Global Anaerobic Digestion Systems Market - Key Trends & Drivers Summarized

Why Are Anaerobic Digestion Systems Gaining Prominence in the Circular Economy Era?

Anaerobic digestion (AD) systems are increasingly being recognized as essential components of a sustainable, circular economy, especially as the world seeks more efficient ways to manage organic waste and reduce carbon emissions. These systems convert organic material - such as food waste, agricultural residues, manure, and sewage sludge - into biogas and digestate through a controlled biological process in the absence of oxygen. The resurgence in interest is not simply due to their waste-handling capabilities but because they offer a dual benefit: generating renewable energy and reducing landfill dependency. Countries across Europe and North America have begun integrating AD systems into broader environmental policies, not just for waste treatment, but also as decentralized energy solutions that reduce reliance on fossil fuels. The push for climate-resilient infrastructure is leading municipalities to adopt these systems as part of their waste and energy management strategies, creating a new role for AD beyond traditional agricultural applications.This growing importance is also shaped by increasing legislative pressure to divert biodegradable waste from landfills. Several regions have enacted bans or heavy levies on organic landfill contributions, pushing industries and local governments to seek alternative waste treatment solutions. Anaerobic digestion is particularly attractive due to its ability to process mixed organic streams and still produce valuable outputs: methane-rich biogas and nutrient-dense digestate. In urban contexts, food waste from restaurants, supermarkets, and households is being funneled into centralized AD facilities to minimize landfill contributions. Meanwhile, in rural areas, livestock operations are adopting on-site systems to manage manure, generate heat and electricity, and reduce odors and pathogens. This versatility is positioning AD systems as indispensable tools in achieving waste reduction targets while simultaneously contributing to local energy independence and agricultural sustainability.

How Is Technology Enhancing the Performance and Efficiency of Anaerobic Digesters?

Technological innovation has played a critical role in elevating the capabilities of anaerobic digestion systems, making them more efficient, scalable, and economically viable across diverse applications. Modern AD plants are equipped with automated feeding systems, thermal pre-treatment modules, and advanced gas cleaning technologies that enhance both the volume and quality of biogas production. Innovations such as two-stage digestion, thermophilic processing, and membrane-based separation allow operators to fine-tune conditions for optimal microbial activity. Additionally, real-time monitoring sensors and software platforms now enable continuous tracking of temperature, pH, volatile fatty acids, and gas composition. These tools help prevent system imbalances and allow for predictive maintenance, thus maximizing uptime and minimizing operational disruptions. As a result, the efficiency of biogas output per ton of input material has significantly improved compared to earlier generations of digesters.Beyond the core digestion process, auxiliary technologies are adding further value to the AD ecosystem. Biogas upgrading units that remove carbon dioxide, hydrogen sulfide, and moisture can refine raw biogas into biomethane, a fuel that meets natural gas quality standards and can be injected into existing pipelines or used as vehicle fuel. This integration with national energy grids is becoming increasingly common, especially in Europe, where green gas certificates provide economic incentives. Some systems are also equipped with combined heat and power (CHP) units that simultaneously generate electricity and recover waste heat, enhancing overall energy utilization. Moreover, digestate treatment technologies are helping convert post-digestion residues into standardized biofertilizers that comply with agricultural regulations. These improvements are lowering operating costs, improving environmental compliance, and expanding the range of feedstocks that can be processed - including high-contamination waste that would have been unsuitable in the past. Collectively, these advances are enabling anaerobic digestion systems to evolve from basic waste treatment units into sophisticated bioresource recovery platforms.

In What Ways Are Market Demands and Sectoral Adoption Influencing Deployment?

The adoption of anaerobic digestion systems is being shaped by a growing diversity in market demand, driven by sectors ranging from agriculture and food processing to municipal waste management and energy production. In agriculture, large-scale livestock farms are embracing AD systems to manage manure more sustainably while capturing value through on-site energy generation and fertilizer production. As regulatory scrutiny over nutrient runoff and odor control increases, these systems are being used not just for compliance but as strategic tools to enhance farm efficiency. In the food and beverage industry, producers are turning to AD to manage process residues, reduce waste disposal costs, and improve sustainability credentials. Breweries, dairy processors, and industrial kitchens are among the largest adopters, with many facilities now integrating AD into their waste management and energy systems.In urban areas, municipalities are implementing centralized anaerobic digestion facilities to manage organic household waste collected through separate bins. These systems offer scalable solutions for dense populations, especially when integrated with district heating schemes or local power grids. Public-private partnerships are playing a critical role in this context, allowing municipalities to outsource the management and operation of digestion plants while maintaining regulatory oversight. Even in the energy sector, anaerobic digestion is being explored as a decentralized renewable energy source. Biogas from AD systems is increasingly used to stabilize microgrids, supply backup power for critical infrastructure, or support rural electrification efforts. Furthermore, the global push for decarbonization is prompting gas utilities and transport companies to invest in biomethane infrastructure as a way to reduce their carbon footprint without overhauling their distribution systems. This growing cross-sectoral appeal underscores the flexibility and resilience of anaerobic digestion systems, which can be tailored to fit both small-scale and industrial-grade needs.

