Global Application Development and Maintenance (ADM) Market - Key Trends & Drivers Summarized

Why Is Application Development and Maintenance (ADM) Critical to Digital Transformation Strategies?

Application Development and Maintenance (ADM) has become a cornerstone of enterprise digital transformation, enabling organizations to stay competitive, agile, and customer-centric in a rapidly evolving technological landscape. As businesses increasingly rely on digital platforms for core operations, customer engagement, and decision-making, the demand for robust, scalable, and secure applications has intensified. ADM encompasses the end-to-end lifecycle of applications - from design, coding, and testing to ongoing support, upgrades, and optimization - ensuring they remain aligned with business goals and user expectations. Enterprises are under growing pressure to accelerate time-to-market for digital services while ensuring application performance, reliability, and compliance. This has elevated ADM from a back-office function to a strategic priority. The need for continuous innovation, driven by technologies such as AI, machine learning, IoT, and cloud computing, requires applications to be modular, responsive, and continuously evolving. As companies shift to microservices architecture, API-first strategies, and DevOps methodologies, the complexity of managing application ecosystems has increased, necessitating specialized ADM frameworks. Furthermore, the COVID-19 pandemic underscored the importance of digital resilience, prompting businesses across sectors - finance, healthcare, retail, manufacturing - to modernize legacy systems and invest in scalable application portfolios. ADM plays a pivotal role in enabling these transformations by ensuring existing applications are optimized and future-ready, bridging the gap between legacy infrastructure and next-generation digital solutions.How Are Agile, DevOps, and Cloud-Native Architectures Reshaping ADM Practices and Performance?

The rise of Agile development methodologies, DevOps culture, and cloud-native architectures has fundamentally transformed how ADM services are planned, executed, and measured. Traditionally, application development followed a linear, waterfall approach with long cycles and rigid scopes. Today, Agile practices emphasize iterative development, customer feedback loops, and cross-functional collaboration, allowing teams to respond swiftly to changing business requirements. DevOps extends this agility by integrating development and operations teams, fostering continuous integration and continuous deployment (CI/CD) pipelines that automate testing, provisioning, and release management. These advancements significantly reduce time-to-market, minimize human error, and enable real-time delivery of application updates and features. Meanwhile, the widespread adoption of cloud-native technologies - such as containers, Kubernetes, and serverless computing - has ushered in a new era of scalability, resilience, and portability in application infrastructure. Organizations are increasingly migrating from monolithic legacy systems to loosely coupled microservices, which require specialized ADM approaches to manage versioning, interoperability, and performance across distributed environments. Infrastructure as Code (IaC) and automated monitoring tools are further streamlining maintenance by allowing proactive issue resolution, performance optimization, and seamless scaling. These technological shifts not only elevate the efficiency of ADM workflows but also empower businesses to deliver more personalized, responsive, and secure digital experiences. As a result, ADM service providers are evolving from traditional vendors to strategic partners in innovation and operational excellence.How Are Industry-Specific Demands and Regulatory Pressures Influencing ADM Adoption and Customization?

ADM strategies are increasingly being tailored to meet industry-specific requirements and comply with complex regulatory frameworks, underscoring the growing need for domain expertise and compliance-aware development practices. In healthcare, for example, application development must ensure HIPAA compliance, secure handling of patient data, and integration with EHR systems. Financial services demand high-performance, low-latency applications that adhere to regulations such as GDPR, PCI DSS, and SOX while offering seamless digital banking experiences. Similarly, in manufacturing and logistics, applications must support IoT integration, supply chain transparency, and predictive maintenance capabilities. These sector-specific nuances necessitate customized ADM solutions that go beyond standard functionality to deliver compliance, interoperability, and innovation in equal measure. Moreover, regulatory environments are becoming increasingly dynamic, requiring applications to be adaptable and regularly updated to reflect new standards and policies. Maintenance becomes a continuous activity involving not only bug fixes and patches but also feature upgrades, vulnerability mitigation, and legal compliance. To meet these demands, ADM service providers are investing in vertical-specific development teams, compliance monitoring tools, and frameworks that allow for rapid customization without sacrificing quality or security. As industries digitize at varying paces, tailored ADM strategies ensure that organizations can balance regulatory obligations with business agility and user-centric innovation, reinforcing the strategic value of ADM in diverse enterprise ecosystems.What Are the Key Drivers Fueling the Growth of the Global ADM Services Market?

The growth in the Application Development and Maintenance (ADM) market is driven by a confluence of digital acceleration, legacy modernization, operational agility, and enterprise demand for continuous innovation. One of the primary drivers is the exponential rise in enterprise software applications, mobile platforms, and cloud-based solutions, all of which require robust development, integration, and lifecycle management. Legacy systems, once the backbone of enterprise IT, are now liabilities in a fast-paced digital world, prompting organizations to invest in application reengineering, migration, and modernization initiatives. Another key growth factor is the surge in demand for omnichannel user experiences - across web, mobile, and IoT - which requires applications to be highly responsive, secure, and seamlessly integrated. The increasing prevalence of hybrid and remote work environments has also elevated the importance of reliable, user-friendly applications that support collaboration, productivity, and data access across geographies. In parallel, enterprises are focusing on cost optimization, driving the adoption of managed services, automation, and AI-driven application monitoring to reduce downtime and operational overhead. Global outsourcing trends continue to support the ADM market, as companies partner with service providers in regions like India, Eastern Europe, and Southeast Asia to tap into skilled talent and round-the-clock service models. Strategic partnerships, mergers, and acquisitions within the IT services sector are further expanding ADM capabilities and global reach. Finally, the rise of low-code and no-code platforms is democratizing application development, allowing business users to participate in the creation and customization of digital tools while IT teams focus on governance and integration. Together, these forces are creating a robust growth environment for the ADM market, positioning it as a key enabler of enterprise transformation and long-term digital sustainability.Report Scope

The report analyzes the Application Development and Maintenance (ADM) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service (Management Service, Maintenance Service, Modernization Service, Development Service, Quality Service); Vertical (IT & Telecom Vertical, BFSI Vertical, Healthcare Vertical, Retail Vertical, Manufacturing Vertical, Government Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Management Service segment, which is expected to reach US$265.8 Billion by 2030 with a CAGR of a 9.2%. The Maintenance Service segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $127.7 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $151 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Application Development and Maintenance (ADM) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Application Development and Maintenance (ADM) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Application Development and Maintenance (ADM) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABC Fruits, AGRANA Beteiligungs-AG, American International Foods, Inc., Austria Juice GmbH, Coloma Frozen Foods and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Application Development and Maintenance (ADM) market report include:

- Accenture plc

- Atos SE

- Capgemini SE

- Cognizant Technology Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology

- Fujitsu Limited

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Larsen & Toubro Infotech Limited

- NTT DATA Corporation

- Oracle Corporation

- Persistent Systems Limited

- SAP SE

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Virtusa Corporation

- Wipro Limited

- Zensar Technologies Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture plc

- Atos SE

- Capgemini SE

- Cognizant Technology Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology

- Fujitsu Limited

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Larsen & Toubro Infotech Limited

- NTT DATA Corporation

- Oracle Corporation

- Persistent Systems Limited

- SAP SE

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Virtusa Corporation

- Wipro Limited

- Zensar Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | January 2026 |

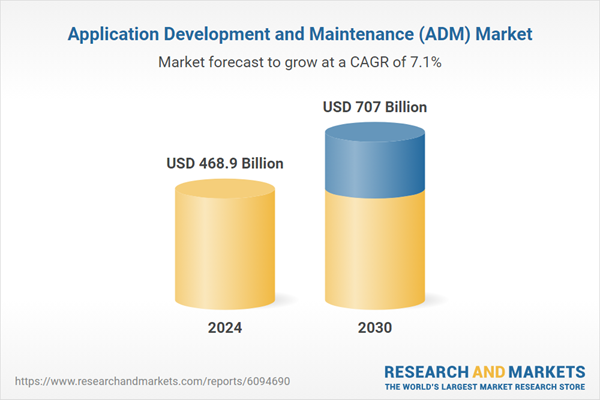

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 468.9 Billion |

| Forecasted Market Value ( USD | $ 707 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |