Global 'Automotive Dampers' Market - Key Trends & Drivers Summarized

How Do Dampers Shape the Dynamics of Ride Comfort and Handling?

Automotive dampers, also known as shock absorbers, play a fundamental role in vehicle suspension systems by controlling the rebound and compression of springs and dissipating kinetic energy. This ensures that vehicles maintain tire contact with the road, providing both ride comfort and safety. Beyond merely softening bumps and vibrations, modern damper systems actively influence handling performance, cornering stability, and braking efficiency. With growing consumer expectations for smoother, more refined rides across segments - from economy cars to luxury SUVs - OEMs are increasingly integrating sophisticated damper technologies that adapt to driving conditions in real time. These include twin-tube and mono-tube designs, as well as gas-charged and adaptive damping systems. The function of dampers has expanded from passive cushioning to a dynamic interface between the road and the vehicle body.What Is Driving the Shift Toward Adaptive and Semi-Active Damping Technologies?

As vehicle architectures evolve with electrification and autonomy, there is a noticeable pivot toward intelligent damping systems. Adaptive and semi-active dampers, which adjust damping force based on road conditions, vehicle load, and driving behavior, are becoming more prevalent. These systems use electronic control units (ECUs) and sensor networks to respond within milliseconds, optimizing ride quality and minimizing body roll or pitch. The integration of magnetorheological (MR) fluid and electro-hydraulic mechanisms in premium models enables on-the-fly suspension tuning without compromising comfort or control. This is particularly beneficial in electric vehicles (EVs), where additional battery weight necessitates more nuanced suspension behavior. Furthermore, semi-active systems are increasingly being adopted in high-performance and commercial vehicles for better load management and improved vehicle dynamics.How Are Material Innovations and NVH Demands Influencing Design Approaches?

Automotive dampers are being redesigned with an eye toward weight reduction, durability, and enhanced noise-vibration-harshness (NVH) performance. Lightweight alloys and composite materials are replacing traditional steel to reduce unsprung mass, improving fuel efficiency and handling responsiveness. Meanwhile, advanced sealing technologies and friction-optimized internal components are being developed to extend product lifespan and reduce maintenance. NVH considerations have become a major design factor, especially in EVs, where the absence of engine noise makes other sources of vibration and disturbance more noticeable. As a result, dampers are now required to contribute not just to ride control, but also to cabin acoustics and vibration isolation. Manufacturers are responding with tuned valve systems and dual-flow piston technology to offer quieter and more refined damping behavior.What Are the Key Forces Powering Market Expansion for Automotive Dampers?

The growth in the automotive dampers market is driven by several factors including the rising demand for ride comfort and handling precision across all vehicle classes, increasing integration of semi-active and electronically controlled damping systems, and the proliferation of electric and autonomous vehicles. As OEMs focus on premiumizing even lower-segment vehicles, the incorporation of advanced suspension components has become a competitive differentiator. The surge in SUV and crossover vehicle sales, which place higher demands on suspension systems, further fuels demand for robust and adaptive dampers. In the commercial vehicle space, stringent ride quality standards and safety regulations are propelling the adoption of high-performance damping solutions. Finally, the expanding global automotive aftermarket - particularly in Asia-Pacific, Latin America, and Eastern Europe - is contributing to sustained demand for replacement and upgraded dampers, reinforcing the market's steady growth trajectory.Report Scope

The report analyzes the Automotive Dampers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$29.6 Billion by 2030 with a CAGR of a 2%. The Commercial Vehicles End-Use segment is also set to grow at 1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.1 Billion in 2024, and China, forecasted to grow at an impressive 3.2% CAGR to reach $8.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Dampers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Dampers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Dampers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisan Industry Co., Ltd., Alfdex AB, BorgWarner Inc., Continental AG, Cummins Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Dampers market report include:

- BILSTEIN (Thyssenkrupp AG)

- Continental AG

- Duroshox

- Gabriel India Ltd.

- Hitachi Astemo Ltd.

- Hyundai Mobis

- ITT Motion Technologies (KONI)

- KYB Corporation

- Marelli

- Mando Corporation

- Monroe (Tenneco Inc.)

- Multimatic Inc.

- Sachs (ZF Friedrichshafen AG)

- Showa Corporation (Hitachi Astemo)

- Sogefi Group

- Tenneco Inc.

- Thyssenkrupp AG

- TRW Automotive (ZF Group)

- Trelleborg AB

- Zhongding Group (Anhui Zhongding)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BILSTEIN (Thyssenkrupp AG)

- Continental AG

- Duroshox

- Gabriel India Ltd.

- Hitachi Astemo Ltd.

- Hyundai Mobis

- ITT Motion Technologies (KONI)

- KYB Corporation

- Marelli

- Mando Corporation

- Monroe (Tenneco Inc.)

- Multimatic Inc.

- Sachs (ZF Friedrichshafen AG)

- Showa Corporation (Hitachi Astemo)

- Sogefi Group

- Tenneco Inc.

- Thyssenkrupp AG

- TRW Automotive (ZF Group)

- Trelleborg AB

- Zhongding Group (Anhui Zhongding)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

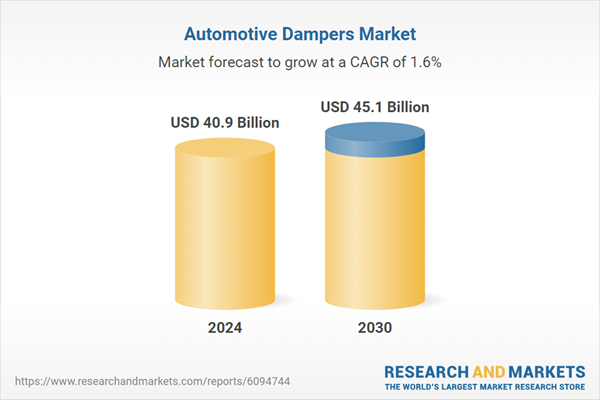

| Estimated Market Value ( USD | $ 40.9 Billion |

| Forecasted Market Value ( USD | $ 45.1 Billion |

| Compound Annual Growth Rate | 1.6% |

| Regions Covered | Global |