What Factors Are Fueling the Growth of the Anaerobic Digestion Systems Market?

The growth in the anaerobic digestion systems market is driven by several factors tied to environmental regulations, energy transformation goals, shifting waste management priorities, and technological adaptability. One of the most prominent growth drivers is the tightening of waste disposal regulations in many regions, particularly the enforcement of landfill diversion policies for organic waste. These regulations are compelling businesses, farms, and municipalities to adopt alternative treatment methods that meet both ecological and economic objectives. Simultaneously, the global movement toward renewable energy is enhancing the appeal of AD systems, which offer a consistent, local source of green energy in the form of biogas and biomethane. Their compatibility with existing gas infrastructure further strengthens their role in the ongoing energy transition.End-use versatility is another significant driver. Anaerobic digestion systems are being adapted for use in diverse settings - from rural farms to city-based processing plants - making them applicable across different economic and geographic contexts. Consumer behavior is also influencing this growth, as rising awareness of food waste and environmental sustainability increases pressure on organizations to adopt circular practices. Many companies now view anaerobic digestion not merely as a compliance requirement but as a value-generating sustainability investment. Technological advances, such as modular digester designs and AI-based operational controls, are making systems easier to deploy and manage, especially for first-time users. Financial incentives, including carbon credits, feed-in tariffs, and green energy grants, are further encouraging adoption, particularly in regions with active climate policy frameworks. Collectively, these factors are positioning anaerobic digestion as a scalable, reliable, and increasingly indispensable tool in the global pursuit of sustainable resource management and low-carbon energy solutions.

Report Scope

The report analyzes the Anaerobic Digestion Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Offering (Hardware Offering, Software Offering, Services Offering); Feedstock (Industrial Waste Feedstock, Municipal Waste Feedstock, Sewage Waste Feedstock, Agricultural Waste Feedstock, Other Feedstocks); Capacity (Medium-Scale Capacity, Large-Scale Capacity, Small-Scale Capacity); Sector (Energy & Utilities Sector, Automotive Sector, Commercial & Residential Sector, Agriculture Sector, Industrial Sector); Application (Agricultural & Industrial Waste Management Application, Power Generation Application, Fuel Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$17.6 Billion by 2030 with a CAGR of a 10.2%. The Software Component segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.4 Billion in 2024, and China, forecasted to grow at an impressive 14.7% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Anaerobic Digestion Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Anaerobic Digestion Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Anaerobic Digestion Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adrenaline Amusements Inc., Alpha Amusements Pvt. Ltd., Dream Arcades®, Inc., Fabbri Group, Focon Game Machines and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Anaerobic Digestion Systems market report include:

- AAT Abwasser- und Abfalltechnik GmbH

- Agraferm Technologies AG

- Anaergia Inc.

- Biogen (UK) Ltd.

- Bioenergy DevCo, LLC

- CH4 Biogas

- Clarke Energy

- EnviTec Biogas AG

- Evoqua Water Technologies Corp.

- Gasum Oy

- Hitachi Zosen Inova AG

- Nature Energy Biogas A/S

- PlanET Biogas Group GmbH

- Renewi plc

- Schmack Biogas GmbH

- SP Renewable Energy Sources Pvt. Ltd.

- SUEZ

- TotalEnergies

- Veolia Environnement S.A.

- WELTEC BIOPOWER GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAT Abwasser- und Abfalltechnik GmbH

- Agraferm Technologies AG

- Anaergia Inc.

- Biogen (UK) Ltd.

- Bioenergy DevCo, LLC

- CH4 Biogas

- Clarke Energy

- EnviTec Biogas AG

- Evoqua Water Technologies Corp.

- Gasum Oy

- Hitachi Zosen Inova AG

- Nature Energy Biogas A/S

- PlanET Biogas Group GmbH

- Renewi plc

- Schmack Biogas GmbH

- SP Renewable Energy Sources Pvt. Ltd.

- SUEZ

- TotalEnergies

- Veolia Environnement S.A.

- WELTEC BIOPOWER GmbH

Table Information

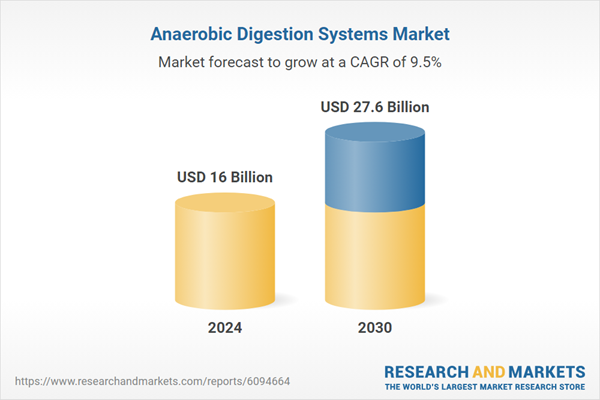

| Report Attribute | Details |

|---|---|

| No. of Pages | 581 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16 Billion |

| Forecasted Market Value ( USD | $ 27.6 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |