Global Alcohol-to-Jet (ATJ) Market - Key Trends & Drivers Summarized

Why Is Alcohol-to-Jet Fuel Emerging as a Key Player in Sustainable Aviation?

As the aviation industry faces growing pressure to decarbonize, Alcohol-to-Jet (ATJ) fuel has emerged as a promising pathway for reducing greenhouse gas emissions without compromising performance or safety. Derived from renewable alcohols such as ethanol or isobutanol, ATJ fuel undergoes a series of chemical transformations to produce hydrocarbons that are compatible with existing jet engines and infrastructure. Unlike fossil-based aviation fuel, ATJ can offer significant lifecycle carbon savings - especially when produced from waste biomass or non-food-based feedstocks. This makes it a valuable solution in the broader push toward sustainable aviation fuel (SAF), which is critical for meeting international climate goals set by organizations such as ICAO and IATA. Airlines, governments, and fuel producers alike are investing in ATJ technology to diversify their fuel sources and build resilience into an industry historically dependent on volatile fossil markets. Additionally, the seamless drop-in compatibility of ATJ with current aviation systems simplifies the transition process, avoiding the need for costly aircraft or fueling infrastructure modifications. The increasing availability of renewable alcohol feedstocks globally, driven in part by the growth of the biofuels and circular economy sectors, further strengthens ATJ's potential as a scalable and near-term decarbonization strategy. As the aviation sector strives to achieve net-zero emissions targets, ATJ is gaining momentum as a practical and forward-looking alternative that balances environmental impact with operational feasibility.How Are Technological Advances Enhancing the Efficiency and Scalability of ATJ Production?

Recent advancements in biochemical engineering, process optimization, and catalysis are accelerating the commercial viability of Alcohol-to-Jet fuel. At the core of ATJ technology is the conversion of alcohol molecules into jet-range hydrocarbons through dehydration, oligomerization, hydrogenation, and refining. Innovations in catalyst design have significantly improved reaction yields and selectivity, making the process more energy-efficient and cost-effective. Companies are also leveraging integrated biorefineries that combine fermentation and conversion steps under one roof, reducing transportation emissions and lowering production overheads. Modular production units are being developed to serve localized markets and tap into regional feedstock supplies, promoting distributed energy models and minimizing supply chain complexity. Advanced process modeling tools and AI-driven optimization software are helping producers fine-tune production parameters in real time, enhancing both output quality and consistency. Moreover, efforts to standardize ATJ fuel composition under international specifications such as ASTM D7566 have opened the door for broader airline adoption and regulatory approvals. As pilot projects scale into commercial operations, producers are experimenting with diverse feedstock options - including industrial waste gases, forestry residues, and algae-based alcohols - to further improve sustainability metrics. The convergence of digital monitoring, green chemistry, and decentralized production architecture is pushing ATJ beyond the realm of experimental innovation into a phase of rapid technological maturity and market readiness. This momentum is laying the groundwork for a new generation of low-carbon aviation fuels that are both technically robust and economically scalable.What Policy, Market, and Industry Trends Are Driving ATJ Fuel Adoption Globally?

The rise of ATJ fuel is being shaped by a complex interplay of policy mandates, economic incentives, and evolving market demands. Government-led initiatives aimed at decarbonizing aviation are creating a fertile environment for ATJ development. In the U.S., programs like the SAF Grand Challenge and bioenergy research funding from the Department of Energy have accelerated public-private collaborations. In Europe, regulatory frameworks such as the Renewable Energy Directive (RED II) and mandates for SAF blending are pushing airlines to diversify their fuel sources. Carbon pricing mechanisms and emissions trading systems further reinforce the financial rationale for switching to low-carbon fuels like ATJ. Airlines are under increasing scrutiny to reduce their carbon footprints, and many are signing long-term offtake agreements with ATJ producers to secure supply and signal environmental responsibility to investors and consumers. Corporate sustainability commitments, investor pressure on ESG performance, and growing climate activism are also catalyzing demand. Meanwhile, fuel producers and refiners are incorporating ATJ into their portfolios to future-proof their operations and align with decarbonization roadmaps. The entry of oil majors and aviation giants into the SAF space is validating the ATJ model and bringing scale, capital, and logistical expertise to the table. International alliances such as the Clean Skies for Tomorrow Coalition are further unifying industry stakeholders behind shared goals. These broader trends are creating a robust market ecosystem in which ATJ can thrive - not as an isolated solution, but as a critical node in a diversified and sustainable aviation fuel supply chain.What Are the Primary Drivers Behind the Growth of the Alcohol-to-Jet Market?

The growth of the Alcohol-to-Jet market is being propelled by a convergence of environmental urgency, feedstock availability, technological progress, and infrastructure compatibility. One of the most significant drivers is the aviation industry's urgent need for sustainable solutions that do not require a complete overhaul of existing engines, logistics, or certification systems - criteria that ATJ meets effectively. The growing availability of renewable alcohols, particularly from waste biomass, agricultural residues, and even carbon-captured fermentation processes, provides a scalable and flexible feedstock base for ATJ fuel production. Economic drivers, including tax incentives, carbon credits, and SAF subsidies, are making ATJ projects more financially attractive to both legacy fuel producers and new entrants. Technological advancements, particularly in catalyst efficiency, fermentation techniques, and integrated plant design, are reducing capital and operational costs, making commercial-scale production increasingly viable. Consumer expectations around airline sustainability are also influencing brand loyalty and ticket purchase behavior, prompting carriers to invest in ATJ to enhance their public image and ESG metrics. Additionally, strategic partnerships between fuel producers, airports, and aircraft manufacturers are smoothing the path for real-world deployment. With international flight routes returning to pre-pandemic levels and global demand for air travel expected to surge over the coming decades, the imperative for cleaner fuels has never been greater. As all these forces align, the Alcohol-to-Jet market is poised for accelerated growth, offering a vital bridge between today's fossil-fuel-driven aviation landscape and tomorrow's low-emission flight ecosystem.Report Scope

The report analyzes the Alcohol-to-Jet (ATJ) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Alcohol-to-Jet fuel, Alcohol-to-Jet Isooctane); Feedstock (Ethanol Feedstock, N-Butanol Feedstock, Iso-Butanol Feedstock, Methanol Feedstock); Technology (Dehydration Technology, Oligomerization Technology, Hydrogenation Technology); Application (Commercial Aircraft Application, Regional Transport Aircraft Application, Military Aviation Application, Business & General Aviation Application, Unmanned Aerial Vehicle Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Alcohol-to-Jet fuel segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 2.7%. The Alcohol-to-Jet Isooctane segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $608.4 Million in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $538.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alcohol-to-Jet (ATJ) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alcohol-to-Jet (ATJ) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alcohol-to-Jet (ATJ) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anheuser-Busch InBev, Arrowtown Drinks, Bliss Hard Seltzer, Boston Beer Company (Truly), Boathouse Beverage Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Alcohol-to-Jet (ATJ) market report include:

- Aemetis Inc.

- Amyris Inc.

- Byogy Renewables Inc.

- Clariant AG

- Cosmo Oil Co., Ltd.

- ExxonMobil Corporation

- FLITE Consortium

- Fulcrum BioEnergy Inc.

- Gevo Inc.

- Honeywell UOP

- Hypoint Inc.

- LanzaJet Inc.

- LanzaTech Inc.

- Marquis SAF

- Masdar

- Mitsui & Co., Ltd.

- Neste Oyj

- Pacific Northwest National Lab

- Red Rock Biofuels LLC

- SkyNRG B.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aemetis Inc.

- Amyris Inc.

- Byogy Renewables Inc.

- Clariant AG

- Cosmo Oil Co., Ltd.

- ExxonMobil Corporation

- FLITE Consortium

- Fulcrum BioEnergy Inc.

- Gevo Inc.

- Honeywell UOP

- Hypoint Inc.

- LanzaJet Inc.

- LanzaTech Inc.

- Marquis SAF

- Masdar

- Mitsui & Co., Ltd.

- Neste Oyj

- Pacific Northwest National Lab

- Red Rock Biofuels LLC

- SkyNRG B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 479 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

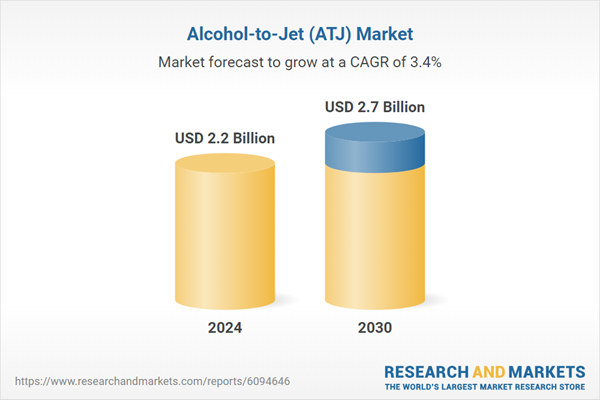

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |