Global Aluminum Anodizing Dyes Market - Key Trends & Drivers Summarized

Why Are Aluminum Anodizing Dyes Essential to Modern Surface Finishing?

Aluminum anodizing dyes are an integral part of the surface treatment process that enhances both the aesthetic and functional qualities of anodized aluminum. Through anodizing, a controlled oxide layer is formed on the surface of aluminum, which not only increases corrosion resistance and surface hardness but also creates a porous structure ideal for dye absorption. Dyes introduced during this stage penetrate the oxide layer, allowing manufacturers to impart a range of vibrant and durable colors to aluminum products. This capability has made anodizing dyes particularly critical in industries such as consumer electronics, automotive, aerospace, and architectural design, where visual appeal must often match mechanical performance. With end-users demanding more customization and product differentiation, colored anodized aluminum offers a sleek, modern appearance while retaining durability. Furthermore, anodizing dyes contribute to UV and wear resistance when sealed properly, making them suitable for outdoor and high-touch applications. Whether it's for smartphones, kitchen appliances, or industrial equipment, the ability to tailor aluminum finishes to brand-specific or functional color schemes is a growing necessity. As the market shifts toward value-added finishes that combine longevity with visual identity, anodizing dyes have moved from being optional add-ons to central elements of product design and durability strategies.How Are Innovations in Dye Chemistry Improving the Performance of Anodized Aluminum?

Advancements in dye chemistry are significantly enhancing the capabilities and versatility of aluminum anodizing processes. Modern anodizing dyes are being engineered to offer improved colorfastness, thermal stability, and compatibility with a broader range of sealing techniques. Traditionally, organic dyes were limited in their resistance to fading and discoloration, particularly in applications exposed to sunlight and harsh environmental conditions. Today, new generations of dyes - including metal-complex and hybrid formulations - are pushing the boundaries by offering enhanced UV resistance, higher chemical tolerance, and greater saturation without compromising the anodic coating. These improvements are critical in sectors like automotive and aerospace, where components may face extreme temperatures, vibration, and corrosive atmospheres. In addition, research into nano-pigments and low-toxicity dye options is expanding the range of colors available while reducing environmental and health impacts. Advanced dispersion techniques ensure better dye penetration and uniformity across complex shapes and large surface areas, allowing for more consistent production quality. Furthermore, digital simulation tools are now being used to predict color behavior under varying thicknesses of anodized layers, making color matching and repeatability more precise. These innovations not only elevate the technical performance of anodized aluminum but also create new creative possibilities for designers and manufacturers seeking to merge function with form.What Market Trends Are Influencing the Demand for Anodizing Dyes Globally?

The demand for aluminum anodizing dyes is being shaped by several key market trends, including the growing emphasis on product aesthetics, environmental sustainability, and material longevity. In consumer electronics, for instance, anodized aluminum has become a standard for premium product lines - from laptops and smartphones to audio equipment - where colored finishes must project brand sophistication while withstanding daily wear. Similarly, in architecture, colored anodized panels are being used in commercial facades and interior décor to achieve both visual impact and long-term resistance to weathering. The increasing use of aluminum in automotive body parts and trim, driven by the need for lightweight, fuel-efficient vehicles, is another growth factor. Here, anodizing dyes allow for corrosion-resistant finishes that match or contrast with other materials. Beyond appearance, regulatory trends and consumer expectations are encouraging the use of environmentally friendly dyes that minimize heavy metals, VOCs, and wastewater contaminants. This is pushing manufacturers toward water-based or biodegradable dye systems. The rise of small-batch manufacturing, 3D printing of aluminum parts, and custom fabrication is also fueling demand for dyes that offer flexibility in coloring unique shapes and finishes without compromising quality. Collectively, these trends point to a future where anodizing dyes are central to product innovation strategies that balance aesthetics, function, and environmental responsibility.What Are the Core Drivers Fueling Growth in the Aluminum Anodizing Dyes Market?

The global growth of the aluminum anodizing dyes market is being propelled by several converging factors that span technological, economic, and industrial domains. One of the primary drivers is the continued expansion of the aluminum industry itself, as lightweight metals become essential across sectors aiming to reduce weight without sacrificing strength. With aluminum becoming more integral in construction, transportation, and consumer goods, the demand for high-performance surface treatments - including aesthetic customization via dyes - is rising in parallel. Another significant driver is the move toward sustainable manufacturing practices, which has elevated the appeal of anodizing over other coating methods due to its low VOC emissions, durability, and recyclability. As manufacturers aim to reduce product lifecycle costs, anodized finishes enhanced by stable dyes offer longer-lasting solutions that reduce the need for repainting or re-coating. The customization trend in both industrial and consumer segments is further encouraging dye use, especially as branding and personalization become standard market differentiators. Government infrastructure investments, particularly in public buildings and transit systems that favor long-lasting, corrosion-resistant materials, also contribute to increased demand for anodized and dyed aluminum parts. Additionally, advances in production technology - including automated dye tanks, precision dosing systems, and real-time color matching - are making it more efficient and cost-effective to incorporate dyeing into anodizing workflows. Together, these factors are fostering robust growth in the anodizing dye market, securing its role as a vital component in modern aluminum finishing applications.Report Scope

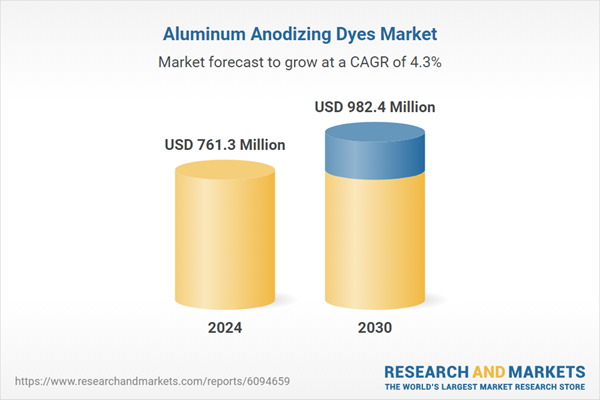

The report analyzes the Aluminum Anodizing Dyes market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Chromic Acid Anodizing Type, Sulfuric or Color Anodizing Type, Hardcoat Anodizing Type, Other Types); Source (Organic Source, Inorganic Source); Application (Automotive Application, Aerospace & Defense Application, Electronics Application, Architectural Application, Consumer Goods Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Chromic Acid Anodizing Dyes segment, which is expected to reach US$505.7 Million by 2030 with a CAGR of a 5.1%. The Sulfuric or Color Anodizing Dyes segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $207.4 Million in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $203.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aluminum Anodizing Dyes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aluminum Anodizing Dyes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aluminum Anodizing Dyes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 2U Inc., Capella University, Cengage Learning Holdings II Inc., Codecademy (by Skillsoft), Coursera Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Aluminum Anodizing Dyes market report include:

- Aal Chem LLC

- Ace Anodizing & Impregnating Co.

- All-Around Dyes Co.

- Anomatic Corporation

- Atotech Deutschland GmbH

- Caswell Inc.

- CHEMEON Surface Technology

- Clariant AG

- Colorants Chem Pvt. Ltd.

- DayGlo Color Corporation

- DyStar Singapore Pte Ltd.

- Erie Plating Company

- Heubach Group

- Hillock Anodizing Inc.

- Kingscote Chemicals Inc.

- Nova International

- Okuno Chemical Industries Co., Ltd.

- Oswal Udhyog

- SIC Technologies

- Stratosphere Enterprise Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aal Chem LLC

- Ace Anodizing & Impregnating Co.

- All-Around Dyes Co.

- Anomatic Corporation

- Atotech Deutschland GmbH

- Caswell Inc.

- CHEMEON Surface Technology

- Clariant AG

- Colorants Chem Pvt. Ltd.

- DayGlo Color Corporation

- DyStar Singapore Pte Ltd.

- Erie Plating Company

- Heubach Group

- Hillock Anodizing Inc.

- Kingscote Chemicals Inc.

- Nova International

- Okuno Chemical Industries Co., Ltd.

- Oswal Udhyog

- SIC Technologies

- Stratosphere Enterprise Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 761.3 Million |

| Forecasted Market Value ( USD | $ 982.4 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |