Global Automotive Diesel Filters Market - Key Trends & Drivers Summarized

Why Are Diesel Filters Still Crucial in a Shifting Automotive Landscape?

As the automotive world accelerates toward electrification, one might assume diesel components are fading into obsolescence. However, diesel-powered vehicles remain deeply entrenched in specific sectors, especially in heavy-duty, off-road, and commercial transportation. Diesel engines continue to be prized for their torque performance, durability, and fuel efficiency - traits that are indispensable for trucking, construction, and agriculture. This continued relevance of diesel engines keeps automotive diesel filters in high demand, particularly in fleet-heavy markets where operational reliability is non-negotiable. Furthermore, growing environmental awareness and the need to mitigate emissions have placed increased pressure on diesel engines to perform cleaner than ever before. Diesel filters play a critical role in this, capturing harmful particulates and enhancing engine longevity. Manufacturers are responding by developing advanced filter technologies that integrate seamlessly into modern diesel engines. These developments help maintain diesel's utility while aligning with stricter environmental expectations, ensuring that diesel filters remain a pivotal component in today's hybrid automotive ecosystem.How Are Emission Regulations Shaping Filter Technologies?

Environmental regulations around the world have grown increasingly stringent, forcing automotive manufacturers to reevaluate and innovate their engine designs. Diesel filters, especially particulate and air filters, have become a frontline defense in helping vehicles meet these rigorous standards. Recent advancements in filter technology have focused on improving filtration efficiency without impeding engine performance. Engineers are leveraging cutting-edge materials like nanofibers, synthetic blends, and multi-layered filtration media that trap more particles while minimizing pressure drop. These filters also last longer, requiring less frequent replacements, which appeals to cost-conscious fleet operators. Beyond particulate matter, filters now address volatile organic compounds and nitrogen oxides more effectively, aligning with multi-tiered emission control strategies. The push toward sustainability has also led to the development of recyclable and biodegradable filter components. Ultimately, regulation-driven innovation has turned diesel filters from a basic maintenance item into a complex, high-performance system that is central to the evolution of cleaner diesel engines.What Regional Forces Are Steering the Diesel Filter Market?

Geographical differences in vehicle usage, environmental regulations, and infrastructure development play a decisive role in the demand for diesel filters. In regions where commercial transportation and industrial activity dominate, such as parts of Asia and Latin America, diesel vehicles still form the backbone of logistics and supply chains. Here, the need for robust, high-efficiency diesel filters is paramount to maintain operational integrity and comply with emerging pollution controls. Meanwhile, in North America and Europe, stricter environmental policies and higher consumer awareness are driving the adoption of more sophisticated filter systems. These regions often lead in the implementation of new emission standards, prompting a quicker uptake of advanced filtration technologies. Conversely, in developing markets, although regulatory frameworks may be less mature, the ongoing expansion of diesel vehicle fleets provides a solid foundation for sustained filter demand. Regional dynamics are also influenced by climate conditions, fuel quality, and maintenance practices, all of which contribute to variations in filter design and performance requirements across the globe.What Drives the Growth in the Automotive Diesel Filters Market?

The growth in the automotive diesel filters market is driven by several factors across technology, end-use application, and consumer behavior. One of the primary drivers is the persistent use of diesel engines in sectors where electrification remains impractical due to energy density and operational requirements. Commercial fleets, agricultural vehicles, and long-haul transport trucks continue to rely heavily on diesel, necessitating reliable filtration systems. Another key factor is the evolution of filter technologies, with innovations improving efficiency, reducing maintenance intervals, and enabling compliance with complex emission norms. Consumer behavior has also shifted toward increased awareness of vehicle health and environmental impact, leading to more regular replacement and upgrading of diesel filters. Additionally, the growth of organized automotive service networks and an expanding aftermarket for filters have made access and affordability of advanced filters more feasible. As vehicles become more connected and diagnostics-driven, predictive maintenance models are also promoting timely filter replacement, indirectly bolstering market growth. Collectively, these diverse drivers reinforce the strategic importance of diesel filters in the ever-evolving automotive landscape.Report Scope

The report analyzes the Automotive Diesel Filters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Passenger Cars Application, Commercial Vehicles Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars Application segment, which is expected to reach US$675.3 Billion by 2030 with a CAGR of a 5.5%. The Commercial Vehicles Application segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $196.2 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $199.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Diesel Filters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Diesel Filters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Diesel Filters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BILSTEIN (Thyssenkrupp AG), Continental AG, Duroshox, Gabriel India Ltd., Hitachi Astemo Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Automotive Diesel Filters market report include:

- ALCO Filters

- ACDelco (General Motors)

- Baldwin Filters (Parker Hannifin)

- Bosch Automotive Aftermarket

- Cummins Filtration

- Denso Corporation

- Donaldson Company, Inc.

- Fleetguard (Cummins Filtration)

- Freudenberg Filtration Technologies

- Hengst SE

- HIFI Filter

- JS Asakashi

- K&N Engineering, Inc.

- Luber-finer

- MAHLE GmbH

- Mann+Hummel Group

- Sogefi Group

- Tokyo Roki Co., Ltd.

- UFI Filters Group

- Zhejiang Universe Filter Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALCO Filters

- ACDelco (General Motors)

- Baldwin Filters (Parker Hannifin)

- Bosch Automotive Aftermarket

- Cummins Filtration

- Denso Corporation

- Donaldson Company, Inc.

- Fleetguard (Cummins Filtration)

- Freudenberg Filtration Technologies

- Hengst SE

- HIFI Filter

- JS Asakashi

- K&N Engineering, Inc.

- Luber-finer

- MAHLE GmbH

- Mann+Hummel Group

- Sogefi Group

- Tokyo Roki Co., Ltd.

- UFI Filters Group

- Zhejiang Universe Filter Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

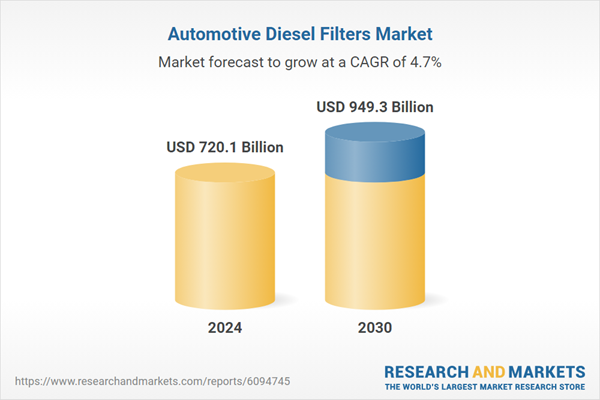

| Estimated Market Value ( USD | $ 720.1 Billion |

| Forecasted Market Value ( USD | $ 949.3 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |