Global Aircraft Window Frames Market - Key Trends & Drivers Summarized

Why Are Aircraft Window Frames Essential for Cabin Integrity, Pressure Containment, and Structural Cohesion Across Flight Envelopes?

Aircraft window frames - structural enclosures that support and secure the cabin windows - are critical for maintaining fuselage pressurization, distributing aerodynamic loads, and preventing structural fatigue around cabin apertures. These components not only anchor multi-layered window panes but also serve as reinforcement points within the fuselage skin, absorbing pressure differentials and vibration stresses during ascent, cruise, and descent cycles.Their strategic importance lies in balancing strength, weight, and corrosion resistance to ensure safe flight under extreme thermal, pressure, and mechanical variations. Window frames are also a focal point for fatigue monitoring and airworthiness inspections, given the stress concentrations that can develop around pressurized openings. Precision in their design and integration is therefore paramount to ensuring long-term structural reliability and passenger safety.

How Are Advanced Alloys, Composite Integration, and Anti-Corrosion Technologies Transforming Window Frame Engineering?

Modern aircraft window frames are increasingly fabricated from high-performance aluminum-lithium alloys, titanium, and corrosion-resistant stainless steels that provide optimal strength-to-weight ratios and extended lifecycle durability. For next-gen platforms, composite window frame structures are being explored to align with all-composite fuselage designs, particularly in wide-body and business jet categories.To address moisture accumulation and galvanic corrosion risks - especially in older aircraft - OEMs are deploying improved surface treatments, sealants, and coatings that protect the frame-fuselage interface. Enhanced bonding technologies and high-precision machining processes are also being used to achieve tighter fit tolerances, improving overall fuselage pressurization performance while minimizing noise and thermal leakage around windows.

Which Aircraft Types, Cabin Configurations, and Global OEM Programs Are Driving Window Frame Demand?

Commercial airliners - particularly single-aisle and long-haul wide-body aircraft - account for the majority of demand, with window frames used throughout passenger cabins, crew areas, and emergency exits. Business jets and VIP-configured aircraft use customized frame designs to accommodate larger or uniquely shaped windows, while military transport aircraft prioritize robustness and simplicity for rapid deployment and low-maintenance environments.OEM production growth from major programs like the Airbus A320neo, A350, Boeing 737 MAX, and 787 Dreamliner continues to drive significant volume. Aftermarket activity - covering frame retrofits, corrosion repairs, and window replacements - is also growing, particularly for aging fleets undergoing structural maintenance checks. Geographically, North America and Europe lead in both production and innovation, while Asia-Pacific is emerging as a manufacturing and MRO hub aligned with domestic aircraft programs and airline expansion.

What Strategic Role Will Window Frames Play in Supporting Lightweight Cabins, Composite Integration, and Long-Haul Aircraft Sustainability?

As fuselage construction shifts toward composite and hybrid-material designs, window frames must evolve to ensure material compatibility, thermal expansion alignment, and structural integrity within mixed-material assemblies. Their design and materials must also accommodate future cabin configurations emphasizing panoramic windows, electrochromic glass, and lighter cabin structures - driving further integration with next-gen materials and smart sealing systems.Window frames will also play a role in enabling sustainability objectives through weight reduction, corrosion resistance, and lifecycle optimization. Could aircraft window frames become a critical junction point where structural innovation, cabin comfort, and composite airframe performance converge in support of the next generation of efficient, long-range aircraft design?

Report Scope

The report analyzes the Aircraft Window Frames market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Cockpit Windshield, Cabin Window); Aircraft Type (Commercial Aircraft, Business Aircraft, Helicopter, Military Aircraft); Material (Metal Frame Material, Composite Frame Material).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cockpit Windshield segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 3.9%. The Cabin Window segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $745.6 Million in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $710.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Window Frames Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Window Frames Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Window Frames Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMETEK, Inc., Arrowhead Products, Eaton Corporation, Exotic Metals Forming Company, Fiber Dynamics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Aircraft Window Frames market report include:

- ACE Advanced Composite Engineering GmbH

- ATR

- BBG GmbH & Co. KG

- Boeing Co

- Bombardier Inc

- Elbit Systems Ltd.

- FACC AG

- Gentex Corporation

- GKN Aerospace

- Kn Aerospace

- Lee Aerospace

- LMI Aerospace

- Magellan Aerospace

- Mitsubishi Heavy Industries

- Nordam Group

- Otto Fuchs KG

- Perkins Aircraft Windows

- PPG Industries Inc

- Saint-Gobain S.A.

- Spirit AeroSystems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACE Advanced Composite Engineering GmbH

- ATR

- BBG GmbH & Co. KG

- Boeing Co

- Bombardier Inc

- Elbit Systems Ltd.

- FACC AG

- Gentex Corporation

- GKN Aerospace

- Kn Aerospace

- Lee Aerospace

- LMI Aerospace

- Magellan Aerospace

- Mitsubishi Heavy Industries

- Nordam Group

- Otto Fuchs KG

- Perkins Aircraft Windows

- PPG Industries Inc

- Saint-Gobain S.A.

- Spirit AeroSystems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 362 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

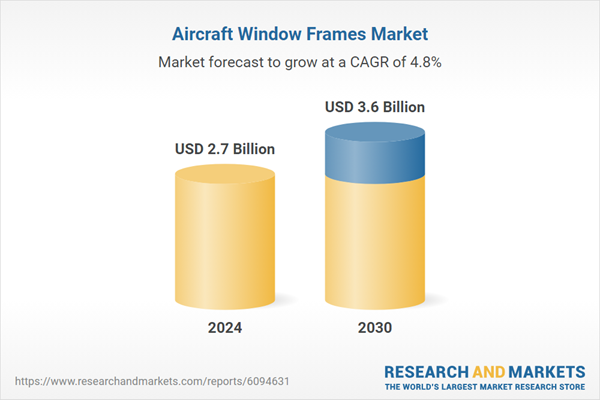

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |