Global Artificial Intelligence (AI) Audio and Video SoC Market - Key Trends & Drivers Summarized

Is AI-Driven Integration Transforming Next-Gen Audio and Video Systems?

Artificial Intelligence (AI) is revolutionizing the design and functionality of System-on-Chip (SoC) solutions used in audio and video processing, marking a major paradigm shift in how digital media systems are built and operated. Traditionally, audio and video SoCs were optimized for basic encoding, decoding, and signal transmission. However, the infusion of AI capabilities is enabling these chips to do far more supporting intelligent scene detection, voice recognition, noise cancellation, object tracking, emotion analysis, and adaptive resolution scaling in real time. These AI-optimized SoCs are built to handle vast amounts of sensor and signal data, making them ideal for use in edge devices such as smart TVs, digital assistants, home surveillance systems, automotive infotainment units, and video conferencing platforms. The integration of deep learning accelerators within SoC architectures allows for on-chip inferencing, eliminating the need for constant cloud connectivity and ensuring faster, more secure processing. Advanced AI-enabled SoCs also support simultaneous audio-visual analytics, which improves user experiences in interactive environments like AR/VR, smart classrooms, and AI-powered healthcare diagnostics. By embedding neural network capabilities directly into the chip, developers can enable real-time responsiveness and personalization, paving the way for highly adaptive and intelligent multimedia systems. As consumer and industrial devices become more reliant on context-aware features and edge intelligence, the role of AI-enhanced SoCs is quickly moving from optional to foundational across a wide array of audio-visual applications.How Are Shifting Consumer Expectations and Industry Use Cases Driving Demand?

The surge in demand for AI audio and video SoCs is strongly linked to evolving consumer expectations for seamless, immersive, and personalized media experiences. In the consumer electronics sector, users now expect smart devices to understand natural language, adjust audio quality dynamically, and deliver high-definition video streams with minimal latency. Smart speakers and voice assistants rely on AI SoCs for real-time language processing, beamforming, and environment-based sound adaptation, while smart TVs and streaming devices use them to upscale resolution, auto-adjust display brightness, and optimize sound according to content type and user preferences. The entertainment and gaming industries are also seeing massive demand for AI-powered chips that enable facial recognition, gesture control, and immersive soundscapes. Beyond consumer electronics, enterprise and industrial applications are emerging as major growth areas. In automotive, AI SoCs are essential for in-cabin voice control, driver monitoring, and video-based safety features. Similarly, in healthcare, AI-enabled SoCs power diagnostic imaging systems, patient monitoring tools, and telemedicine platforms that require synchronized audio-video processing with intelligent interpretation. Surveillance and security systems are leveraging these chips for facial recognition, anomaly detection, and behavioral analytics in real-time. These varied applications highlight how AI SoCs are no longer niche solutions, but mission-critical technologies reshaping user experience, security, and operational efficiency across multiple industries.Is Technological Innovation Outpacing Traditional Chip Design Constraints?

As AI workloads become more complex and real-time responsiveness becomes a competitive necessity, chip manufacturers are rapidly evolving SoC design architectures to accommodate new processing paradigms. Traditional SoCs, which relied heavily on CPUs and DSPs, are now being augmented with dedicated AI engines, machine learning cores, and neural processing units (NPUs) that allow for parallel and low-power inference. These chips are specifically tailored to support convolutional neural networks (CNNs), recurrent neural networks (RNNs), and transformer-based models that are commonly used in voice and video recognition tasks. Recent breakthroughs in semiconductor fabrication such as 5nm and 3nm processes have enabled higher transistor densities, lower power consumption, and faster clock speeds, all of which enhance the efficiency of AI operations on-chip. Furthermore, SoCs are being designed with heterogeneous computing in mind, integrating CPU, GPU, NPU, and custom accelerators into a single die to optimize both flexibility and performance. The integration of AI with video codecs, audio DSPs, and connectivity modules (e.g., Wi-Fi 6, Bluetooth 5.3) is enabling multifunctional chips that support intelligent processing in compact devices. Memory bandwidth and on-chip cache optimization are also critical advancements, helping to eliminate data bottlenecks and enhance multitasking performance. Open-source AI frameworks and compiler toolchains are being increasingly supported at the hardware level, allowing for easier deployment and fine-tuning of AI models directly on SoCs. These design innovations are enabling a new class of edge AI devices that are more responsive, scalable, and power-efficient than ever before, fundamentally shifting the balance between cloud and edge computing.What Forces Are Fueling the Global Expansion of AI Audio and Video SoCs?

The growth in the artificial intelligence (AI) audio and video SoC market is driven by several factors rooted in technology convergence, expanding use cases, changing device ecosystems, and strategic shifts in semiconductor production. One of the key drivers is the increasing demand for intelligent edge devices across consumer, industrial, and enterprise segments pushing the need for compact chips that can perform complex processing locally without relying on cloud latency or bandwidth. The rapid proliferation of smart home devices, personal digital assistants, and smart displays is further intensifying the need for chips that combine AI with audio-video signal processing in a single, low-power package. In the automotive space, the trend toward autonomous and semi-autonomous driving is creating a strong pull for high-performance SoCs that can handle in-vehicle infotainment, driver monitoring, and speech-based navigation. Similarly, the post-pandemic normalization of video conferencing and remote work has created a sustained demand for high-quality audio-visual communication devices that rely on AI SoCs to enhance clarity, reduce background noise, and automatically frame or track speakers. Another growth factor is the increasing investment in localized AI processing capabilities in regions like North America, Europe, and Asia-Pacific, where national strategies and funding initiatives are driving domestic semiconductor production. Meanwhile, the expansion of 5G and ultra-fast connectivity is enabling richer AI workloads at the edge, supporting AI SoCs in drones, surveillance systems, and industrial robots. Finally, strategic alliances between chipmakers, cloud service providers, and AI software companies are accelerating innovation and reducing time to market, allowing AI audio and video SoCs to reach a broader spectrum of applications and devices worldwide. These diverse and high-impact forces are collectively shaping a robust and expansive future for the global AI SoC market.Key Insights:

- Market Growth: Understand the significant growth trajectory of the AI Audio SoC segment, which is expected to reach US$33.2 Billion by 2030 with a CAGR of a 39.1%. The AI Video SoC segment is also set to grow at 52.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 53.8% CAGR to reach $17.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Intelligence (AI) Audio and Video SoC Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Intelligence (AI) Audio and Video SoC Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Intelligence (AI) Audio and Video SoC Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AKM Semiconductor, Allwinner Technology, Ambarella, Analog Devices, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Artificial Intelligence (AI) Audio and Video SoC market report include:

- AKM Semiconductor

- Allwinner Technology

- Ambarella

- Analog Devices

- Apple Inc.

- Broadcom Inc.

- Cirrus Logic

- Infineon Technologies

- Intel Corporation

- MediaTek Inc.

- NXP Semiconductors

- ON Semiconductor

- Qualcomm Technologies

- Realtek Semiconductor

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Synaptics Incorporated

- Texas Instruments

- XMOS Ltd.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AKM Semiconductor

- Allwinner Technology

- Ambarella

- Analog Devices

- Apple Inc.

- Broadcom Inc.

- Cirrus Logic

- Infineon Technologies

- Intel Corporation

- MediaTek Inc.

- NXP Semiconductors

- ON Semiconductor

- Qualcomm Technologies

- Realtek Semiconductor

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Synaptics Incorporated

- Texas Instruments

- XMOS Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

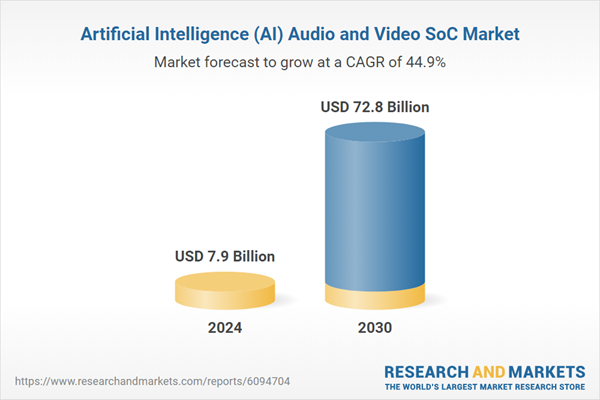

| Estimated Market Value ( USD | $ 7.9 Billion |

| Forecasted Market Value ( USD | $ 72.8 Billion |

| Compound Annual Growth Rate | 44.9% |

| Regions Covered | Global |