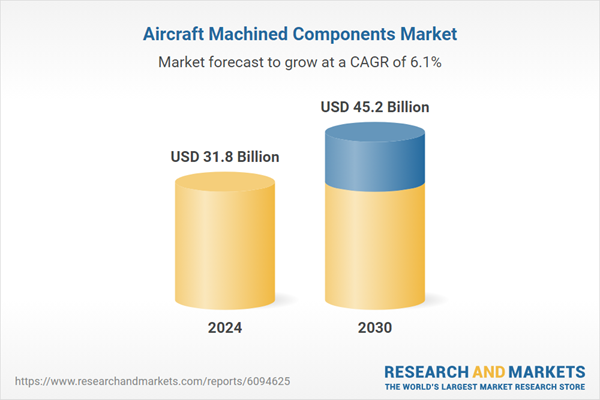

| Estimated Market Value ( USD | $ 31.8 Billion |

| Forecasted Market Value ( USD | $ 45.2 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |