Global Aircraft Wiring Harness Market - Key Trends & Drivers Summarized

Why Are Wiring Harnesses Foundational to Power Distribution, Signal Integrity, and Systems Integration in Modern Aircraft?

Aircraft wiring harnesses - bundled assemblies of wires, connectors, terminals, and protective sleeving - form the central nervous system of modern aircraft, enabling electrical power transmission, signal routing, and communication across virtually all onboard systems. These harnesses interconnect avionics, flight controls, propulsion units, lighting, cabin systems, environmental controls, and safety devices, ensuring synchronized operation throughout the airframe.Their strategic role is amplified by the increasing electrification and digitalization of aircraft systems. As aircraft evolve into complex electronic platforms, the wiring harness must deliver fault-free operation under extreme vibration, electromagnetic interference (EMI), pressure changes, and temperature variation. Fail-safe design, redundancy, and regulatory compliance make wiring harnesses indispensable to airworthiness and flight safety.

How Are Lightweight Materials, EMI Shielding, and Smart Wiring Technologies Advancing Harness Engineering?

Advancements in conductor materials - such as lightweight aluminum, silver-plated copper, and high-strength alloys - are reducing mass without compromising conductivity or mechanical durability. Insulation materials like polyimide, PTFE, and XL-ETFE are increasingly used for high-temperature resistance and fluid compatibility. Harnesses are also being routed more efficiently, with 3D modeling and digital twin tools optimizing length, weight, and spatial fit.EMI shielding is a growing focus, especially as high-frequency data transmission and fly-by-wire systems become standard. Braided metal shields, foil wraps, and ferrite beads are incorporated to ensure clean signal transmission. Meanwhile, smart harness technologies - with embedded sensors, RFID tags, and fault-detection circuits - are enabling predictive maintenance, real-time diagnostics, and automated health monitoring, aligning with next-gen aircraft system intelligence.

Which Aircraft Programs, Systems, and Geographic Markets Are Driving Demand for Wiring Harnesses?

Wiring harnesses are critical to every major aircraft system, including avionics (navigation, communication, flight control), propulsion (engine sensors, fuel flow, ignition), cabin systems (IFE, lighting, HVAC), and safety mechanisms (fire suppression, de-icing, emergency signaling). Both OEM assembly and aftermarket retrofit markets rely heavily on customized, platform-specific harness solutions.Demand is led by commercial aviation, where narrow- and wide-body aircraft require extensive harness networks due to high passenger system density and digital subsystems. Military jets and helicopters demand rugged, EMI-hardened harnesses for mission-critical operations. Business aviation and urban air mobility (UAM) platforms require lightweight, space-optimized designs with high integration density. North America and Europe dominate the market due to aircraft production volume and technological maturity, while Asia-Pacific is accelerating with indigenous programs and fleet expansions in China, India, and Southeast Asia.

What Strategic Role Will Wiring Harnesses Play in Supporting Electrification, Modularity, and Data-Driven Aircraft Ecosystems?

As aircraft move toward more-electric and all-electric propulsion systems, wiring harnesses will become the primary architecture supporting distributed power delivery, thermal control, and high-voltage component integration. Modular harness solutions will enable faster final assembly, simpler MRO operations, and easier configuration updates across mixed fleets.With increasing emphasis on digital system interconnectivity, smart wiring harnesses will support real-time monitoring, networked diagnostics, and software-defined flight operations. Could next-generation aircraft wiring harnesses evolve from passive enablers to intelligent, modular, and data-aware infrastructure - powering the transition to electric, connected, and autonomous aviation ecosystems?

Report Scope

The report analyzes the Aircraft Wiring Harness market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Aircraft Wire Harness Terminal, Aircraft Wire Harness Connector); Material (PVC Material, Polyethylene Material, Polyurethane Material, Thermoplastic Elastomers Material, Vinyl Material).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aircraft Wire Harness Terminal segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of a 4%. The Aircraft Wire Harness Connector segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $711.6 Million in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $679.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Wiring Harness Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Wiring Harness Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Wiring Harness Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Advanced Composite Engineering GmbH, ATR, BBG GmbH & Co. KG, Boeing Co, Bombardier Inc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Aircraft Wiring Harness market report include:

- Acme Aerospace Components

- Amphenol Aerospace

- Aviall, a Boeing Company

- Carlisle Interconnect Technologies

- Circor Aerospace

- ContiTech AG

- Delphi Technologies

- Eaton Corporation

- Esterline Technologies

- FCI Aerospace

- Huber+Suhner AG

- LEMO SA

- Moog Inc.

- Nexans

- Nordam Group

- Rockwell Collins (now Collins Aerospace)

- Safran Electrical & Power

- TE Connectivity

- UTC Aerospace Systems (now Collins Aerospace)

- Zodiac Aerospace (now part of Safran)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme Aerospace Components

- Amphenol Aerospace

- Aviall, a Boeing Company

- Carlisle Interconnect Technologies

- Circor Aerospace

- ContiTech AG

- Delphi Technologies

- Eaton Corporation

- Esterline Technologies

- FCI Aerospace

- Huber+Suhner AG

- LEMO SA

- Moog Inc.

- Nexans

- Nordam Group

- Rockwell Collins (now Collins Aerospace)

- Safran Electrical & Power

- TE Connectivity

- UTC Aerospace Systems (now Collins Aerospace)

- Zodiac Aerospace (now part of Safran)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

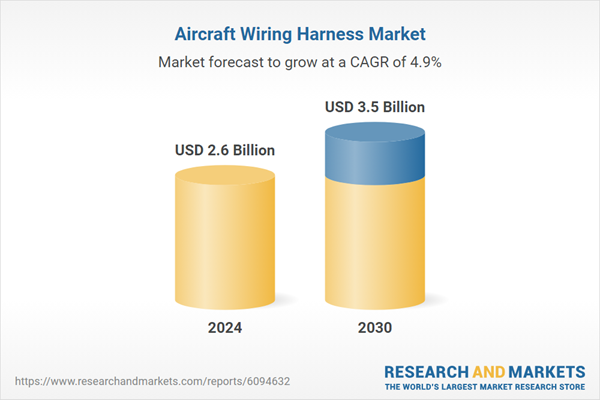

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |